Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

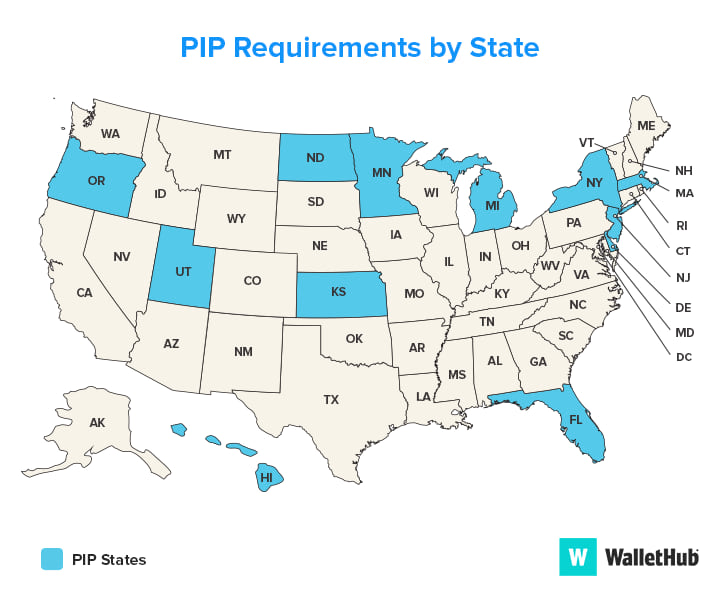

When it comes to car insurance, there are various types of coverage that drivers can choose from. One of these is Personal Injury Protection (PIP), which can provide medical and related expenses coverage for the driver and passengers involved in an accident. But is PIP required in Alabama? Let’s find out.

Alabama is one of the few states that does not require drivers to have PIP coverage. However, it is important to note that having this type of coverage can still be beneficial in case of an accident, as it can help cover medical bills and other related expenses.

Yes, Personal Injury Protection (PIP) is required in Alabama. Alabama is a no-fault state, which means that regardless of who caused the accident, each driver’s own insurance company will pay for their medical expenses and lost wages. The minimum PIP coverage required by law in Alabama is $2,500, but higher limits are available.

Understanding Personal Injury Protection in Alabama

What is Personal Injury Protection?

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses and lost wages in the event of an accident. It is also known as no-fault insurance, as it pays out regardless of who was at fault for the accident.

In Alabama, PIP is not required by law, but it is an option that drivers can choose to add to their policy. PIP can be a valuable addition to your car insurance policy, as it can provide coverage for medical expenses and lost wages that may not be covered by other types of insurance.

What Does PIP Cover?

If you are involved in a car accident in Alabama and have PIP coverage, your policy will typically cover the following expenses:

- Medical expenses: PIP will cover medical expenses that arise as a result of the accident, such as hospital bills, doctor’s fees, and rehabilitation costs.

- Lost wages: If you are unable to work due to your injuries, PIP will cover a portion of your lost wages.

- Funeral expenses: If a passenger in your vehicle is killed in an accident, PIP may cover some of their funeral expenses.

- Survivor benefits: If the accident results in your death, PIP may pay out survivor benefits to your dependents.

Benefits of PIP Coverage

There are several benefits to adding PIP coverage to your car insurance policy in Alabama:

- Peace of mind: Knowing that you have coverage for medical expenses and lost wages in the event of an accident can provide peace of mind.

- Protection for passengers: PIP coverage extends to passengers in your vehicle, so they can also receive coverage for medical expenses and lost wages.

- No-fault coverage: With PIP coverage, you do not have to prove who was at fault for the accident in order to receive benefits.

Is PIP Worth the Cost?

The cost of adding PIP coverage to your car insurance policy will depend on several factors, including your driving history, the make and model of your vehicle, and your age. While PIP coverage can be an added expense, it can also provide valuable protection in the event of an accident.

When considering whether or not to add PIP coverage to your policy, it is important to weigh the potential benefits against the cost. If you are concerned about the cost of PIP coverage, you may want to consider increasing your deductible or exploring other ways to save money on your car insurance policy.

PIP vs. Other Types of Car Insurance

There are several types of car insurance that are required by law in Alabama, including liability insurance and uninsured motorist coverage. While these types of insurance can provide important protection, they do not cover medical expenses or lost wages in the event of an accident.

PIP coverage can provide additional protection for you and your passengers, and can help ensure that you are able to cover your medical expenses and lost wages if you are involved in an accident.

Conclusion

While Personal Injury Protection is not required by law in Alabama, it can be a valuable addition to your car insurance policy. PIP coverage can provide coverage for medical expenses and lost wages in the event of an accident, and can provide peace of mind for you and your passengers. When considering whether or not to add PIP coverage to your policy, it is important to weigh the potential benefits against the cost and explore your options for saving money on your car insurance policy.

Frequently Asked Questions

What is Personal Injury Protection (PIP)?

Personal Injury Protection (PIP) is a type of car insurance coverage that can pay for medical expenses, lost wages, and other damages if you or your passengers are injured in a car accident. PIP coverage is often referred to as “no-fault” insurance because it can pay out regardless of who was at fault for the accident.

In Alabama, PIP coverage is optional, but it may be required if you have a loan or lease on your vehicle. Some insurance companies may also require PIP coverage as part of their policy offerings.

What does PIP coverage typically cover?

PIP coverage typically covers medical expenses, lost wages, and other damages related to a car accident. This can include things like hospital bills, doctor’s visits, rehabilitation costs, and even funeral expenses if someone is killed in the accident.

PIP coverage can also include benefits for lost income if you are unable to work due to your injuries, as well as benefits for essential services like childcare and housekeeping if you are unable to perform those tasks yourself.

How much PIP coverage should I get?

The amount of PIP coverage you should get depends on your individual needs and budget. In Alabama, the minimum amount of PIP coverage you can purchase is $2,500, but you can typically choose higher limits if you want more protection.

Keep in mind that higher coverage limits will typically result in higher premiums, but they can also provide more financial protection if you are injured in a car accident.

Do I need PIP coverage if I have health insurance?

While health insurance can help cover some medical expenses related to a car accident, PIP coverage can provide additional benefits that health insurance may not cover. For example, PIP coverage can provide benefits for lost wages and essential services like childcare and housekeeping, which are not typically covered by health insurance.

Ultimately, whether or not you need PIP coverage if you have health insurance will depend on your individual situation and coverage needs.

What happens if I don’t have PIP coverage and I’m injured in a car accident?

If you don’t have PIP coverage and you’re injured in a car accident, you may be responsible for paying for your own medical expenses, lost wages, and other damages related to the accident. This can be a significant financial burden, especially if you have serious injuries that require ongoing medical care.

It’s important to consider the potential risks and benefits of PIP coverage when choosing your car insurance policy, and to make an informed decision based on your individual needs and budget.

What is Personal Injury Protection (PIP)?

In conclusion, personal injury protection is not required in Alabama, but it is highly recommended. Accidents can happen at any time, and having this type of coverage can provide peace of mind and financial protection in case of injury.

While it may seem like an unnecessary expense, the cost of medical bills and lost wages can quickly add up without the proper insurance coverage. Additionally, personal injury protection can cover expenses that may not be included in other types of insurance, such as funeral costs and rehabilitation expenses.

Ultimately, the decision to purchase personal injury protection in Alabama is up to each individual. It is important to carefully consider the potential risks and benefits and consult with an experienced insurance agent to determine the best coverage options for your unique circumstances.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts