Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

Biking is a fun and healthy way to get around, but accidents can happen. If you’re a homeowner and love to bike, you might be wondering if your homeowners insurance will cover you in case of a bike accident. The answer is not straightforward, but it’s important to know the details so you can make sure you’re protected.

In this article, we’ll explore whether homeowners insurance covers bike accidents, what types of coverage might be available, and how to make sure you have the right protection for your needs. Whether you’re an avid cyclist or just like to take leisurely rides around the neighborhood, understanding your insurance options can help give you peace of mind while you enjoy the open road.

Yes, homeowners insurance may cover bike accidents if the policy includes liability coverage. Liability coverage typically includes protection against bodily injury or property damage caused by the policyholder or their family members. However, it’s important to check the policy’s specific coverage limits and exclusions to ensure that the bike accident is covered. Additionally, some insurance companies offer separate coverage specifically for bicycles.

Does Homeowners Insurance Cover Bike Accidents?

If you own a bike, you may wonder if your homeowners insurance policy covers bike accidents. The answer is not straightforward since it depends on the type of coverage you have. In this article, we’ll explore the different types of homeowners insurance policies and the extent of their coverage for bike accidents.

Types of Homeowners Insurance Policies

There are different types of homeowners insurance policies available, and each has different levels of coverage. The most common types of homeowners insurance policies are:

1. HO-1: Covers only basic perils, such as fire and theft.

2. HO-2: Covers more perils than HO-1, such as falling objects and water damage.

3. HO-3: Covers all perils except those specifically excluded in the policy.

4. HO-4: Renters insurance that covers personal belongings and liability.

5. HO-5: Covers all perils and provides more extensive coverage than HO-3.

6. HO-6: Condo insurance that covers personal belongings and liability.

7. HO-7: Covers mobile homes.

8. HO-8: Covers older homes that would otherwise be difficult to insure.

Does Homeowners Insurance Cover Bike Accidents?

If you have an HO-3 or HO-5 policy, your homeowners insurance policy may cover bike accidents. Typically, your policy will cover the cost of repairing or replacing your bike if it is damaged or stolen. However, there may be limits on the amount of coverage available.

It’s important to note that if you were at fault for the bike accident, your liability coverage may also come into play. Liability coverage can help cover the costs of any damages or injuries you cause to others while riding your bike.

Benefits of Homeowners Insurance for Bike Accidents

Having homeowners insurance coverage for bike accidents can provide peace of mind knowing that you’re protected in case of an accident. You don’t have to worry about the cost of repairing or replacing your bike, which can be expensive.

Additionally, if someone is injured in a bike accident that you caused, your liability coverage can help cover the cost of their medical bills and other expenses. This can be especially important if the injured person decides to sue you for damages.

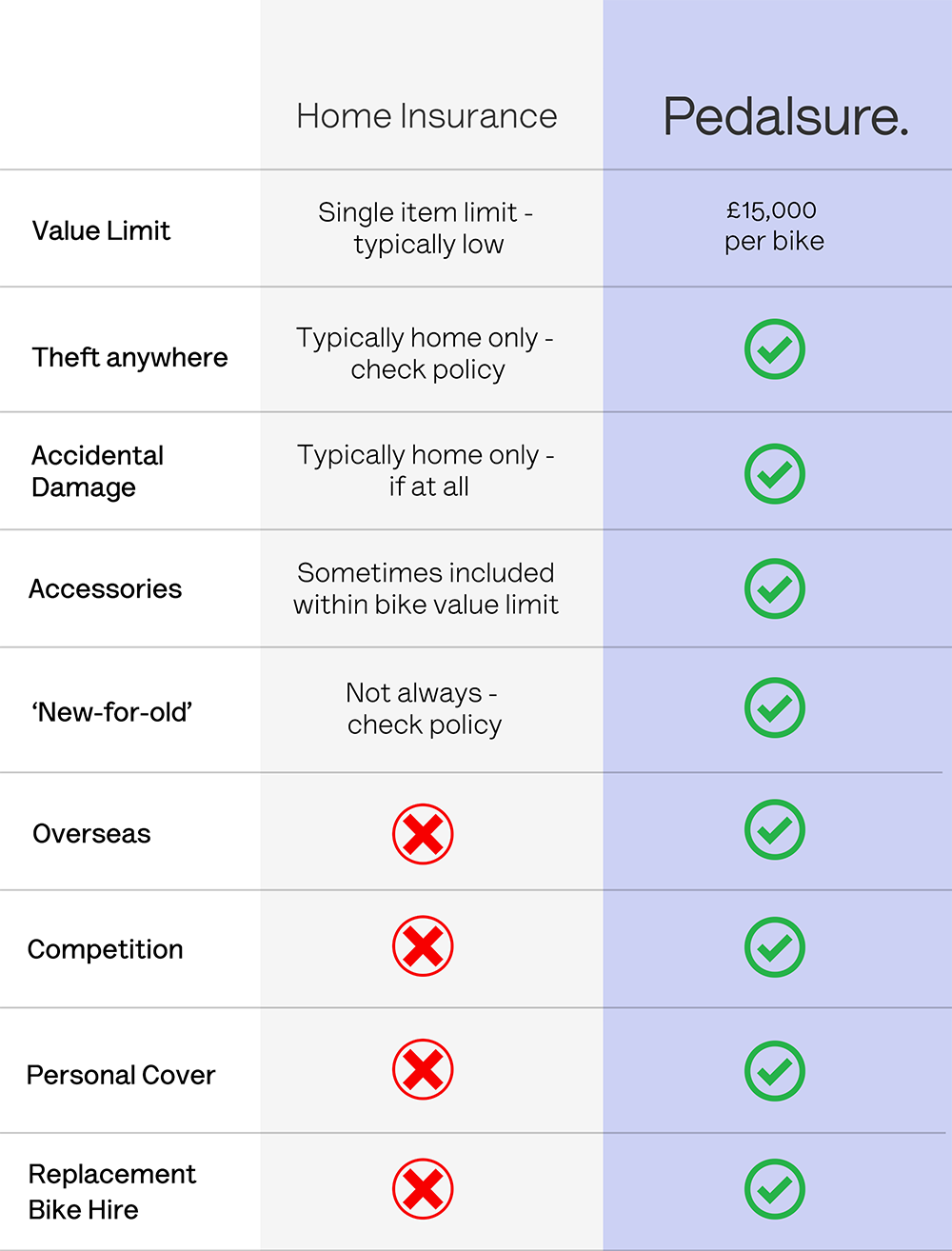

Homeowners Insurance vs. Bike Insurance

While homeowners insurance policies may cover bike accidents, it’s important to note that they may not provide as much coverage as a dedicated bike insurance policy. Bike insurance policies are specifically designed to cover bike accidents and often provide more extensive coverage than homeowners insurance.

If you frequently ride your bike and want more comprehensive coverage, you may want to consider purchasing a separate bike insurance policy in addition to your homeowners insurance policy.

Conclusion

In summary, whether or not your homeowners insurance policy covers bike accidents depends on the type of policy you have. If you have an HO-3 or HO-5 policy, your policy may cover bike accidents to a certain extent. However, if you want more comprehensive coverage, you may want to consider purchasing a separate bike insurance policy.

Regardless of whether you have homeowners insurance or bike insurance, it’s important to always practice safe riding habits and wear protective gear to minimize the risk of accidents.

Contents

- Frequently Asked Questions

- What is covered under homeowners insurance for bike accidents?

- What is not covered under homeowners insurance for bike accidents?

- What should I do if I am involved in a bike accident on my property?

- Should I purchase additional coverage for bike accidents?

- What should I look for when reviewing my homeowners insurance policy for bike accident coverage?

- Be Careful Making a Bicycle Insurance Claim | How to Get Full Property Damage for Your Bike

Frequently Asked Questions

Homeowners insurance is an essential investment for anyone who owns a home. It provides financial protection against damage to your property and liability for accidents that occur on your property. However, when it comes to bike accidents, there are a few things you need to know.

What is covered under homeowners insurance for bike accidents?

Homeowners insurance typically covers bike accidents that occur on your property. This means that if someone is riding their bike on your property and they are injured, your homeowners insurance policy may provide coverage for their medical expenses and any damages they may be entitled to. However, it’s important to note that not all homeowners insurance policies are created equal. Some policies may provide more coverage than others, so it’s important to review your policy carefully to understand what is covered.

Additionally, if you have a high-value bike, you may need to purchase additional coverage to protect it. Homeowners insurance policies typically have limits on how much they will pay out for certain types of items, and a high-value bike may exceed that limit. In this case, you may need to purchase additional coverage to ensure that your bike is fully protected.

What is not covered under homeowners insurance for bike accidents?

While homeowners insurance may provide coverage for bike accidents that occur on your property, it typically does not provide coverage for accidents that occur off your property. For example, if you are riding your bike off your property and you are involved in an accident, your homeowners insurance policy will not provide coverage for your medical expenses or any damages you may be entitled to.

Additionally, if you are at fault for a bike accident that occurs on your property, your homeowners insurance policy may not provide coverage. This is because most homeowners insurance policies do not provide coverage for intentional acts or acts of negligence. In this case, you may be held responsible for any damages or injuries that occur as a result of your actions.

What should I do if I am involved in a bike accident on my property?

If you are involved in a bike accident on your property, the first thing you should do is seek medical attention if necessary. Once everyone is safe and any injuries have been addressed, you should contact your homeowners insurance company to report the accident. Your insurance company will investigate the accident and determine if any coverage is available under your policy.

If the accident involves another person, it’s important to exchange insurance information and contact information with them. You should also take photos of the scene of the accident and any damage that was caused. This information will be helpful when filing a claim with your insurance company.

Should I purchase additional coverage for bike accidents?

If you have a high-value bike or if you frequently ride your bike off your property, you may want to consider purchasing additional coverage for bike accidents. This can provide additional protection for your bike and any injuries or damages that may occur as a result of an accident.

Additionally, if you frequently host events on your property where bike riding is involved, you may want to consider purchasing additional liability coverage. This can help protect you in the event that someone is injured while riding their bike on your property.

What should I look for when reviewing my homeowners insurance policy for bike accident coverage?

When reviewing your homeowners insurance policy for bike accident coverage, there are a few things you should look for. First, you should review the liability coverage to ensure that it provides coverage for bike accidents that occur on your property. You should also review the personal property coverage to ensure that it provides adequate coverage for your bike.

If you have a high-value bike, you should review the policy limits to ensure that your bike is fully covered. Additionally, you should review the policy exclusions to ensure that there are no exclusions that would prevent coverage for bike accidents.

Be Careful Making a Bicycle Insurance Claim | How to Get Full Property Damage for Your Bike

In conclusion, it’s important to understand what your homeowners insurance policy covers when it comes to bike accidents. While some policies may offer limited coverage, it’s always a good idea to review your policy and consider adding additional coverage if needed.

If you frequently ride your bike or have valuable equipment, such as an expensive bike, it may be worth investing in a separate bicycle insurance policy. This can provide more comprehensive coverage for accidents, theft, and other incidents related to your bike.

Ultimately, the best way to protect yourself and your bike is to practice safe riding habits and take precautions such as wearing a helmet and locking up your bike when not in use. By being informed and proactive, you can ensure that you have the right coverage and take steps to minimize the risk of accidents and other mishaps.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts