Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

Accidents happen, and sometimes they result in personal injuries that can be life-changing. When this happens, it’s important to know what your legal options are, including the possibility of a personal injury settlement. However, once you receive a settlement, you may be wondering if it counts as income for tax purposes or other financial considerations. In this article, we’ll explore whether or not a personal injury settlement is considered income and what you need to know about the legal and financial implications.

If you’ve been involved in an accident and received a personal injury settlement, you may be wondering if you need to report it as income on your tax return. Additionally, you may be wondering if the settlement affects your eligibility for government benefits or other financial considerations. Understanding the legal and financial implications of a personal injury settlement is crucial to ensuring that you receive the full compensation you deserve and don’t face any unexpected financial consequences down the line.

A personal injury settlement is generally not considered taxable income by the IRS. However, if you receive punitive damages or compensation for lost wages, those portions may be subject to taxation. It’s important to consult with a tax professional to ensure you understand the tax implications of your settlement.

Contents

- Is a Personal Injury Settlement Considered Income?

- Frequently Asked Questions

- What is a personal injury settlement?

- Is a personal injury settlement taxable?

- Do I have to report my personal injury settlement on my tax return?

- What if I receive a structured settlement instead of a lump sum?

- What if I receive a personal injury settlement and then become disabled?

- Is A Personal Injury Settlement Considered Income? Here’s What You Need To Know

Is a Personal Injury Settlement Considered Income?

Getting injured in an accident can be a life-changing experience, and it’s not uncommon for those who suffer injuries to receive a settlement from the responsible party or their insurance company. While this settlement can be a much-needed relief, it’s important to understand how it will affect your taxes and whether it is considered income.

What is a Personal Injury Settlement?

A personal injury settlement is a financial award that a plaintiff receives after winning a lawsuit or negotiating a settlement with the responsible party or their insurance company. The settlement is meant to compensate the plaintiff for the damages they suffered as a result of the accident or injury.

Types of Personal Injury Settlements

There are two types of personal injury settlements: compensatory and punitive. Compensatory settlements are meant to compensate the plaintiff for their losses, such as medical bills, lost wages, and pain and suffering. Punitive settlements, on the other hand, are meant to punish the responsible party for their actions and deter them from engaging in similar behavior in the future.

How is a Personal Injury Settlement Taxed?

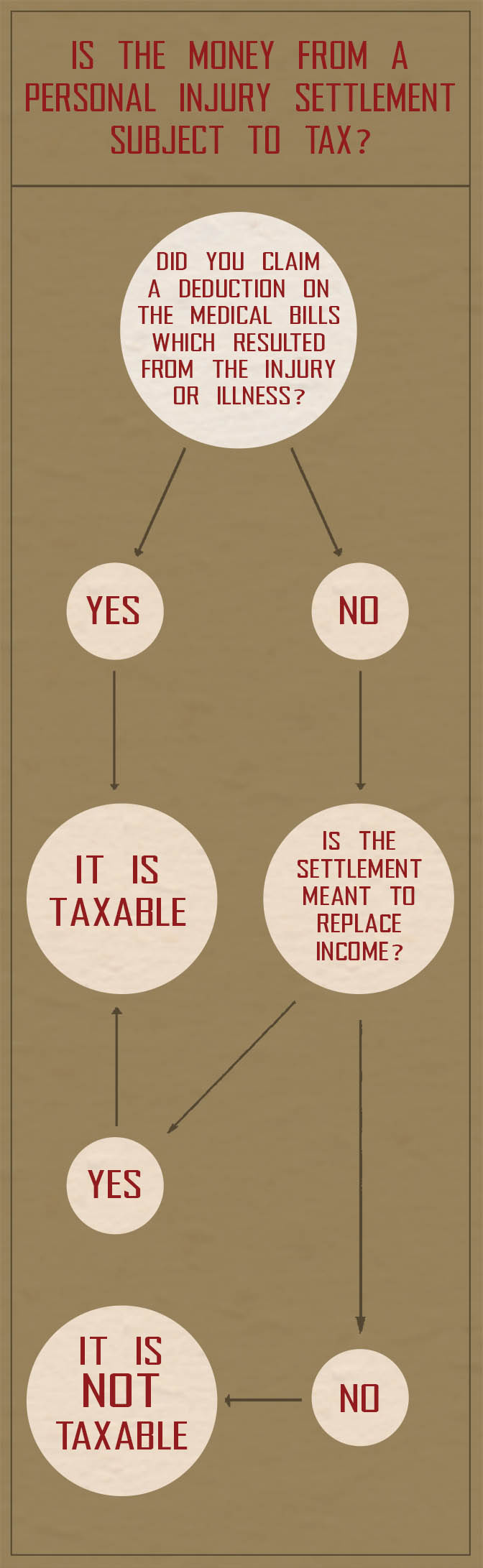

Whether a personal injury settlement is considered income and taxed depends on the type of damages it covers.

Compensatory Damages

Compensatory damages, which are meant to compensate the plaintiff for their losses, are generally not considered income and are not taxed. This includes damages for medical expenses, lost wages, and pain and suffering.

Punitive Damages

Punitive damages, which are meant to punish the responsible party and deter them from engaging in similar behavior in the future, are considered income and are taxed.

Benefits of a Personal Injury Settlement

A personal injury settlement can provide many benefits to the plaintiff, including:

Financial Relief

A personal injury settlement can provide much-needed financial relief for a plaintiff who has suffered injury and incurred medical expenses or lost wages.

Closure

A settlement can provide a sense of closure for the plaintiff, allowing them to move on from the accident and focus on their recovery.

Peace of Mind

A settlement can provide peace of mind for the plaintiff, knowing that they have received compensation for their losses and that the responsible party has been held accountable for their actions.

Personal Injury Settlement vs. Income

While a personal injury settlement may be considered income for tax purposes, it is important to remember that it is a one-time payment and not a regular source of income. It is also important to note that the tax implications of a settlement can vary depending on the circumstances of the case.

Personal Injury Settlement vs. Workers’ Compensation

Workers’ compensation benefits are generally not considered income and are not taxed. This is because workers’ compensation benefits are meant to compensate the worker for lost wages and medical expenses that are a direct result of their work-related injury.

Personal Injury Settlement vs. Social Security Disability Benefits

Social Security Disability benefits are generally not affected by a personal injury settlement. However, if the settlement amount is large enough, it may affect the plaintiff’s eligibility for certain needs-based government benefits, such as Medicaid or Supplemental Security Income (SSI).

Conclusion

In conclusion, a personal injury settlement may be considered income for tax purposes, but the tax implications can vary depending on the type of damages the settlement covers. It is important to consult a tax professional to fully understand the tax implications of a personal injury settlement. Regardless of the tax implications, a personal injury settlement can provide much-needed financial relief, closure, and peace of mind for those who have suffered injury as a result of someone else’s actions.

Frequently Asked Questions

What is a personal injury settlement?

A personal injury settlement is a financial compensation that an injured party receives as a result of a lawsuit or settlement. This compensation is meant to cover the costs associated with the injury, such as medical bills, lost wages, and pain and suffering.

Personal injury settlements can be reached through negotiations with the responsible party’s insurance company or through a court trial. The amount of compensation awarded will depend on the severity of the injury, the impact it has had on the injured party’s life, and other factors.

Is a personal injury settlement taxable?

Whether a personal injury settlement is taxable or not depends on the circumstances surrounding the settlement. In general, compensation for physical injuries or illnesses is not taxable, but compensation for emotional distress or punitive damages may be.

If you have questions about the tax implications of a personal injury settlement, it’s best to consult with a tax professional who can provide guidance specific to your situation.

Do I have to report my personal injury settlement on my tax return?

If your personal injury settlement is not taxable, you do not need to report it on your tax return. However, if a portion of your settlement is taxable, you will need to report that amount on your tax return.

The responsible party’s insurance company should provide you with a Form 1099 detailing the taxable portion of your settlement. Make sure to keep this form and provide it to your tax preparer when filing your taxes.

What if I receive a structured settlement instead of a lump sum?

A structured settlement is a type of settlement where the compensation is paid out over time, rather than in a lump sum. If you receive a structured settlement, the tax implications will depend on the terms of the settlement.

In general, if the settlement is for physical injuries or illnesses, the payments will not be taxable. However, if the settlement includes compensation for emotional distress or punitive damages, the payments may be taxable.

What if I receive a personal injury settlement and then become disabled?

If you become disabled after receiving a personal injury settlement, the tax implications will depend on the circumstances surrounding your disability benefits. In general, disability benefits are taxable if they are paid for by an employer or through an insurance policy that was paid for by pre-tax dollars.

If you are receiving disability benefits, it’s best to consult with a tax professional to determine the tax implications of your personal injury settlement in relation to your disability benefits.

Is A Personal Injury Settlement Considered Income? Here’s What You Need To Know

In conclusion, a personal injury settlement is not always considered as income. It depends on the type of damages awarded in the settlement. Compensation for medical expenses and physical injuries are generally not considered taxable income. However, if the settlement includes compensation for lost wages or emotional distress, it may be subject to taxation. It’s important to consult with a tax professional or attorney to understand the tax implications of a personal injury settlement. Overall, it’s crucial to understand the terms of your settlement and how it may affect your financial situation.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts