Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

If you’ve been involved in an auto accident or other type of personal injury, you may be wondering what type of insurance coverage you need to protect yourself financially. Personal Injury Protection (PIP) and Medical Payments (MedPay) are two of the most common types of coverage available to those who have been injured, and it can be difficult to understand the differences between them. In this article, we’ll look at the differences between PIP and MedPay, so you can make an informed decision about the best type of insurance coverage for your situation.

| Personal Injury Protection | Medical Payments |

|---|---|

| PIP is a type of coverage that pays for your medical expenses and lost wages if you’re injured in a car accident, regardless of who is at fault. | Medical Payments coverage, also known as MedPay, provides reimbursement for medical bills incurred due to an accident, regardless of who is at fault. |

| PIP coverage also covers family members living in the same household. | MedPay coverage does not cover family members living in the same household. |

| PIP may also cover funeral expenses, childcare expenses, and other related costs. | MedPay generally only covers medical expenses. |

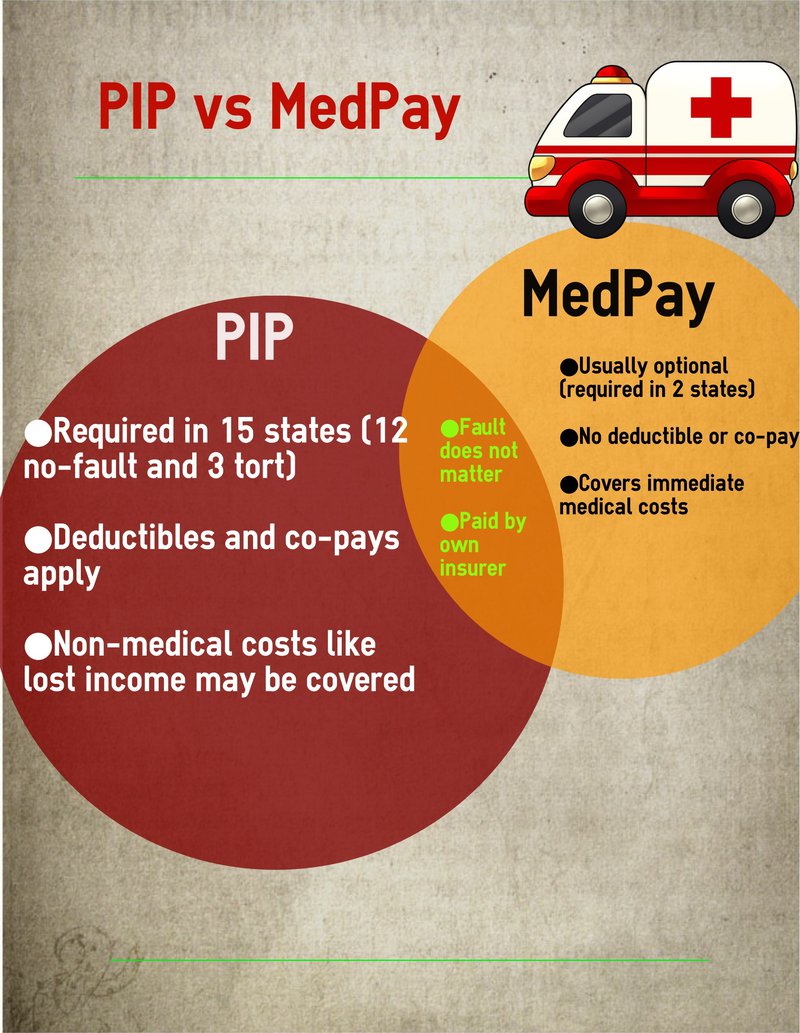

Chart Comparing: Personal Injury Protection Vs Medical Payments

| Personal Injury Protection (PIP) | Medical Payments (Med Pay) | |

|---|---|---|

| Coverage | PIP covers medical expenses, lost wages, and other damage for the policyholder and other passengers in the car. | Med Pay covers medical expenses for you and passengers in your car, regardless of who caused the accident. |

| Benefits | PIP has a much broader coverage than Med Pay, covering medical expenses, lost wages, and other damages. | Med Pay only covers medical expenses, regardless of who caused the accident. |

| Limits | PIP limits vary based on the policy. | Med Pay limits typically range from $1,000 to $10,000. |

| Cost | PIP costs vary based on the policy and the limits you choose. | Med Pay is generally cheaper than PIP and the cost varies by state. |

| Claims | PIP claims are typically made directly with the insurer. | Med Pay claims are typically made with the health care provider. |

| Lawsuits | PIP is considered a “no-fault” insurance and lawsuits are generally not allowed. | Med Pay does not limit the right to sue. |

Contents

Personal Injury Protection vs. Medical Payments

Personal Injury Protection (PIP) and Medical Payments (MedPay) are both types of insurance coverage that provide financial assistance to policyholders when they are injured in a car accident. Both forms of coverage can help pay for medical expenses, lost wages, and other related costs. However, there are some key differences between the two types of coverage.

What is Personal Injury Protection?

Personal Injury Protection is an insurance coverage that covers medical and related expenses for an individual who is injured in a car accident. It covers the expenses of the policyholder, regardless of who is at fault for the accident. This type of coverage often includes medical expenses, lost wages, and funeral costs. The amount of coverage varies by state and policy, but typically ranges from $5,000 to $50,000.

PIP coverage is typically offered as part of an auto insurance policy, but can also be purchased as a stand-alone policy. It is important to understand that PIP coverage is not a form of liability insurance, which is designed to protect you from being sued by another driver. PIP coverage only covers the expenses of the policyholder and does not provide any protection against lawsuits.

PIP coverage is required in some states, and optional in others. It is important to understand the laws in your state to determine if PIP coverage is required or optional.

What is Medical Payments Coverage?

Medical Payments coverage is a type of insurance coverage that is designed to cover medical expenses for an individual who is injured in a car accident. It covers the medical bills of the policyholder, regardless of who is at fault for the accident. This type of coverage typically includes medical expenses, lost wages, and funeral costs. The amount of coverage varies by state and policy, but typically ranges from $1,000 to $10,000.

MedPay coverage is typically offered as part of an auto insurance policy, but can also be purchased as a stand-alone policy. It is important to understand that MedPay coverage is not a form of liability insurance, which is designed to protect you from being sued by another driver. MedPay coverage only covers the expenses of the policyholder and does not provide any protection against lawsuits.

MedPay coverage is not required in any state, and is typically offered as an optional coverage. It is important to understand the laws in your state to determine if MedPay coverage is available.

Differences Between Personal Injury Protection and Medical Payments

The key difference between Personal Injury Protection and Medical Payments is the amount of coverage. PIP coverage typically provides more coverage than MedPay coverage, and is often required in some states. MedPay coverage is typically offered as an optional coverage, and typically provides less coverage than PIP coverage.

Another key difference between the two types of coverage is the type of expenses that they cover. PIP coverage typically covers more types of expenses than MedPay coverage, including medical bills, lost wages, and funeral costs. MedPay coverage typically only covers medical bills.

It is also important to note that PIP and MedPay coverage are not forms of liability insurance, and do not provide any protection against lawsuits. Both types of coverage are designed to cover the expenses of the policyholder, regardless of who is at fault for the accident.

Which Type of Coverage Should I Choose?

The type of coverage that you choose will depend on your specific needs and the laws in your state. If you live in a state that requires PIP coverage, then you should purchase a policy that includes PIP coverage. If you live in a state that does not require PIP coverage, then you should consider purchasing MedPay coverage.

If you are looking for more coverage, then you should consider purchasing a policy that includes both PIP and MedPay coverage. This will provide you with more coverage than either type of coverage alone, and will also provide more protection against lawsuits.

It is important to understand the differences between PIP and MedPay coverage, and to make sure that you purchase the coverage that is right for you. It is also important to understand the laws in your state to make sure that you are in compliance with the law.

Personal Injury Protection Vs Medical Payments Pros & Cons

-

Pros of Personal Injury Protection

- It pays for medical costs regardless of who is at fault in an accident.

- It covers lost wages if you are unable to work due to injuries sustained in an accident.

- It covers funeral expenses in the event of death.

-

Cons of Personal Injury Protection

- It does not cover property damage.

- It does not cover pain and suffering.

- It is often expensive and not required in some states.

-

Pros of Medical Payments

- It pays for medical costs regardless of who is at fault in an accident.

- It covers lost wages if you are unable to work due to injuries sustained in an accident.

- It covers funeral expenses in the event of death.

-

Cons of Medical Payments

- It does not cover property damage.

- It does not cover pain and suffering.

- It is often expensive and not required in some states.

Personal Injury Protection Vs Medical Payments

After careful consideration, it is clear that Personal Injury Protection (PIP) is the better choice for those looking for coverage for medical expenses due to an accident. PIP provides a wide range of coverage, including medical expenses, lost wages, and more, while Medical Payments coverage is generally limited to medical expenses only.

The benefits of PIP coverage are numerous. It covers medical expenses regardless of who is at fault in an accident, which can be extremely beneficial in cases where the responsible party is uninsured or underinsured. Additionally, PIP coverage can help cover lost wages due to being unable to work due to injury or hospitalization.

In contrast, Medical Payments coverage is limited to medical expenses, and does not provide any other coverage in the event of an accident. Additionally, it only covers up to a certain amount, which may not be enough to cover the full cost of medical bills.

For these reasons, Personal Injury Protection is the clear winner when considering which coverage is better for medical expenses after an accident. Here are three reasons why PIP is the better choice:

- It covers medical expenses regardless of who is at fault.

- It covers lost wages due to injury or hospitalization.

- It provides more comprehensive coverage than Medical Payments coverage.

Frequently Asked Questions

Personal Injury Protection (PIP) and Medical Payments (MedPay) are two types of coverage offered by car insurance companies. PIP covers medical expenses and lost wages for you and your passengers, while MedPay covers medical expenses for you and your passengers. Both coverages are important for protecting yourself and your passengers in case of an accident.

What Is Personal Injury Protection (PIP)?

Personal Injury Protection (PIP) is a type of insurance coverage that pays for medical expenses and lost wages for you and your passengers if you are injured in an auto accident. PIP covers medical bills for hospital stays, doctor visits, medications, physical therapy, and other medical expenses. It also covers lost wages for you and your passengers if you are unable to work due to your injuries. PIP coverage is required in some states, but it is optional in most states.

What Is Medical Payments (MedPay)?

Medical Payments (MedPay) is another type of car insurance coverage that pays for medical expenses for you and your passengers if you are involved in an auto accident. MedPay pays for medical bills such as hospital stays, doctor visits, medications, physical therapy, and other medical expenses. It does not cover lost wages, unlike PIP. MedPay is optional in most states, but it is required in some states.

How Does Personal Injury Protection Differ from Medical Payments?

Personal Injury Protection (PIP) and Medical Payments (MedPay) are both types of coverage offered by car insurance companies, but they differ in a few key ways. PIP covers medical expenses and lost wages for you and your passengers, while MedPay only covers medical expenses. PIP is required in some states, while MedPay is optional in most states. Additionally, PIP covers more types of medical expenses than MedPay.

What Does Personal Injury Protection Cover?

Personal Injury Protection (PIP) covers medical expenses and lost wages for you and your passengers if you are injured in an auto accident. PIP covers medical bills for hospital stays, doctor visits, medications, physical therapy, and other medical expenses. It also covers lost wages for you and your passengers if you are unable to work due to your injuries. PIP covers more types of medical expenses than MedPay.

What Does Medical Payments Cover?

Medical Payments (MedPay) is a type of car insurance coverage that pays for medical expenses for you and your passengers if you are involved in an auto accident. MedPay pays for medical bills such as hospital stays, doctor visits, medications, physical therapy, and other medical expenses. MedPay does not cover lost wages, unlike PIP. MedPay is optional in most states, but it is required in some states.

Personal Injury Protection or Medical Payments

Personal Injury Protection and Medical Payments are two important types of car insurance coverage that can help you protect yourself, your passengers, and your finances in the event of an accident. While both are important coverage options, they differ in how they pay out and the benefits they offer. PIP is more comprehensive and provides more coverage, while Medical Payments is more limited but may be more suitable for certain types of insurance needs. Ultimately, it’s important to review the coverage options available to you to find the best one for your situation.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts