Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

Slip and fall accidents can happen to anyone, anywhere. Whether it’s a slippery floor or a loose carpet, these accidents can lead to serious injuries and hefty medical bills. However, with the right insurance policy in place, you can rest assured that your medical expenses will be covered. In this article, we’ll explore how deductibles work on slip and fall accidents and how you can make the most out of your insurance policy. Let’s get started!

Have you ever wondered how deductibles work on slip and fall accidents? Well, the truth is, it can be a bit confusing. The deductible is the amount of money you have to pay out of pocket before your insurance kicks in. But how does this work when it comes to slip and fall accidents? Don’t worry, we’ve got you covered. In this article, we’ll break down everything you need to know about deductibles and how they apply to slip and fall accidents.

Deductibles work differently for slip and fall accidents depending on the type of insurance coverage. For example, if you have a personal injury protection (PIP) policy, your deductible will be waived. However, if you have a liability policy, you will be responsible for paying the deductible before your insurance kicks in. It’s important to review your policy to understand the specifics of your coverage.

Understanding How Deductibles Work on Slip and Fall Accidents

What is a Slip and Fall Accident?

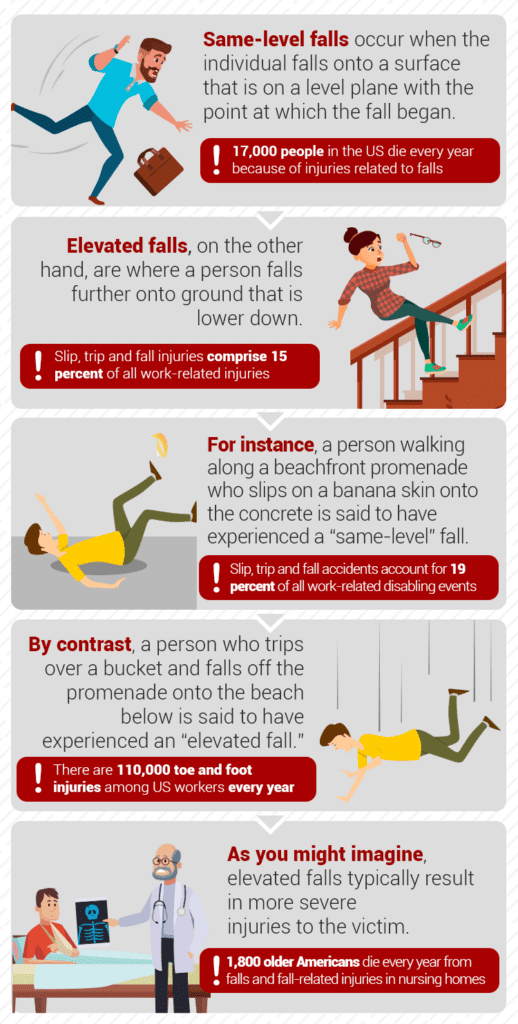

Slip and fall accidents happen when someone falls due to a hazardous condition on someone else’s property. These types of accidents can occur at any time and can cause injuries ranging from minor to severe. Slip and fall accidents can happen on private property, public property, or in commercial buildings.

In order to determine who is responsible for a slip and fall accident, the court will look at the property owner’s duty of care. Property owners have a responsibility to keep their premises safe for visitors and to warn them of any potential hazards.

What is a Deductible?

A deductible is the amount of money that an insurance policyholder must pay before their insurance coverage kicks in. In the case of slip and fall accidents, the injured person’s medical expenses may be covered by the property owner’s insurance policy. However, the policy may have a deductible, which means that the injured person will be responsible for paying a portion of their medical expenses out of pocket.

The amount of the deductible will vary depending on the policy. It is important to note that even if the injured person is not at fault for the accident, they may still be responsible for paying the deductible.

How Does a Deductible Work in a Slip and Fall Accident?

If someone is injured in a slip and fall accident on someone else’s property, the property owner’s insurance policy may cover the injured person’s medical expenses. However, if the policy has a deductible, the injured person will be responsible for paying a portion of their medical expenses out of pocket.

For example, if the injured person has $10,000 in medical expenses and the policy has a $1,000 deductible, the injured person will be responsible for paying the first $1,000 of their medical expenses. The insurance company will then cover the remaining $9,000.

Benefits of Having Insurance Coverage for Slip and Fall Accidents

Having insurance coverage for slip and fall accidents can provide peace of mind for property owners and visitors. Property owners can protect themselves from potential lawsuits and visitors can have the assurance that their medical expenses will be covered if they are injured on someone else’s property.

Additionally, having insurance coverage can help to cover the costs associated with slip and fall accidents, such as medical expenses, lost wages, and pain and suffering.

Insurance Coverage vs. Personal Injury Lawsuits

If someone is injured in a slip and fall accident on someone else’s property, they may have the option to file a personal injury lawsuit against the property owner. However, this can be a lengthy and expensive process.

Having insurance coverage can provide an alternative to filing a lawsuit. The injured person can file a claim with the property owner’s insurance company and receive compensation for their medical expenses and other damages.

Conclusion

Slip and fall accidents can happen to anyone at any time. Understanding how deductibles work on slip and fall accidents is important for property owners and visitors alike. While having insurance coverage can provide peace of mind, it is important to understand the terms of the policy, including the deductible.

Contents

- Frequently Asked Questions

- What is a deductible?

- How does a deductible work for slip and fall accidents?

- Can I choose my deductible amount for slip and fall accidents?

- What happens if I can’t afford my deductible for a slip and fall accident?

- Does my deductible apply to medical expenses for a slip and fall accident?

- Slip and Fall Accident at Work: What To Do

Frequently Asked Questions

What is a deductible?

A deductible is an amount you must pay out of pocket before your insurance company starts covering the cost of your claim. For example, if you have a $500 deductible and your slip and fall accident results in $1,000 in damages, you will need to pay $500 while your insurance company covers the remaining $500.

Deductibles are a way for insurance companies to share the cost of claims with policyholders and encourage responsible behavior by reducing the number of small claims filed.

How does a deductible work for slip and fall accidents?

When you file a slip and fall accident claim with your insurance company, they will assess the damage and determine the amount of the claim. If your deductible is $500 and the claim is for $1,000, you will need to pay the $500 deductible before your insurance company starts covering the remaining $500.

It’s important to note that deductibles may vary depending on your insurance policy and the circumstances of your slip and fall accident. Be sure to review your policy and speak with your insurance company to understand your specific deductible requirements.

Can I choose my deductible amount for slip and fall accidents?

Yes, you may be able to choose your deductible amount for slip and fall accidents when you purchase your insurance policy. Generally, the higher your deductible, the lower your monthly premium. However, it’s important to find a balance that works for your budget and needs.

Keep in mind that choosing a higher deductible means you’ll need to pay more out of pocket if you have a slip and fall accident. Be sure to weigh the costs and benefits of each deductible option before making a decision.

What happens if I can’t afford my deductible for a slip and fall accident?

If you can’t afford your deductible for a slip and fall accident, you may need to pay for the damages out of pocket or explore other options for financing the deductible. Some insurance companies may offer payment plans or financing options to help you cover the cost of your deductible.

It’s important to speak with your insurance company and explore your options as soon as possible to avoid any delays in the claims process and ensure you receive the coverage you need.

Does my deductible apply to medical expenses for a slip and fall accident?

Yes, your deductible may apply to medical expenses for a slip and fall accident. If you have medical payments coverage as part of your insurance policy, your deductible may apply to those expenses. However, if you have separate health insurance coverage, your deductible may not apply.

Be sure to check your insurance policy and speak with your insurance company to understand how your deductible applies to medical expenses for slip and fall accidents.

Slip and Fall Accident at Work: What To Do

In conclusion, understanding how deductibles work on slip and fall accidents can help you make informed decisions when it comes to your insurance coverage. By knowing how much you will be responsible for paying out of pocket before your insurance kicks in, you can budget accordingly and avoid any surprises.

It’s important to note that deductibles can vary depending on your insurance policy and the severity of the accident. It’s always a good idea to review your policy and speak with your insurance provider to fully understand your coverage.

In the end, taking the time to understand how deductibles work can help you protect yourself financially in the event of a slip and fall accident. By being prepared and informed, you can ensure that you have the coverage you need to get back on your feet after an unexpected injury.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts