Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

Car accidents can be a nightmare, causing not only physical and emotional stress but also financial burden. Many car owners wonder if they can claim depreciation on their car after an accident. After all, your vehicle’s value decreases significantly once it’s been in a crash. In this article, we’ll explore whether you’re entitled to depreciation claims and how to go about it.

Depreciation is a significant factor that affects the value of a car. It’s the difference between what you paid for the car and what it’s worth after a certain period. If you’ve been in an accident, the depreciation value of your car can be significant. So, let’s dive in and find out if you can claim it.

If your car is damaged in an accident, you may be able to claim depreciation as part of your insurance claim. Depreciation is the decrease in value that occurs as a result of wear and tear or aging. However, whether you can claim depreciation on your car after an accident depends on several factors, such as the terms of your insurance policy and the extent of the damage. It’s best to check with your insurance provider to see if you’re eligible.

Can I Claim Depreciation on My Car After an Accident?

Understanding Car Depreciation

Car depreciation is the decrease in the value of your vehicle over time. It is a natural occurrence that happens to all cars, regardless of how careful you are in maintaining them. The moment you drive your car out of the dealership, its value starts to decrease. This is because cars are considered depreciating assets, which means that their value decreases over time due to wear and tear, technological advancements, and other factors.

What is Car Depreciation?

Depreciation is the reduction in the value of an asset over time. In the case of cars, depreciation is caused by natural wear and tear, as well as changes in technology and market demand. It is important to understand car depreciation because it affects the resale value of your car. The more a car has depreciated, the less it is worth in the eyes of potential buyers.

Factors That Affect Car Depreciation

There are several factors that can affect the rate of car depreciation. Some of these include:

– Age: The older a car is, the more it has depreciated.

– Mileage: The more miles a car has, the more it has depreciated.

– Condition: The better the condition of a car, the less it has depreciated.

– Brand and Model: Some car brands and models depreciate faster than others due to market demand.

Can You Claim Depreciation on Your Car After an Accident?

In most cases, you cannot claim depreciation on your car after an accident. This is because car depreciation is considered a natural occurrence and not a direct result of the accident. However, there are a few exceptions to this rule.

When Can You Claim Depreciation on Your Car After an Accident?

You may be able to claim depreciation on your car after an accident if:

– Your car is relatively new: If your car is less than a year old, you may be able to claim depreciation if the accident has significantly reduced its value.

– Your car is a classic or rare model: If your car is a classic or rare model, you may be able to claim depreciation as these cars can appreciate in value over time.

– Your car is leased: If you are leasing your car, you may be able to claim depreciation if the accident has significantly reduced its value.

How Much Depreciation Can You Claim?

The amount of depreciation you can claim after an accident depends on several factors, including:

– The age of your car

– The mileage of your car

– The condition of your car before the accident

– The extent of the damage caused by the accident

In most cases, you will need to get an appraisal of your car’s value before and after the accident to determine the amount of depreciation you can claim.

The Benefits of Claiming Depreciation on Your Car After an Accident

While it may be difficult to claim depreciation on your car after an accident, there are several benefits to doing so. These include:

– Increased compensation: If you are able to claim depreciation, you may receive a higher settlement from your insurance company.

– Peace of mind: Claiming depreciation can help you feel like you are getting a fair settlement for your damaged car.

– Protection for future accidents: If your car has already depreciated significantly due to the accident, it may be less likely to depreciate further if it is involved in another accident.

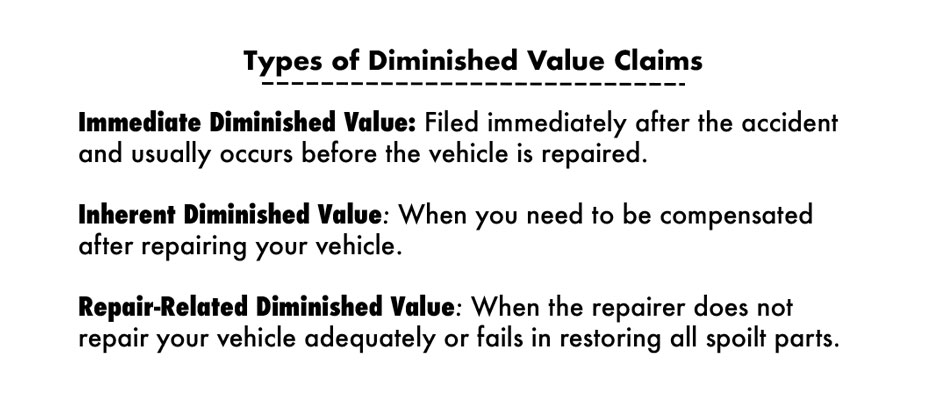

Depreciation vs. Diminished Value

It is important to note that depreciation is different from diminished value. Depreciation is the natural decrease in the value of your car over time, while diminished value is the decrease in value that occurs as a result of an accident. Diminished value is more likely to be covered by insurance, while depreciation is not.

When Can You Claim Diminished Value on Your Car?

You may be able to claim diminished value on your car if:

– Your car is relatively new: If your car is less than a year old, you may be able to claim diminished value if the accident has significantly reduced its value.

– Your car is a classic or rare model: If your car is a classic or rare model, you may be able to claim diminished value as these cars can appreciate in value over time.

– Your car is leased: If you are leasing your car, you may be able to claim diminished value if the accident has significantly reduced its value.

How Much Diminished Value Can You Claim?

The amount of diminished value you can claim after an accident depends on several factors, including:

– The age of your car

– The mileage of your car

– The condition of your car before the accident

– The extent of the damage caused by the accident

In most cases, you will need to get an appraisal of your car’s value before and after the accident to determine the amount of diminished value you can claim.

The Bottom Line

In most cases, you cannot claim depreciation on your car after an accident. However, there are a few exceptions to this rule, and it may be possible to claim diminished value instead. If you are unsure whether you are eligible to claim depreciation or diminished value, it is best to speak to your insurance company or a qualified attorney to determine your options.

Contents

- Frequently Asked Questions

- What is Depreciation?

- What Type of Insurance Do I Need to Claim Depreciation?

- How Do I Calculate Depreciation on My Car After an Accident?

- What Documentation Do I Need to Claim Depreciation?

- Can I Claim Depreciation on My Car if I Was at Fault in the Accident?

- Diminished Value Claims – Recovering Insurance Money after a Car Accident

Frequently Asked Questions

Here are some common questions about claiming depreciation on your car after an accident:

What is Depreciation?

Depreciation is the decrease in value of an asset over time. In the case of a car, it’s the amount of money your car loses in value as it ages or sustains damage. Depreciation is a common expense that car owners face and can be claimed on your taxes if you use your car for business purposes.

However, claiming depreciation on your car after an accident can be a bit more complicated, and the rules vary depending on your situation and the type of insurance you have.

What Type of Insurance Do I Need to Claim Depreciation?

If you want to claim depreciation on your car after an accident, you will need to have comprehensive or collision insurance. These types of insurance policies cover the cost of damage to your car, including depreciation.

If you only have liability insurance, you will not be able to claim depreciation on your car after an accident because this type of insurance only covers damage to other people’s property, not your own.

How Do I Calculate Depreciation on My Car After an Accident?

The amount of depreciation you can claim on your car after an accident depends on a few factors, such as the age of the car, the extent of the damage, and the market value of the car. To calculate this amount, you will need to consult an expert in car valuation, such as a mechanic or a car appraiser.

Once you have an estimate of the amount of depreciation, you can submit this information to your insurance company and request reimbursement for the lost value of your car.

What Documentation Do I Need to Claim Depreciation?

To claim depreciation on your car after an accident, you will need to provide documentation of the damage to your car, as well as proof of the car’s value before and after the accident. This can include receipts, repair estimates, and appraisals.

If you are unsure of what documentation you need to provide, you should contact your insurance company and ask for guidance.

Can I Claim Depreciation on My Car if I Was at Fault in the Accident?

If you were at fault in the accident, you may still be able to claim depreciation on your car if you have comprehensive or collision insurance. However, your insurance rates may go up as a result of the accident, so it’s important to weigh the pros and cons of making a claim.

If you were not at fault in the accident, you may be able to claim depreciation on your car through the other driver’s insurance company. In this case, you will need to provide documentation of the damage and the car’s value before and after the accident, as well as proof of the other driver’s negligence.

Diminished Value Claims – Recovering Insurance Money after a Car Accident

In conclusion, claiming depreciation on your car after an accident is a complicated process that requires careful consideration. While it is possible to claim depreciation, there are many factors that can affect the amount you are entitled to. It is important to work with a qualified professional who can help you navigate the complex world of insurance claims and vehicle depreciation.

Ultimately, the decision to claim depreciation should be based on your individual circumstances and the extent of the damage to your vehicle. It is important to weigh the potential benefits against the potential costs and to consult with experts in the field to ensure that you are making an informed decision.

In the end, claiming depreciation on your car after an accident can be a valuable way to recoup some of the financial losses associated with the incident. However, it is important to approach the process with caution and to seek professional guidance to ensure that you are getting the best possible outcome. With the right approach and the right support, you can successfully claim depreciation and move forward confidently after an accident.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts