Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

California is known for its strict laws and regulations, but when it comes to personal injury protection, many residents are left wondering if it’s required. Personal injury protection, also known as PIP, is a type of car insurance that covers medical expenses and lost wages for those involved in an accident. So, is it mandatory in California? Let’s dive in and find out.

With so many confusing insurance policies out there, it’s no surprise that many Californians are unsure if PIP is required by law. While California does require drivers to carry liability insurance, which covers damages to other people’s property and injuries, PIP is not mandatory. However, it’s still important to understand the benefits of PIP and how it can protect you in the event of an accident.

Personal Injury Protection (PIP) is not required in California. However, if you are involved in an accident, PIP can help cover medical expenses, lost wages, and other related costs regardless of who is at fault. It is an optional coverage that can be added to your auto insurance policy.

Contents

- Is Personal Injury Protection Required in California?

- Frequently Asked Questions

- 1. What is Personal Injury Protection (PIP)?

- 2. What types of car insurance are required in California?

- 3. What other types of car insurance are available in California?

- 4. Should I purchase Personal Injury Protection (PIP) in California?

- 5. How much does Personal Injury Protection (PIP) cost in California?

- What is Personal Injury Protection (PIP)?

Is Personal Injury Protection Required in California?

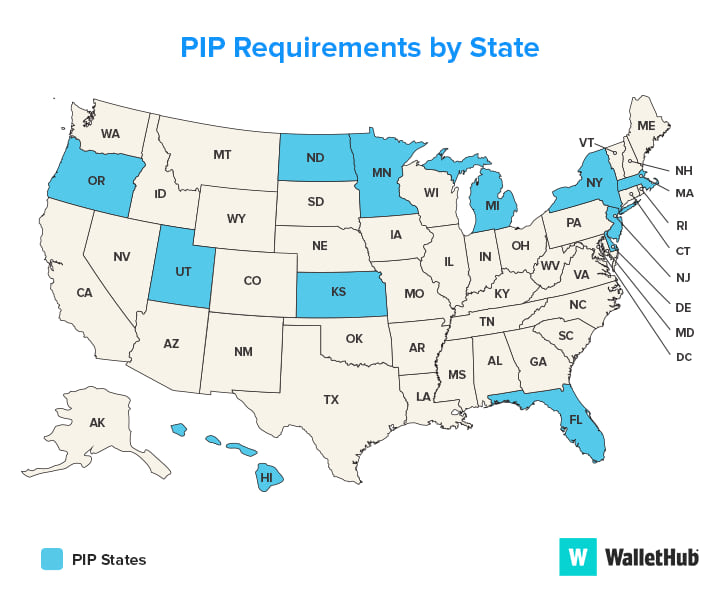

Personal injury protection (PIP) is a type of car insurance that covers medical expenses, lost wages, and other related expenses if you or your passengers are injured in a car accident. Although PIP is mandatory in some states, it is not required in California. However, you may still want to consider getting PIP coverage to protect yourself and your passengers in case of an accident.

What is Personal Injury Protection?

Personal injury protection, also known as no-fault insurance, is a type of car insurance that covers medical expenses and lost wages if you or your passengers are injured in a car accident, regardless of who was at fault for the accident. PIP coverage typically includes:

- Medical expenses

- Lost wages

- Funeral expenses

- Childcare expenses

Is PIP Required in California?

No, PIP is not required in California. However, California does require drivers to carry liability insurance, which covers damages to other people’s property and injuries to other people in the event of an accident. The minimum liability coverage required in California is:

- $15,000 for injury/death to one person

- $30,000 for injury/death to more than one person

- $5,000 for damage to property

Benefits of Personal Injury Protection

Although PIP is not required in California, there are several benefits to having this type of coverage. First and foremost, PIP provides additional coverage for medical expenses and lost wages that may not be fully covered by your health insurance or disability insurance. PIP also covers expenses related to childcare or household services that may be necessary while you recover from your injuries.

Another benefit of PIP is that it is a no-fault insurance, meaning that you can file a claim regardless of who was at fault for the accident. This can help streamline the claims process and ensure that you receive the compensation you are entitled to in a timely manner.

PIP vs. Liability Insurance

While liability insurance is required in California, it only covers damages and injuries to other people in the event of an accident. PIP, on the other hand, covers medical expenses and lost wages for you and your passengers, regardless of who was at fault for the accident. Additionally, PIP can provide coverage for expenses related to childcare or household services that may be necessary while you recover from your injuries.

How to Get Personal Injury Protection in California

Although PIP is not required in California, you can still purchase this type of coverage from your car insurance provider. The cost of PIP coverage will vary depending on your insurance provider, the level of coverage you choose, and other factors such as your driving record and the make and model of your car.

Conclusion

While PIP is not required in California, it can provide valuable coverage for medical expenses, lost wages, and other related expenses if you or your passengers are injured in a car accident. Consider talking to your car insurance provider about adding PIP coverage to your policy to ensure that you are fully protected in the event of an accident.

Frequently Asked Questions

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses, lost wages, and other damages in case of an accident. It is mandatory in some states, but is it required in California? Here are some answers to common questions about PIP in California.

1. What is Personal Injury Protection (PIP)?

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses, lost wages, and other damages in case of an accident. It is also known as no-fault insurance, because it pays out regardless of who was at fault for the accident. In California, PIP is not required by law, but it may be included as an option in your car insurance policy.

If you are injured in a car accident, PIP can help you pay for medical expenses and other costs that are not covered by your health insurance or other types of car insurance. It can also provide coverage for lost wages if you are unable to work due to your injuries.

2. What types of car insurance are required in California?

California law requires all drivers to have liability insurance, which covers damages to other people and property in case of an accident that you are responsible for. The minimum liability insurance requirements in California are:

– $15,000 for injury/death to one person

– $30,000 for injury/death to more than one person

– $5,000 for damage to property

3. What other types of car insurance are available in California?

In addition to liability insurance, you can also purchase collision insurance, which covers damages to your own vehicle in case of an accident, and comprehensive insurance, which covers damages caused by factors such as theft, vandalism, and natural disasters. Personal Injury Protection (PIP) is another type of car insurance that is available in some states, but it is not required in California.

If you are financing or leasing your vehicle, your lender may require you to purchase collision and comprehensive insurance in addition to liability insurance.

4. Should I purchase Personal Injury Protection (PIP) in California?

Whether or not you should purchase Personal Injury Protection (PIP) in California depends on your individual circumstances. If you have good health insurance and disability coverage, you may not need PIP. However, if you do not have adequate health insurance or disability coverage, PIP can provide valuable protection in case of an accident.

Additionally, PIP can provide coverage for expenses that are not covered by other types of car insurance, such as lost wages and household services. If you frequently drive in areas with high rates of accidents or have a long commute, you may want to consider purchasing PIP.

5. How much does Personal Injury Protection (PIP) cost in California?

The cost of Personal Injury Protection (PIP) varies depending on your individual circumstances, such as your age, driving record, and the type of vehicle you drive. In general, PIP is more expensive than liability insurance, but less expensive than collision or comprehensive insurance.

If you are considering purchasing PIP, it is important to shop around and compare quotes from multiple insurance providers. You may also want to consider raising your deductible or adjusting your coverage limits to find a policy that fits your budget.

What is Personal Injury Protection (PIP)?

In conclusion, it is important to understand that Personal Injury Protection (PIP) is not required in California. However, it is highly recommended to have PIP coverage as it can provide valuable benefits in the event of an accident. PIP can help cover medical expenses, lost wages, and other related costs regardless of who was at fault for the accident.

Ultimately, the decision to purchase PIP coverage is up to the individual driver. Taking the time to research and understand the benefits of PIP can help drivers make an informed decision about their insurance coverage. While it may not be required by law, having PIP coverage can provide peace of mind and financial protection in the event of an accident.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts