Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

Personal injury protection (PIP) is a type of car insurance coverage that pays for medical expenses and lost wages for you and your passengers after a car accident. But is PIP required in Pennsylvania? The answer is not as straightforward as you might think. In this article, we’ll explore the ins and outs of PIP in Pennsylvania, including what it covers, who is required to have it, and what happens if you don’t have it.

Yes, Personal Injury Protection (PIP) is required in Pennsylvania. It provides coverage for medical expenses, lost wages, and other related expenses in case of a car accident, regardless of who is at fault. The minimum coverage required is $5,000, but higher limits are available for purchase.

Is Personal Injury Protection Required in Pennsylvania?

What is Personal Injury Protection?

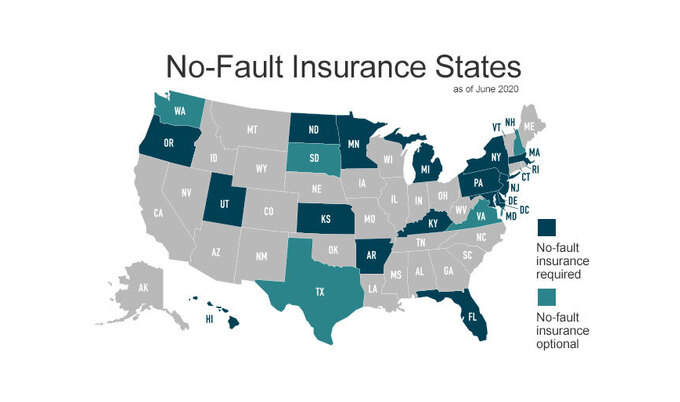

Personal Injury Protection, or PIP, is an insurance coverage that provides financial assistance to drivers and passengers who are injured in a car accident. It is often referred to as “no-fault” coverage because it pays out regardless of who caused the accident. PIP coverage can help pay for medical bills, lost wages, and other expenses related to the accident.

Is PIP Required in Pennsylvania?

Yes, Personal Injury Protection is required in Pennsylvania. Under the state’s Motor Vehicle Financial Responsibility Law, all drivers must carry PIP coverage with a minimum limit of $5,000. This coverage is designed to provide quick and easy access to medical benefits for those injured in a car accident.

Benefits of PIP Coverage

There are several benefits to having Personal Injury Protection coverage. First and foremost, it can help cover medical expenses related to an accident, including hospital bills, doctor’s visits, and rehabilitation costs. Additionally, PIP coverage can provide benefits for lost wages if an injured person is unable to work due to their injuries. Finally, PIP coverage can help cover expenses related to household services, such as cleaning or child care, that may become necessary due to the accident.

How PIP Coverage Compares to Other Types of Insurance

Personal Injury Protection coverage is often compared to other types of insurance, such as liability coverage and medical payments coverage. Liability coverage is designed to protect drivers from financial responsibility if they cause an accident that results in injury or property damage. Medical payments coverage, on the other hand, is designed to provide medical benefits to the policyholder and their passengers in the event of an accident.

Compared to these other types of insurance, PIP coverage is unique in that it provides benefits regardless of who caused the accident. This can be especially beneficial in situations where it may not be immediately clear who was at fault, or where multiple parties may share responsibility for the accident.

How to Choose the Right PIP Coverage

When selecting Personal Injury Protection coverage, it is important to consider your specific needs and budget. While the state of Pennsylvania requires a minimum limit of $5,000, you may wish to purchase additional coverage to provide greater protection in the event of a serious accident. Additionally, you may be able to save money on your insurance premiums by choosing a higher deductible or by bundling your PIP coverage with other types of insurance.

Conclusion

Personal Injury Protection is a required form of insurance in Pennsylvania that provides financial assistance to drivers and passengers who are injured in a car accident. This coverage can help cover medical expenses, lost wages, and other costs related to the accident. When selecting PIP coverage, it is important to consider your specific needs and budget to ensure that you are adequately protected in the event of an accident.

Contents

- Frequently Asked Questions

- What is Personal Injury Protection (PIP) coverage in Pennsylvania?

- What does PIP insurance cover in Pennsylvania?

- Who is required to have PIP insurance in Pennsylvania?

- What happens if I don’t have PIP insurance in Pennsylvania?

- How much does PIP insurance cost in Pennsylvania?

- What is Personal Injury Protection (PIP)?

Frequently Asked Questions

Personal injury protection (PIP) is an essential coverage that motorists need to have in several states in the US. However, the rules on PIP coverage may vary depending on your location. This article seeks to answer some of the frequently asked questions about PIP coverage in Pennsylvania.

What is Personal Injury Protection (PIP) coverage in Pennsylvania?

PIP coverage is a type of insurance that covers medical expenses and lost wages in case of an accident. It is a mandatory requirement in Pennsylvania, and every driver is required to have at least $5,000 in PIP coverage. The coverage may extend to other household members who are also covered under the policy.

The PIP coverage is designed to help you pay for medical expenses, lost wages, and other related expenses in case you are injured in an accident. The coverage is not dependent on who is at fault for the accident, and it can be used to pay for medical expenses, rehabilitation, and even funeral expenses in case of death.

What does PIP insurance cover in Pennsylvania?

Pennsylvania’s PIP insurance covers medical expenses, lost wages, and funeral expenses in case of death. The coverage also extends to other passengers in your car who are not covered by their insurance, pedestrians, and bicyclists. The coverage is not dependent on who is at fault for the accident.

The minimum PIP coverage in Pennsylvania is $5,000, but you can choose to purchase higher limits. However, PIP coverage does not cover property damage or liability for damages you may cause to other people’s property or injuries you cause to others in an accident.

Who is required to have PIP insurance in Pennsylvania?

Every driver in Pennsylvania is required to have at least $5,000 of PIP insurance coverage. The coverage must be purchased from a licensed insurance company in the state. The coverage may extend to other household members who are also covered under the policy.

If you are caught driving without PIP coverage, you may face penalties, including fines and suspension of your driver’s license. It is crucial to make sure you have the required PIP coverage to avoid these penalties.

What happens if I don’t have PIP insurance in Pennsylvania?

Driving without PIP insurance in Pennsylvania is illegal, and you may face penalties if caught. The penalties for driving without PIP coverage may include fines, suspension of your driver’s license, and even impounding of your car.

Additionally, if you are involved in an accident, you may have to pay for your medical expenses and lost wages out of pocket. This can be a significant financial burden, especially if you sustain severe injuries that require extensive medical treatment.

How much does PIP insurance cost in Pennsylvania?

The cost of PIP insurance in Pennsylvania varies depending on several factors, such as your age, driving record, and the level of coverage you choose. The minimum PIP coverage in Pennsylvania is $5,000, but you can choose to purchase higher limits.

It is essential to shop around and compare rates from different insurance companies to find the best price for your PIP coverage. You can also consider bundling your PIP coverage with other types of insurance, such as liability or collision coverage, to save money on your overall insurance costs.

What is Personal Injury Protection (PIP)?

In conclusion, personal injury protection is not required in Pennsylvania, but it is highly recommended. This type of coverage can provide you with peace of mind in the event of an accident, knowing that you and your passengers will be covered for medical expenses, lost wages, and other damages. While it may add to your insurance premiums, the benefits far outweigh the costs.

Ultimately, the decision to purchase personal injury protection is a personal one. However, it is important to weigh the potential risks and benefits of this coverage. By doing so, you can make an informed decision that will protect you and your loved ones in the event of an accident.

In conclusion, while Pennsylvania law does not require personal injury protection, it can be a valuable asset for drivers. Whether you opt for this coverage or not, it is important to maintain adequate insurance in order to protect yourself and others on the road. In the end, the best way to ensure your safety is to be a responsible driver and always follow traffic laws.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts