Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

Maine is known for its scenic beauty, but accidents can happen anytime, anywhere. Personal Injury Protection (PIP) is an insurance policy that helps cover medical and other expenses related to a car accident. But is it required in Maine?

The answer is yes. Maine law requires all drivers to have Personal Injury Protection (PIP) as part of their auto insurance policy. This means that if you’re involved in a car accident, your PIP coverage will help pay for your medical expenses, lost wages, and other related costs. So, it’s important to make sure you have this type of coverage to protect yourself and others on the road.

Yes, Personal Injury Protection (PIP) is required in Maine. This insurance coverage provides medical expenses, lost wages, and other related expenses for the driver and passengers involved in an accident, regardless of who was at fault. The minimum coverage limit in Maine is $2,000, but drivers can opt for higher limits.

Is Personal Injury Protection Required in Maine?

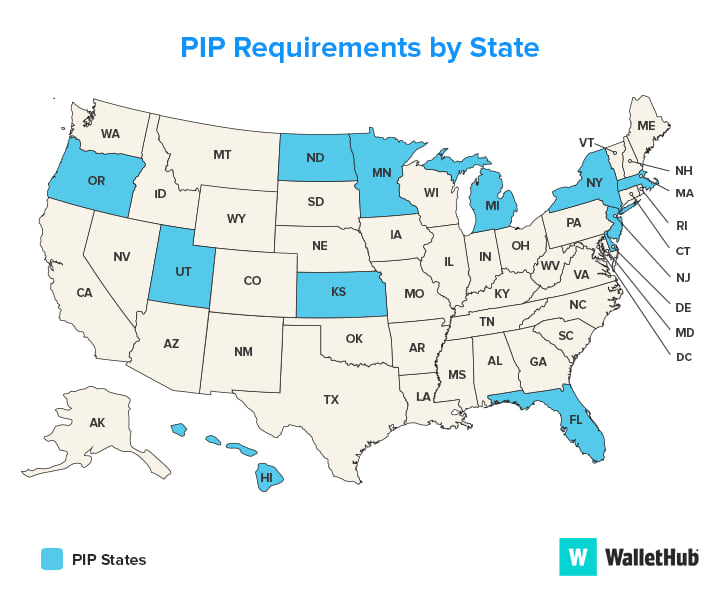

Maine is one of the few states in the United States that requires drivers to have Personal Injury Protection (PIP) as part of their auto insurance policy. PIP is a type of coverage that provides benefits for medical expenses, lost wages, and other related costs in the event of an accident, regardless of who is at fault. In this article, we will explore the details about PIP in Maine, its benefits, and how it compares to other types of auto insurance coverage.

What is Personal Injury Protection?

Personal Injury Protection, or PIP, is a type of auto insurance that covers medical expenses, lost wages, and other related costs for you and your passengers if you are involved in an accident. It is also known as no-fault insurance because it provides benefits regardless of who is at fault in the accident. In Maine, PIP is a required coverage that must be included in every driver’s auto insurance policy.

There are different types of PIP coverage available in Maine, including basic PIP, enhanced PIP, and optional PIP. Basic PIP covers up to $2,000 in medical expenses, while enhanced PIP covers up to $10,000 in medical expenses and $2,000 in lost wages. Optional PIP provides additional coverage for medical expenses, lost wages, and other related costs, depending on the policy.

Benefits of Personal Injury Protection

One of the main benefits of PIP is that it provides benefits to you and your passengers, regardless of who is at fault in the accident. This means that you can receive medical treatment and other related services without having to worry about who will pay for it. PIP also covers lost wages, which can be a significant benefit if you are unable to work due to the accident.

Another benefit of PIP is that it provides coverage for medical expenses that may not be covered by your health insurance policy. For example, if you have a high deductible or out-of-pocket maximum on your health insurance, PIP can help cover those costs. PIP also covers other related expenses, such as transportation to and from medical appointments and household services that you may be unable to perform due to your injuries.

Personal Injury Protection vs. Other Types of Auto Insurance Coverage

In addition to PIP, there are other types of auto insurance coverage that you can choose to include in your policy, such as liability, collision, and comprehensive coverage. Liability coverage is required in Maine and covers damages and injuries that you may cause to other drivers or their property. Collision coverage covers damages to your own vehicle in the event of an accident, while comprehensive coverage covers damages to your vehicle that are not related to an accident, such as theft, vandalism, or natural disasters.

While these types of coverage are important, they do not provide the same level of benefits as PIP. Liability coverage only covers damages and injuries that you are responsible for, while collision and comprehensive coverage only cover damages to your vehicle. PIP, on the other hand, provides benefits for medical expenses, lost wages, and other related costs, regardless of who is at fault in the accident.

Conclusion

In conclusion, Personal Injury Protection is a required coverage in Maine that provides benefits for medical expenses, lost wages, and other related costs in the event of an accident, regardless of who is at fault. PIP is an important coverage that can help protect you and your passengers in the event of an accident, and it provides benefits that are not covered by other types of auto insurance coverage. If you are a driver in Maine, it is important to include PIP in your auto insurance policy to ensure that you are fully protected.

Frequently Asked Questions

When it comes to Maine car insurance, there are a lot of questions that drivers may have. One of the most common questions is whether or not Personal Injury Protection (PIP) is required. Here are some answers to other frequently asked questions.

What is Personal Injury Protection (PIP)?

Personal Injury Protection, or PIP, is a type of car insurance coverage that pays for medical expenses, lost wages, and other related expenses if you or your passengers are injured in a car accident. PIP coverage is also known as “no-fault” coverage because it pays out regardless of who is at fault for the accident.

In Maine, PIP coverage is mandatory for all drivers and must be included in all car insurance policies. The minimum PIP coverage limit in Maine is $2,000, but drivers can choose to purchase higher limits if they wish.

What happens if I don’t have PIP coverage in Maine?

If you are driving in Maine without PIP coverage, you are breaking the law. In addition to facing legal penalties, you may also be responsible for paying for your own medical expenses and lost wages if you are injured in a car accident, even if the accident was not your fault.

If you are caught driving without PIP coverage in Maine, you may be fined and your driver’s license may be suspended.

Is PIP coverage the same as medical payments coverage?

No, PIP coverage and medical payments coverage are not the same thing. While both types of coverage can help pay for medical expenses after a car accident, PIP coverage is more comprehensive and also covers lost wages and other related expenses.

In Maine, PIP coverage is mandatory, while medical payments coverage is optional. Drivers can choose to add medical payments coverage to their car insurance policy if they wish.

Can I choose not to have PIP coverage?

No, you cannot choose to opt out of PIP coverage in Maine. PIP coverage is mandatory for all drivers and must be included in all car insurance policies.

However, drivers can choose to purchase higher PIP coverage limits if they wish. This can help ensure that they are fully covered in the event of a serious car accident that results in significant medical expenses and lost wages.

How much PIP coverage do I need in Maine?

The minimum PIP coverage limit in Maine is $2,000, but drivers can choose to purchase higher limits if they wish. The amount of PIP coverage you need may depend on a variety of factors, such as your individual medical needs, the number of people in your household, and how much lost income you would need to replace if you were unable to work due to a car accident.

When choosing PIP coverage limits, it is important to carefully consider your own needs and consult with an insurance professional if you have any questions or concerns.

What is Personal Injury Protection (PIP)?

In conclusion, while personal injury protection (PIP) is not required in all states, it is mandatory in the state of Maine. PIP is designed to provide financial protection to drivers and passengers in the event of an accident, regardless of who is at fault. Having PIP coverage can help ease the financial burden of medical bills, lost wages, and other expenses that may arise after an accident.

It is important to note that Maine’s PIP requirements are subject to change, and drivers should stay up-to-date on any updates or changes to the law. Additionally, drivers may want to consider purchasing additional insurance coverage beyond the minimum required by law to ensure they are fully protected in the event of an accident.

Overall, while PIP may seem like an added expense, it can provide valuable financial protection in the event of an accident. By having PIP coverage, drivers can have peace of mind knowing that they and their passengers are protected against unforeseen expenses.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts