Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

If you’re a driver in Kentucky, you may be wondering if Personal Injury Protection (PIP) is required by law. The answer, in short, is yes. PIP is a form of car insurance that covers medical expenses and lost wages in the event of an accident.

Understanding the ins and outs of PIP can be confusing, but it’s important to know what you’re required to have. In this article, we’ll break down the requirements for PIP in Kentucky and what it means for you as a driver. So, let’s dive in!

Yes, Personal Injury Protection (PIP) is required in Kentucky. Every driver in the state must carry a minimum of $10,000 in PIP coverage to pay medical expenses and lost wages in case of an accident, regardless of who was at fault. PIP also covers passengers and pedestrians involved in the accident.

Is Personal Injury Protection Required in Kentucky?

What is Personal Injury Protection?

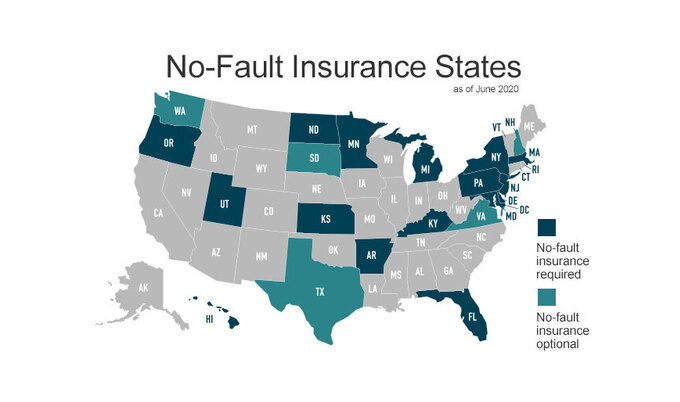

Personal Injury Protection (PIP) is a type of insurance coverage that pays for the medical expenses, lost wages, and other related expenses of the driver and passengers involved in a car accident, regardless of who was at fault. PIP coverage is considered “no-fault” insurance, meaning that it pays out regardless of who caused the accident.

In Kentucky, PIP coverage is required by law for all drivers and vehicle owners. The minimum PIP coverage required is $10,000 per person per accident, although drivers can choose to purchase higher limits if they wish.

Benefits of Personal Injury Protection

One of the main benefits of PIP coverage is that it provides quick and easy access to medical treatment for those injured in a car accident. This can be especially important if the injured person doesn’t have health insurance or can’t afford to pay for medical treatment out of pocket.

Another benefit of PIP coverage is that it covers lost wages for those who are unable to work due to their injuries. This can help injured individuals stay afloat financially while they recover and get back to work.

Finally, PIP coverage can also help cover other related expenses, such as transportation costs to medical appointments or home care services.

How Does PIP Coverage Compare to Other Types of Insurance?

While PIP coverage is required in Kentucky, drivers can also choose to purchase other types of insurance coverage, such as liability coverage or collision coverage.

Liability coverage is designed to pay for damages and injuries caused by the insured driver to others in an accident. Collision coverage, on the other hand, pays for damages to the insured driver’s own car in the event of an accident.

While PIP coverage is focused on providing medical and related expenses for the insured driver and passengers, liability and collision coverage are more focused on protecting against financial liabilities related to damages and injuries caused by the insured driver.

Conclusion

In conclusion, Personal Injury Protection (PIP) coverage is required in Kentucky for all drivers and vehicle owners. PIP coverage provides important benefits such as quick and easy access to medical treatment, coverage for lost wages, and coverage for other related expenses. While PIP coverage is focused on providing medical and related expenses, drivers can also choose to purchase other types of insurance coverage such as liability or collision coverage to protect against financial liabilities related to damages and injuries caused by the insured driver.

Contents

Frequently Asked Questions

Here are some frequently asked questions about personal injury protection in Kentucky:

What is Personal Injury Protection?

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses, lost wages, and other related expenses in the event of a car accident. PIP is also known as “no-fault” insurance because it pays out regardless of who was at fault for the accident.

In Kentucky, PIP is mandatory and drivers are required to carry a minimum of $10,000 in coverage.

What Does PIP Cover?

PIP covers medical expenses, lost wages, and other related expenses such as transportation costs to and from medical appointments. PIP can also cover funeral expenses and survivor benefits in the event of a fatal car accident.

It’s important to note that PIP only covers expenses up to the policy limit. If your medical expenses exceed your PIP coverage, you may be able to file a claim with the at-fault driver’s insurance company or your own health insurance provider.

Who is Covered by PIP?

In Kentucky, PIP covers the policyholder, their passengers, and any pedestrians who are injured in a car accident. PIP also covers the policyholder and their household members if they are injured in another car or as a pedestrian, as long as the injury is related to a car accident.

If you are driving someone else’s car and are involved in an accident, the owner’s PIP coverage will apply first. If the owner does not have PIP coverage, your own PIP coverage may apply.

What Happens if I Don’t Have PIP Coverage?

If you are caught driving without PIP coverage in Kentucky, you may face fines and other penalties. Additionally, if you are injured in a car accident and do not have PIP coverage, you may be responsible for paying your own medical expenses and related costs out of pocket.

If you are injured in a car accident and the at-fault driver does not have insurance or does not have enough insurance to cover your expenses, you may be able to file a claim with your own uninsured/underinsured motorist coverage if you have it.

Can I Waive PIP Coverage?

In Kentucky, drivers can choose to waive PIP coverage if they have health insurance that will cover their medical expenses in the event of a car accident. However, it’s important to note that waiving PIP coverage also waives your right to sue the at-fault driver for pain and suffering, unless your injuries meet certain criteria.

If you choose to waive PIP coverage, you must do so in writing and provide proof of your health insurance coverage.

Kentucky’s PIP Insurance Requirements | Personal Injury Protection Insurance | Rhoads & Rhoads

In conclusion, if you are a driver in Kentucky, it is important to understand the state’s requirements for auto insurance. Personal Injury Protection (PIP) is required in Kentucky, which means that every driver must carry a minimum amount of coverage for medical expenses and lost wages in the event of an accident.

While some drivers may see PIP as an unnecessary expense, it is important to remember that accidents can happen to anyone at any time. Without PIP coverage, you could be left with significant medical bills and lost income, which can be devastating for you and your family.

Ultimately, the decision to carry PIP coverage is up to you. However, it is important to carefully consider the potential risks and benefits before making a decision. By doing so, you can ensure that you are adequately protected in the event of an accident and can have peace of mind while on the road.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts