Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

Car accidents can be a traumatic experience, and dealing with insurance companies after the fact can be equally daunting. With so much at stake, it’s important to know the most common mistakes to avoid when dealing with insurance companies.

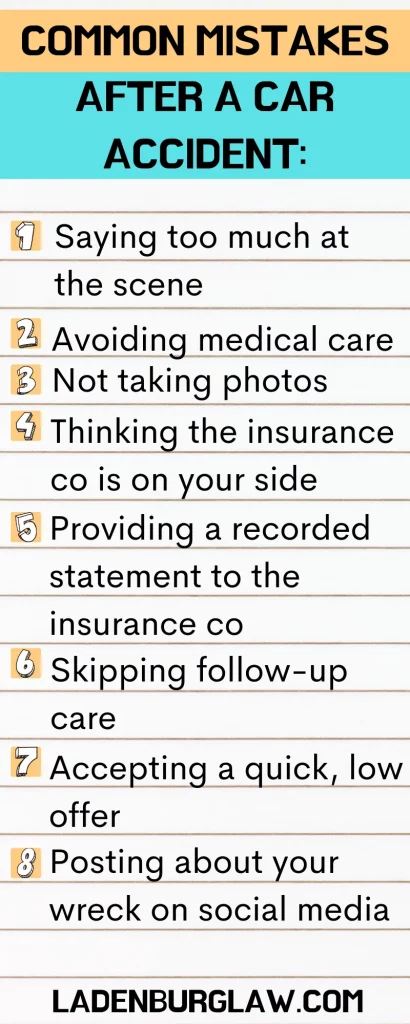

In this article, we’ll take a closer look at the top 8 mistakes to avoid when dealing with insurance companies after a car accident. Whether you’re new to the process or a seasoned pro, these tips can help you navigate the often-complicated world of insurance and ensure that you receive the compensation you deserve. So, without further ado, let’s dive in!

Avoid these common mistakes when dealing with insurance companies after a car accident: waiting to seek medical treatment, admitting fault, signing a settlement too quickly, not gathering enough evidence, not reporting the accident to the police, not notifying your own insurance company, not understanding your policy, and not seeking legal advice when necessary. Taking these precautions can help ensure a smoother claims process and a better outcome.

Top 8 Mistakes to Avoid When Dealing with Insurance Companies After a Car Accident

Car accidents can be distressing, and dealing with insurance companies can add another level of stress. It’s important to be cautious and avoid making mistakes that could hurt your chances of filing a successful insurance claim. Here are the top 8 mistakes to avoid when dealing with insurance companies after a car accident.

1. Not Reporting the Accident to the Police

One of the biggest mistakes people make after a car accident is not reporting it to the police. Failing to report the accident to the police could hurt your chances of filing a successful insurance claim. Without a police report, it may be difficult to prove that the accident occurred and who was at fault. It’s important to call the police and report the accident as soon as possible.

It’s also important to make sure that you get a copy of the police report. The police report will contain important information, such as the names of the drivers involved, the location of the accident, and any witnesses.

2. Admitting Fault

Another mistake people make after a car accident is admitting fault. It’s important to be careful about what you say to the other driver and the insurance company. Even if you think you were at fault, it’s best to let the insurance companies and the police determine who was at fault. Admitting fault could hurt your chances of filing a successful insurance claim.

3. Not Seeking Medical Attention

After a car accident, it’s important to seek medical attention, even if you don’t feel like you were injured. Some injuries, such as whiplash, may not show up until a few days after the accident. It’s important to get checked out by a medical professional to make sure you don’t have any injuries.

If you do have injuries, make sure to document everything. Keep a record of all medical bills, doctor’s appointments, and any medication you were prescribed.

4. Not Taking Pictures

Another mistake people make after a car accident is not taking pictures. Pictures can be used as evidence in your insurance claim. Take pictures of the damage to your car, the other driver’s car, and any injuries you or your passengers sustained.

5. Giving a Recorded Statement

Insurance companies may ask you to give a recorded statement after a car accident. It’s important to be careful about what you say during this statement. Insurance companies may use your statement against you, so it’s important to be cautious.

If you’re unsure about giving a recorded statement, it’s best to speak with an attorney first.

6. Accepting the First Settlement Offer

Insurance companies may offer you a settlement after a car accident. It’s important to be cautious about accepting the first settlement offer. The first settlement offer may not be enough to cover all of your damages.

It’s best to speak with an attorney before accepting any settlement offers.

7. Not Hiring an Attorney

Another mistake people make after a car accident is not hiring an attorney. An attorney can help you navigate the complex insurance process and make sure you get the compensation you deserve.

If you’re unsure about whether or not you need an attorney, it’s best to speak with one to discuss your options.

8. Waiting Too Long to File Your Claim

Finally, waiting too long to file your insurance claim can hurt your chances of receiving compensation. It’s important to file your claim as soon as possible after the accident.

If you’re unsure about how to file your claim, speak with your insurance company or an attorney for guidance.

In conclusion, dealing with insurance companies after a car accident can be challenging. It’s important to be cautious and avoid making mistakes that could hurt your chances of receiving compensation. By following these tips, you can improve your chances of filing a successful insurance claim.

Contents

- Frequently Asked Questions

- What should I do immediately after a car accident?

- Should I accept the first settlement offer from the insurance company?

- What are some mistakes to avoid when dealing with insurance companies after a car accident?

- How long does it take to settle a car accident claim with an insurance company?

- What should I do if the insurance company denies my claim?

- 7 Dirty Tricks Insurance Companies Will Play After an Auto Accident | Denmon Pearlman Law

Frequently Asked Questions

What should I do immediately after a car accident?

After a car accident, your first priority should be to ensure that everyone involved is safe and receive medical attention if necessary. Then, you should call the police and exchange insurance information with the other driver. It is also important to document the scene of the accident by taking pictures and gathering witness information. Lastly, you should notify your insurance company of the accident.

By following these steps, you can ensure that you have the necessary information to file a claim with your insurance company and protect yourself from potential legal issues.

Should I accept the first settlement offer from the insurance company?

No, it is not recommended to accept the first settlement offer from the insurance company without consulting with an attorney or evaluating the full extent of your damages. The initial offer from the insurance company may not fully cover all of your expenses, including medical bills and lost wages, and accepting the offer could prevent you from seeking further compensation in the future.

It is important to consult with a legal professional who can evaluate your case and negotiate on your behalf to ensure you receive fair compensation for your damages and injuries.

What are some mistakes to avoid when dealing with insurance companies after a car accident?

Some common mistakes to avoid when dealing with insurance companies after a car accident include admitting fault, providing a recorded statement without legal representation, accepting a quick settlement offer without fully assessing damages, and signing a release before receiving full compensation.

Other mistakes to avoid include failing to seek medical attention, failing to document the accident scene, and failing to notify your insurance company of the accident in a timely manner. By avoiding these mistakes, you can protect your rights and ensure that you receive fair compensation for your damages and injuries.

How long does it take to settle a car accident claim with an insurance company?

The time it takes to settle a car accident claim with an insurance company can vary depending on the complexity of the case and the extent of the damages involved. In some cases, a claim can be settled within a few weeks, while in others, it may take several months or even years.

It is important to work with an experienced attorney who can negotiate on your behalf and ensure that you receive fair compensation for your damages and injuries in a timely manner.

What should I do if the insurance company denies my claim?

If the insurance company denies your claim, it is important to consult with a legal professional who can evaluate your case and determine if you have grounds for a lawsuit. Your attorney can gather evidence, negotiate with the insurance company, and represent you in court if necessary.

By taking legal action, you can protect your rights and ensure that you receive fair compensation for your damages and injuries.

7 Dirty Tricks Insurance Companies Will Play After an Auto Accident | Denmon Pearlman Law

In conclusion, dealing with insurance companies after a car accident can be a daunting task, but avoiding these top 8 mistakes can make the process smoother and more successful.

Firstly, it’s crucial to never admit fault or sign anything without fully understanding the terms. Secondly, always report the accident to the insurance company as soon as possible. Thirdly, keeping all documents and records organized and readily accessible can save time and hassle.

By avoiding these mistakes and being knowledgeable about the process, you can ensure that you receive the compensation you deserve and move forward with peace of mind. Remember, the key is to stay calm, informed, and assertive when dealing with insurance companies after a car accident.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts