Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

Personal injury protection (PIP) is a type of auto insurance coverage that is designed to cover medical expenses and lost wages in the event of an accident. PIP is mandatory in some states, while optional in others, but regardless of where you live, it’s important to understand what it covers and how it works.

In this article, we’ll take a closer look at personal injury protection and explore what it covers, who it covers, and how it can benefit you in the event of an accident. Whether you’re shopping for car insurance or just want to know more about your coverage options, this guide will help you make informed decisions and protect yourself on the road.

Personal Injury Protection (PIP) covers medical expenses, lost wages, and other related expenses if you or your passengers are injured in a car accident. Depending on the state you live in, PIP may also cover rehabilitation, funeral expenses, and other costs. PIP is a no-fault insurance, which means that it pays out regardless of who was at fault for the accident.

Contents

- What Does Personal Injury Protection Cover?

- Medical Expenses Coverage

- Lost Wages Coverage

- Funeral Expenses Coverage

- Rehabilitation Expenses Coverage

- Benefits of Personal Injury Protection Coverage

- Personal Injury Protection Coverage vs. Medical Payments Coverage

- Personal Injury Protection Coverage vs. Liability Coverage

- Personal Injury Protection Coverage vs. Uninsured/Underinsured Motorist Coverage

- Conclusion

- Frequently Asked Questions

What Does Personal Injury Protection Cover?

Personal Injury Protection (PIP) is a type of auto insurance policy that covers medical expenses and lost wages for you and your passengers in case of an accident. PIP coverage is mandatory in some states, while in others, it is optional. So, it is essential to understand what PIP covers before purchasing an auto insurance policy. In this article, we will discuss everything you need to know about PIP coverage.

Medical Expenses Coverage

The primary coverage that PIP provides is medical expenses coverage. This coverage pays for any medical expenses incurred due to an accident, including hospital stays, doctor visits, X-rays, surgeries, and rehabilitation. PIP coverage typically covers medical expenses for you and your passengers, regardless of who is at fault for the accident.

In addition to medical expenses, PIP coverage may also cover other medical-related expenses, such as ambulance fees, prosthetics, and chiropractic care. It is essential to check with your insurance provider to understand the exact medical expenses covered under your PIP policy.

Lost Wages Coverage

In addition to medical expenses coverage, PIP coverage also provides lost wages coverage. This coverage pays for any lost wages due to an accident. If you are unable to work due to an accident, PIP coverage will cover your lost wages up to the policy limit.

Lost wages coverage may also cover other related expenses, such as childcare expenses or housekeeping expenses. It is essential to check with your insurance provider to understand the exact lost wages coverage under your PIP policy.

Funeral Expenses Coverage

In some states, PIP coverage may also include funeral expenses coverage. This coverage pays for any funeral expenses incurred due to an accident. Funeral expenses coverage typically covers the policyholder and their passengers.

It is essential to check with your insurance provider to understand if your PIP policy includes funeral expenses coverage.

Rehabilitation Expenses Coverage

Rehabilitation expenses coverage is another type of coverage that PIP may provide. This coverage pays for any rehabilitation expenses incurred due to an accident. Rehabilitation expenses may include physical therapy, occupational therapy, and speech therapy.

It is essential to check with your insurance provider to understand if your PIP policy includes rehabilitation expenses coverage.

Benefits of Personal Injury Protection Coverage

There are several benefits of having PIP coverage. Firstly, PIP coverage provides immediate medical expenses coverage without the need to go through a lengthy claims process. This means that you can get the medical attention you need as soon as possible.

Secondly, PIP coverage provides lost wages coverage, which means that you can continue to pay your bills even if you are unable to work due to an accident.

Thirdly, PIP coverage may also cover other related expenses, such as childcare expenses or housekeeping expenses, which can help ease the financial burden of an accident.

Personal Injury Protection Coverage vs. Medical Payments Coverage

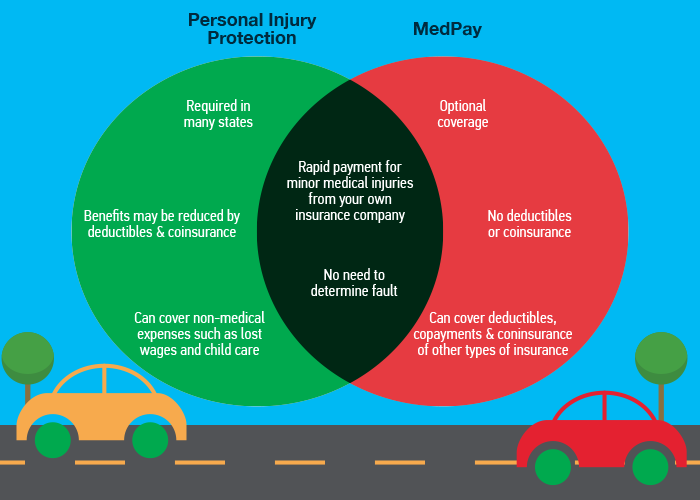

Personal Injury Protection coverage and Medical Payments coverage are both types of auto insurance policies that cover medical expenses. However, there are some key differences between the two types of coverage.

PIP coverage typically provides broader coverage than Medical Payments coverage. PIP coverage not only covers medical expenses but also lost wages, rehabilitation expenses, and funeral expenses (in some states).

Medical Payments coverage, on the other hand, only covers medical expenses, and the coverage amount is typically lower than PIP coverage.

Personal Injury Protection Coverage vs. Liability Coverage

Personal Injury Protection coverage and Liability coverage are also different types of auto insurance policies. Liability coverage covers damages and injuries that you may cause to other people in an accident. PIP coverage, on the other hand, covers medical expenses and lost wages for you and your passengers.

It is essential to have both types of coverage to ensure that you are fully protected in case of an accident.

Personal Injury Protection Coverage vs. Uninsured/Underinsured Motorist Coverage

Personal Injury Protection coverage and Uninsured/Underinsured Motorist coverage are also different types of auto insurance policies. Uninsured/Underinsured Motorist coverage provides coverage if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages and injuries.

PIP coverage, on the other hand, provides coverage for medical expenses and lost wages for you and your passengers, regardless of who is at fault for the accident.

Conclusion

Personal Injury Protection coverage is an important type of auto insurance policy that covers medical expenses and lost wages for you and your passengers in case of an accident. PIP coverage provides immediate medical expenses coverage, lost wages coverage, and may also cover other related expenses, such as childcare expenses or housekeeping expenses.

It is essential to understand what PIP coverage includes before purchasing an auto insurance policy to ensure that you are fully protected in case of an accident.

Frequently Asked Questions

Personal Injury Protection (PIP) is a type of insurance coverage that helps pay for medical expenses and lost wages resulting from a car accident. Here are some common questions and answers about PIP coverage.

What types of injuries does PIP cover?

PIP coverage typically covers a wide range of injuries sustained in a car accident, including broken bones, burns, lacerations, and whiplash. It can also cover more serious injuries like traumatic brain injuries and spinal cord injuries.

However, it’s important to note that PIP coverage varies depending on the insurance policy, so it’s best to check with your insurance company to see exactly what types of injuries are covered under your policy.

Does PIP cover lost wages?

Yes, PIP coverage can help cover lost wages resulting from a car accident. If you’re injured in a car accident and can’t work, PIP can help pay for your lost wages up to a certain amount.

It’s important to note that PIP coverage typically only covers a portion of your lost wages, so it’s a good idea to have disability insurance or other forms of income protection in place as well.

Does PIP cover medical expenses?

Yes, PIP coverage helps pay for medical expenses resulting from a car accident. This can include ambulance fees, hospital bills, doctor’s visits, and rehabilitation costs.

However, it’s important to note that PIP coverage typically only covers a portion of your medical expenses, so it’s a good idea to have health insurance or other forms of medical coverage in place as well.

Does PIP cover passengers in my car?

Yes, PIP coverage typically covers passengers in your car who are injured in a car accident, regardless of who was at fault for the accident. This can include family members, friends, and other passengers.

However, it’s important to note that PIP coverage may not be enough to cover all of the medical expenses and lost wages of all passengers in the car, so it’s a good idea to have additional insurance coverage in place if possible.

Does PIP cover me if I’m at fault for the accident?

Yes, PIP coverage typically covers you even if you’re at fault for the car accident. This can help pay for your medical expenses and lost wages, even if you caused the accident.

However, it’s important to note that PIP coverage may not be enough to cover all of your expenses if you caused a serious accident, so it’s a good idea to have additional insurance coverage in place if possible.

What is Personal Injury Protection (PIP)?

In conclusion, personal injury protection (PIP) is an essential coverage option for individuals in the United States. It offers compensation for medical expenses, lost wages, and other related costs in the event of an accident, regardless of who was at fault. It can also cover the costs of rehabilitation and essential services, such as childcare or housekeeping.

Moreover, PIP coverage can provide peace of mind, knowing that you and your loved ones are protected in case of an accident. With the rising costs of medical care, lost wages, and other expenses, having PIP coverage can be a lifesaver.

If you’re considering purchasing PIP coverage, make sure to carefully review your policy to understand what it covers and any limitations. By doing so, you can ensure that you’re fully protected in the event of an accident.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts