Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

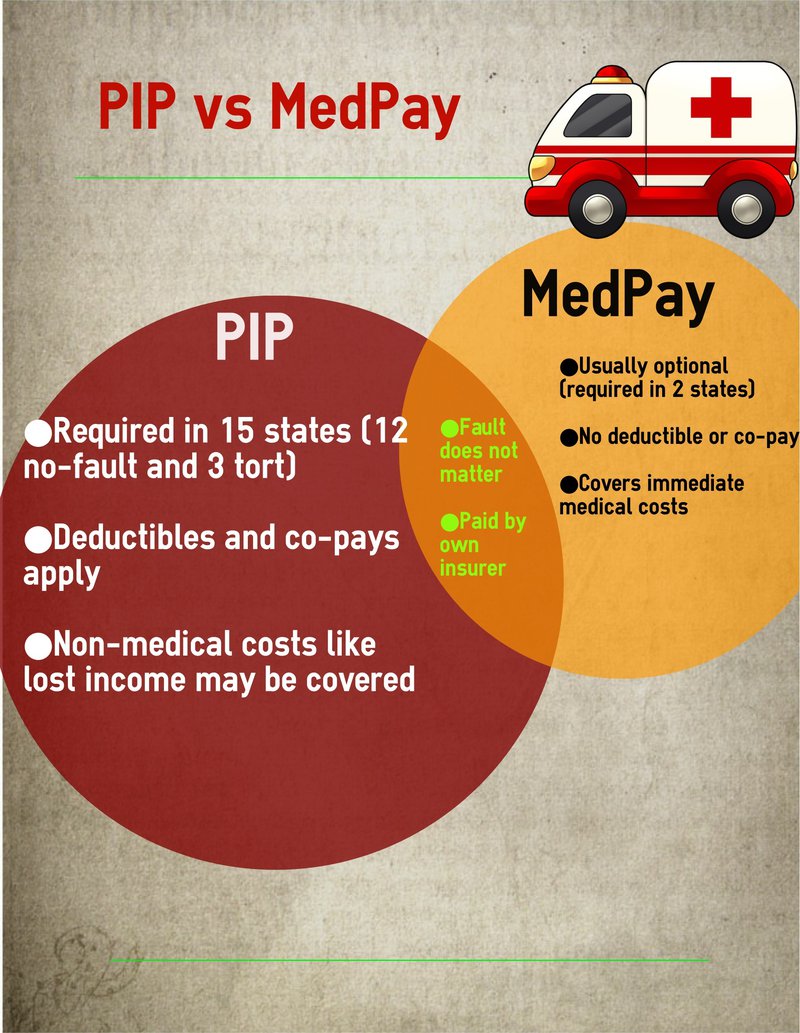

Personal injury protection (PIP) and medical payments (MedPay) are two types of insurance coverage that can help pay for medical expenses after an accident. While both cover medical costs, there are some key differences between the two. In this article, we will explore the similarities and differences between PIP and MedPay to help you better understand which option may be best for you.

If you’re unsure which type of coverage to choose, don’t worry. We’ll break down what each coverage offers and the pros and cons of each. Whether you’re looking for more comprehensive coverage or just trying to save money on your insurance premiums, we’ve got you covered. So, let’s dive in and explore the world of PIP vs MedPay.

Personal Injury Protection and Medical Payments are both types of auto insurance coverage that can assist in paying for medical expenses after an accident. Personal Injury Protection (PIP) covers medical bills, lost wages, and other related expenses regardless of fault. Medical Payments (MedPay) coverage is more limited and only covers medical expenses up to a certain amount. PIP is required in some states, while MedPay is optional.

Contents

Personal Injury Protection Vs Medical Payments: Understanding the Difference

What is Personal Injury Protection?

Personal Injury Protection (PIP) is a type of insurance coverage that provides compensation for medical expenses, lost wages, and other related expenses in case of a car accident. This coverage is mandatory in some states, while in others, it is optional.

In the event of an accident, PIP coverage will pay for your medical expenses regardless of who caused the accident. This means that even if you were at fault, you can still receive compensation for your medical bills.

Some of the benefits of PIP coverage include coverage for rehabilitation services, funeral expenses, and lost wages. It can also provide compensation for household services that you may not be able to perform due to your injuries.

What are Medical Payments?

Medical Payments (MedPay) coverage is also a type of insurance coverage that provides compensation for medical expenses resulting from a car accident. However, unlike PIP, MedPay does not cover lost wages or other related expenses.

MedPay coverage is optional in most states and can be used to supplement your health insurance coverage. This means that if you have health insurance, you can use MedPay to pay for your deductible or co-payments.

Some of the benefits of MedPay coverage include coverage for ambulance services, hospital stays, and medical treatments. It can also provide coverage for dental work, chiropractic treatments, and other related expenses.

Benefits of PIP Coverage

One of the main benefits of PIP coverage is that it provides compensation for lost wages. This can be especially helpful if you are unable to work due to your injuries. PIP coverage can also provide compensation for household services, which can be a significant help if you are unable to perform them due to your injuries.

Another benefit of PIP coverage is that it provides coverage for rehabilitation services. This can include physical therapy, occupational therapy, and other related services. These services can help you recover from your injuries and get back to your normal activities.

Benefits of MedPay Coverage

One of the main benefits of MedPay coverage is that it can be used to supplement your health insurance coverage. This means that if you have high deductibles or co-payments, you can use MedPay to pay for these expenses.

Another benefit of MedPay coverage is that it provides coverage for ambulance services and hospital stays. This can be especially helpful if you have a high-deductible health insurance plan or if you do not have health insurance.

PIP Vs MedPay: Which is Better?

Both PIP and MedPay coverage are designed to provide compensation for medical expenses resulting from a car accident. However, the main difference between the two is that PIP coverage provides coverage for lost wages and other related expenses, while MedPay does not.

If you are concerned about lost wages or household services, then PIP coverage may be the better option for you. However, if you already have health insurance coverage and are mainly concerned about medical expenses, then MedPay coverage may be the better option for you.

Ultimately, the decision between PIP and MedPay coverage will depend on your individual needs and circumstances. It is always a good idea to speak with an insurance agent to determine which type of coverage is best for you.

Conclusion

In conclusion, Personal Injury Protection (PIP) and Medical Payments (MedPay) coverage are two types of insurance coverage that provide compensation for medical expenses resulting from a car accident. While PIP coverage provides coverage for lost wages and other related expenses, MedPay coverage mainly provides coverage for medical expenses.

When choosing between PIP and MedPay coverage, it is important to consider your individual needs and circumstances. Always speak with an insurance agent to determine which type of coverage is best for you.

Frequently Asked Questions

Personal injury protection (PIP) and medical payments (MedPay) are two types of car insurance coverage that help pay for medical expenses after a car accident. While they are similar, there are some key differences between the two. Here are some common questions and answers about PIP vs. MedPay.

What is Personal Injury Protection?

Personal injury protection, or PIP, is a type of car insurance that covers medical expenses and lost wages after a car accident, regardless of who was at fault. PIP also covers other expenses, such as child care and funeral costs. PIP is required in some states, but not all.

PIP typically has higher coverage limits than MedPay, and may also cover expenses related to rehabilitation and disability. However, PIP can be more expensive than MedPay.

What is Medical Payments?

Medical payments, or MedPay, is a type of car insurance that covers medical expenses after a car accident, regardless of who was at fault. MedPay is optional in most states, and typically has lower coverage limits than PIP. MedPay generally only covers medical expenses, and does not cover lost wages or other expenses.

MedPay may be a good option if you have health insurance with a high deductible or copay, as it can help cover out-of-pocket expenses. However, if you have good health insurance, MedPay may be redundant.

Which one should I choose?

Whether you choose PIP or MedPay depends on your individual needs and circumstances. If you live in a state that requires PIP, you will need to purchase it. If you have good health insurance, you may not need either PIP or MedPay. However, if you have a high deductible or copay, MedPay may be a good option to help cover out-of-pocket expenses.

If you are unsure which type of coverage to choose, you may want to consult with an insurance agent who can help you understand your options and choose the coverage that is right for you.

Can I have both PIP and MedPay?

Yes, you can have both PIP and MedPay. In fact, some states require drivers to have both types of coverage. Having both types of coverage can provide extra protection in the event of an accident, but it can also be more expensive.

If you have both PIP and MedPay, PIP will typically be used first to cover medical expenses, and MedPay will be used to cover any remaining expenses.

Do I still need PIP or MedPay if I have health insurance?

If you have good health insurance, you may not need PIP or MedPay. However, if you have a high deductible or copay, MedPay may be a good option to help cover out-of-pocket expenses. PIP may also be a good option if you are concerned about lost wages or other expenses related to a car accident.

Ultimately, the decision to purchase PIP or MedPay depends on your individual needs and circumstances. You may want to consult with an insurance agent to discuss your options and determine the best course of action.

Personal Injury Protection or Medical Payments

In conclusion, personal injury protection (PIP) and medical payments (MedPay) are two types of insurance coverage that can help pay for medical expenses after a car accident. While both cover medical expenses, PIP offers more comprehensive coverage, including lost wages and other expenses. On the other hand, MedPay is a simpler and more affordable option that only covers medical expenses.

When choosing between PIP and MedPay, it’s important to consider your individual needs and budget. If you’re looking for more comprehensive coverage and can afford higher premiums, PIP may be the better option for you. However, if you’re on a tight budget and just need basic medical coverage, MedPay may be the way to go. Ultimately, it’s up to you to decide which type of coverage best meets your needs.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts