Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

Car accidents can be a stressful and overwhelming experience. From dealing with medical bills, car repairs, and insurance claims, the last thing you want to worry about is taxes on any settlement you receive. But are car accident settlements taxed? The answer is not a simple yes or no, and it all depends on the circumstances surrounding your settlement. In this article, we will explore the various factors that determine whether your car accident settlement is taxable and provide you with the information you need to navigate this often-confusing topic. So, let’s dive in!

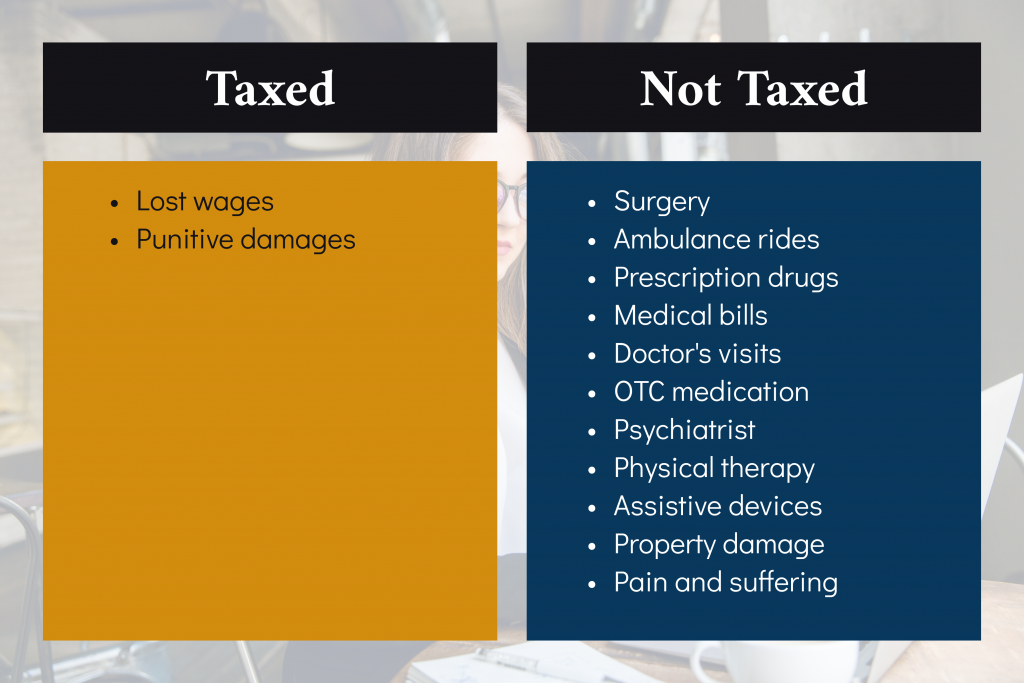

Car accident settlements are typically not taxable as long as they are compensatory in nature and meant to reimburse the victim for specific damages, such as medical expenses or lost wages. However, if the settlement includes punitive damages or interest, those amounts may be taxable. It’s best to consult with a tax professional to determine the taxability of your specific settlement.

Contents

- Are Car Accident Settlements Taxed?

- Frequently Asked Questions

- 1. What is a car accident settlement?

- 2. Are car accident settlements taxable?

- 3. What types of damages are typically covered in a car accident settlement?

- 4. How is a car accident settlement calculated?

- 5. How long does it take to receive a car accident settlement?

- Are Car Accident Settlements Taxable? – Spaulding Injury Law

Are Car Accident Settlements Taxed?

Car accidents can be a traumatic experience for anyone. However, they can become even more complicated when it comes to settlement negotiations. One question that often arises is whether or not car accident settlements are taxed. In this article, we’ll explore the answer to this question and explain everything you need to know about car accident settlements and taxes.

Understanding Car Accident Settlements

When you’re involved in a car accident, you may be entitled to compensation for your injuries and damages. This compensation is often paid out by the insurance company of the other driver involved in the accident. The amount of compensation you receive will depend on the severity of your injuries and the extent of the damages.

Types of Car Accident Settlements

There are two main types of car accident settlements: structured settlements and lump-sum settlements. A structured settlement is an agreement between you and the insurance company to pay you a certain amount of money over a set period of time. A lump-sum settlement, on the other hand, is a one-time payment made to you in a single payment.

Are Car Accident Settlements Taxed?

The short answer is no, car accident settlements are not typically taxed. The reason for this is that settlements are considered compensation for your losses and injuries, rather than income. This means that you do not have to pay taxes on the settlement amount.

Exceptions to the Rule

While car accident settlements are generally not taxed, there are some exceptions to this rule. For example, if you receive compensation for lost wages, the portion of the settlement that covers your lost wages may be subject to taxes. Additionally, if you receive punitive damages as part of your settlement, those damages may be subject to taxes.

How to Report a Settlement on Your Taxes

While car accident settlements are not typically taxed, you may still need to report your settlement on your taxes. To do this, you’ll need to fill out IRS Form 1040 and include the settlement amount on line 6. If you received a settlement for lost wages, you’ll need to report that amount on line 7.

Benefits of Non-Taxable Settlements

One of the biggest benefits of non-taxable settlements is that you get to keep more of the money you receive. This means that you can use the settlement money to pay for medical bills, car repairs, and other expenses without worrying about taxes eating into your funds.

Structured Settlements vs. Lump-Sum Settlements

When it comes to car accident settlements, you may have the option of choosing between a structured settlement and a lump-sum settlement. Structured settlements provide a steady stream of income over time, while lump-sum settlements provide a one-time payment. The choice between the two will depend on your financial needs and goals.

Conclusion

In summary, car accident settlements are not typically taxed. This is because settlements are considered compensation for your losses and injuries, rather than income. However, there are some exceptions to this rule, and you may still need to report your settlement on your taxes. If you’re unsure about how to handle your settlement from a tax perspective, it’s always best to consult with a tax professional.

Frequently Asked Questions

1. What is a car accident settlement?

A car accident settlement is a financial agreement between the parties involved in a car accident. The settlement is typically paid by the at-fault driver’s insurance company to the injured party, and is intended to compensate the injured party for their medical expenses, lost wages, and other damages resulting from the accident.

The settlement amount is negotiated by the parties involved, and can vary depending on the severity of the injuries and the circumstances of the accident.

2. Are car accident settlements taxable?

Whether or not a car accident settlement is taxable depends on the nature of the damages being compensated. In general, compensation for physical injuries or emotional distress resulting from a car accident is not taxable.

However, any portion of the settlement that is intended to compensate the injured party for lost wages or other income is typically taxable as income. It is important to consult with a tax professional to determine the taxability of a car accident settlement.

3. What types of damages are typically covered in a car accident settlement?

A car accident settlement can cover a wide range of damages, including medical expenses, lost wages, property damage, pain and suffering, and emotional distress. The specific damages covered will depend on the circumstances of the accident and the injuries sustained by the injured party.

In some cases, the settlement may also include compensation for future medical expenses or lost wages, as well as punitive damages if the at-fault driver’s actions were particularly egregious.

4. How is a car accident settlement calculated?

The amount of a car accident settlement is typically calculated by adding up the total amount of damages suffered by the injured party, including medical expenses, lost wages, and other damages. This total amount is then adjusted based on the severity of the injuries, the long-term effects of the injuries, and the likelihood of future medical expenses or lost wages.

The parties involved in the settlement negotiation will typically consult with medical and financial experts to determine the appropriate compensation for the injured party.

5. How long does it take to receive a car accident settlement?

The length of time it takes to receive a car accident settlement can vary widely depending on the circumstances of the accident and the negotiation process. In some cases, a settlement can be reached relatively quickly, while in other cases it may take months or even years to reach a settlement.

It is important to work with an experienced attorney who can help guide you through the settlement process and ensure that your rights are protected throughout the negotiation and settlement process.

Are Car Accident Settlements Taxable? – Spaulding Injury Law

In conclusion, the answer to whether car accident settlements are taxed is not a straightforward one. While compensatory damages for medical expenses and property damage are generally tax-free, the same cannot be said for punitive damages or lost wages. It is important to consult with a tax professional to understand the tax implications of your settlement and ensure compliance with the IRS.

In addition, the tax laws regarding car accident settlements vary from state to state. Therefore, it is crucial to understand the specific laws that apply to your state before filing your taxes.

Lastly, it is important to keep accurate records of all the settlement amounts and expenses incurred to support your claim. This includes medical bills, legal fees, and property damage costs. By doing so, you can ensure that you receive the maximum amount of compensation while minimizing your tax liability.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts