Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

When it comes to protecting yourself financially after an accident, it is important to understand the differences between motorcycle accident insurance coverage and car accident insurance coverage. With the right coverage, you can rest assured that you are fully protected in the event of an accident. In this article, we will explore the key differences between motorcycle accident insurance coverage and car accident insurance coverage, helping you to make the right decisions for your individual circumstances.

| Motorcycle Accident Insurance Coverage | Car Accident Insurance Coverage |

|---|---|

| It typically covers medical expenses, property damage, and liability. | It typically covers medical bills, property damage, and liability. |

| Insurance companies may require extra coverage for riders. | Insurance companies may not require extra coverage for drivers. |

| It may cover some additional items, such as towing and rental reimbursement. | It may cover some additional items, such as towing and rental reimbursement. |

Motorcycle Accident Insurance Coverage Vs Car Accident Insurance Coverage: In-Depth Comparison Chart

| Insurance Coverage | Motorcycle Accidents | Car Accidents |

|---|---|---|

| Liability Coverage | Required in most states and covers damage to other people and property. | Required in most states and covers damage to other people and property. |

| Collision Coverage | Optional coverage that pays for damage to your motorcycle caused by a collision. | Optional coverage that pays for damage to your car caused by a collision. |

| Comprehensive Coverage | Optional coverage that pays for damage to your motorcycle caused by non-collision events such as theft, hail, fire, etc. | Optional coverage that pays for damage to your car caused by non-collision events such as theft, hail, fire, etc. |

| Medical Coverage | Optional coverage that pays for medical costs resulting from an accident. | Optional coverage that pays for medical costs resulting from an accident. |

| Uninsured Motorist Coverage | Optional coverage that pays for damages caused by an uninsured motorist. | Optional coverage that pays for damages caused by an uninsured motorist. |

| Underinsured Motorist Coverage | Optional coverage that pays for damages caused by an underinsured motorist. | Optional coverage that pays for damages caused by an underinsured motorist. |

Contents

- Motorcycle Accident Insurance Coverage Vs Car Accident Insurance Coverage

- Motorcycle Accident Insurance Coverage Vs Car Accident Insurance Coverage Pros & Cons

- Which is Better – Motorcycle Accident Insurance Coverage Vs Car Accident Insurance Coverage?

- Frequently Asked Questions

- What Kind of Insurance Should I Have for Motorcycle Accidents?

- What Kind of Insurance Should I Have for Car Accidents?

- Is Motorcycle Insurance More Expensive than Car Insurance?

- Are Motorcycles Covered by Health Insurance?

- Are Cars Covered by Health Insurance?

- Your Motorcycle Accident Claim (3 COMMON Ways to Lose)

Motorcycle Accident Insurance Coverage Vs Car Accident Insurance Coverage

Many people are unaware of the differences between motorcycle accident insurance coverage and car accident insurance coverage. When you own a motorcycle, you need to understand the different types of insurance that you need and the coverage they provide. This article will provide a comparison between motorcycle accident insurance coverage and car accident insurance coverage.

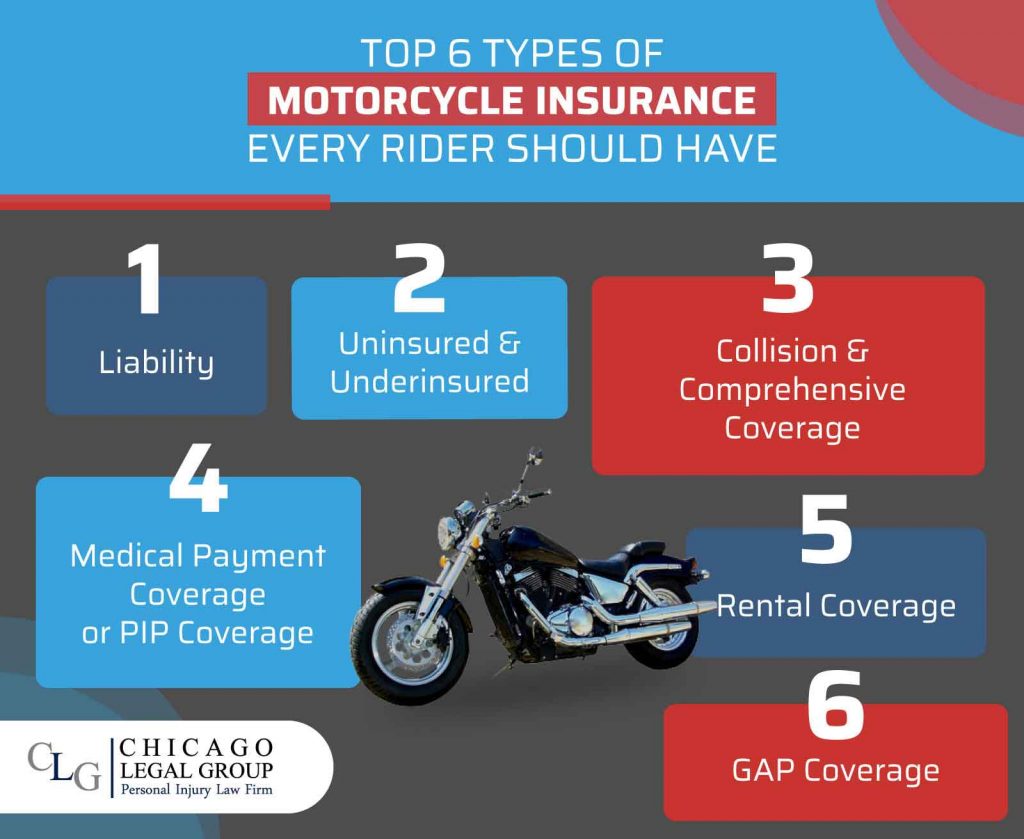

Types of Insurance Coverage

The types of coverage available for motorcycles and cars are similar. Both vehicles require liability insurance, which covers the costs of property damage and medical bills if you are found at fault in an accident. Collision insurance may also be required, which covers the cost of repairing or replacing your vehicle after an accident. Personal injury protection (PIP) can also be purchased, which covers medical bills, lost wages, and other accident-related costs.

Coverage Amounts

The amount of coverage you need for your motorcycle or car depends on the type and value of the vehicle. Generally, motorcycle policies require higher coverage limits due to the increased risk of injury and property damage. For example, you may require $50,000 in liability coverage for a car, whereas a motorcycle policy may require $100,000 in liability coverage.

Rates and Premiums

The cost of motorcycle and car insurance is determined by a variety of factors, including the type of vehicle, the age and driving experience of the driver, and the amount of coverage purchased. Generally, motorcycle insurance is more expensive than car insurance due to the increased risk of injury and property damage.

Discounts

Insurance companies may offer discounts for motorcycle and car insurance. These discounts may be offered for safe driving, for taking a defensive driving course, or for being a member of certain organizations. Discounts may also be available for purchasing both motorcycle and car insurance from the same insurer.

Policy Exclusions

It is important to understand the exclusions in your motorcycle and car insurance policies. These exclusions may include coverage for damage caused by wear and tear, weather-related damage, or damage caused by a driver without valid insurance.

Uninsured Motorists Coverage

Uninsured motorist coverage is available for both motorcycle and car insurance policies. This coverage provides protection if you are involved in an accident with an uninsured driver or a driver without valid insurance.

Rental Car Coverage

Rental car coverage may also be included in a motorcycle or car insurance policy. This coverage pays for the cost of a rental car if your vehicle is damaged or stolen. The coverage may also provide protection if your vehicle is in the shop for repairs.

Medical Payments Coverage

Medical payments coverage is available with both motorcycle and car insurance policies. This coverage pays for medical bills if you or your passengers are injured in an accident. The coverage may also cover funeral expenses if a person is killed in an accident.

Motorcycle Accident Insurance Coverage Vs Car Accident Insurance Coverage Pros & Cons

Motorcycle Accident Insurance Coverage Pros

- Typically more affordable than car insurance

- Less paperwork and fewer restrictions

- Faster and easier to purchase coverage

Motorcycle Accident Insurance Coverage Cons

- Lack of protection for other riders

- Risk of serious injury or death

- Higher rate of theft and vandalism

Car Accident Insurance Coverage Pros

- Comprehensive coverage for all passengers

- Protection from theft and vandalism

- Lower rates for experienced drivers

Car Accident Insurance Coverage Cons

- More expensive than motorcycle insurance

- More paperwork and restrictions

- Higher risk of injury or death

Which is Better – Motorcycle Accident Insurance Coverage Vs Car Accident Insurance Coverage?

When it comes to choosing between motorcycle accident insurance coverage and car accident insurance coverage, there are several factors to consider. Both types of coverage offer protection in the event of an accident, such as medical bills, vehicle repair costs, and more. While both options can provide needed financial relief, there are differences in the amount of coverage and the cost of the policies.

For those who prefer the convenience and cost savings of a motorcycle, motorcycle accident insurance coverage may be the better choice. Motorcycles are generally less expensive to insure than cars, and the coverage can be tailored to the rider’s needs. Motorcycle accident insurance can also provide coverage for medical expenses, legal fees, and other costs associated with an accident.

On the other hand, car accident insurance coverage is often more comprehensive than motorcycle coverage. This type of coverage often includes liability coverage for damage to other people’s property, collision coverage for damage to your vehicle, and comprehensive coverage for damage from events other than accidents. Car accident insurance coverage can also cover a wider range of expenses, including rental car costs and medical bills.

In the end, the best policy for you will depend on your own needs and preferences. Here are three reasons to consider motorcycle accident insurance coverage over car accident insurance coverage:

- Motorcycle accident insurance is typically less expensive than car insurance.

- The coverage can be tailored to the rider’s needs.

- The coverage can provide protection for medical expenses, legal fees, and other costs associated with an accident.

Frequently Asked Questions

Insurance coverage for accidents involving motorcycles is complex and different from coverage for cars. This article aims to answer common questions regarding motorcycle accident insurance coverage versus car accident insurance coverage.

What Kind of Insurance Should I Have for Motorcycle Accidents?

The kind of insurance you should have for motorcycle accidents depends on where you live. In most states, you’ll need to have liability insurance for your motorcycle, which covers you for any property damage or bodily injury that you may cause to someone else. You may also want to get uninsured/underinsured motorist coverage, which can cover you in the event that you’re hit by someone who doesn’t carry enough insurance. Finally, if you’re financing your motorcycle, you may be required to get collision and comprehensive coverage, which will cover damages to your motorcycle regardless of who is at fault.

What Kind of Insurance Should I Have for Car Accidents?

Similar to motorcycle accidents, the kind of insurance you should have for car accidents also depends on where you live. In most states, you’ll need to have liability insurance for your car, which covers you for any property damage or bodily injury that you may cause to someone else. You should also get uninsured/underinsured motorist coverage, which can cover you in the event that you’re hit by someone who doesn’t carry enough insurance. If you’re financing your car, you may be required to get collision and comprehensive coverage, which will cover damages to your car regardless of who is at fault.

Is Motorcycle Insurance More Expensive than Car Insurance?

Generally speaking, motorcycle insurance is more expensive than car insurance. This is due to the fact that motorcycles are considered to be more risky than cars. Motorcycle riders are more likely to be involved in an accident, and they are more exposed to the elements than people in cars, which can lead to more costly damages. Additionally, motorcycle repairs can be more expensive than car repairs.

Are Motorcycles Covered by Health Insurance?

Most health insurance plans will cover medical expenses related to motorcycle accidents. However, it’s important to note that your health insurance may not cover the cost of your motorcycle and any property damage that may have occurred. Additionally, your health insurance may not cover any costs related to lost wages or pain and suffering.

Are Cars Covered by Health Insurance?

Similar to motorcycles, most health insurance plans will cover medical expenses related to car accidents. However, it’s important to note that your health insurance may not cover the cost of your car and any property damage that may have occurred. Additionally, your health insurance may not cover any costs related to lost wages or pain and suffering.

Your Motorcycle Accident Claim (3 COMMON Ways to Lose)

In conclusion, motorcycle accident insurance coverage and car accident insurance coverage are both important for protecting drivers in the event of an accident. Ultimately, the best type of coverage for you depends on your budget, the type of vehicle you own, and your individual needs. Make sure to do your research to find the right coverage for you so that you can have peace of mind when driving.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts