Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

If you’re a driver in Florida, you might be wondering whether you need personal injury protection (PIP) insurance. After all, car accidents can happen to anyone, and it’s important to know your legal obligations and financial responsibilities. In this article, we’ll explore the laws and regulations surrounding PIP insurance in Florida, and help you understand whether you need this type of coverage. So whether you’re a new driver or a seasoned pro, read on to learn more about PIP insurance and how it can protect you in the event of an accident.

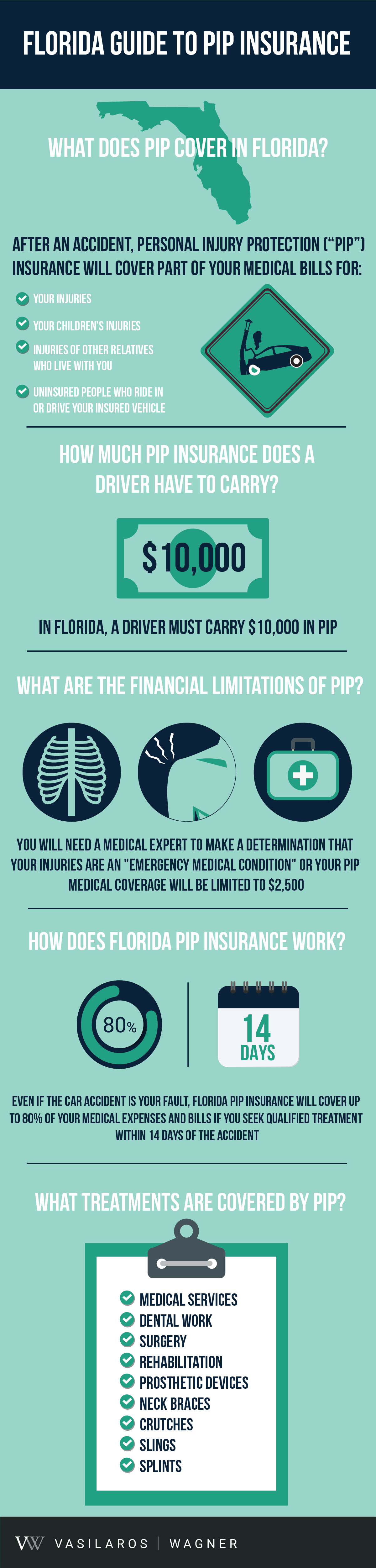

Yes, Personal Injury Protection (PIP) is required in Florida. It is mandatory for all drivers to carry a minimum of $10,000 in PIP coverage and $10,000 in Property Damage Liability (PDL) coverage. PIP covers medical expenses, lost wages, and other related expenses regardless of who is at fault in an accident. Failure to carry PIP coverage can result in fines, suspension of your driver’s license, and even legal action.

Contents

- Is Personal Injury Protection Required in Florida?

- What is Personal Injury Protection (PIP)?

- The Requirements for Personal Injury Protection (PIP) in Florida

- The Benefits of Personal Injury Protection (PIP) Coverage in Florida

- The Drawbacks of Personal Injury Protection (PIP) Coverage in Florida

- Personal Injury Protection (PIP) vs. Bodily Injury Liability Coverage in Florida

- The Verdict: Is Personal Injury Protection (PIP) Required in Florida?

- Conclusion

- Frequently Asked Questions

- What is personal injury protection (PIP) insurance?

- Do I need PIP insurance if I have health insurance?

- What happens if I don’t have PIP insurance in Florida?

- Can I waive PIP insurance in Florida?

- What is the deadline for filing a PIP claim in Florida?

- Florida Car Insurance 101: What is PIP (Personal Injury Protection) Coverage?

Is Personal Injury Protection Required in Florida?

Personal Injury Protection (PIP) is an auto insurance coverage that covers medical expenses and lost wages in the event of an accident. In Florida, PIP coverage is mandatory for all registered vehicles. It is important for drivers to understand the specifics of PIP coverage in Florida to ensure they are adequately protected in the event of an accident.

What is Personal Injury Protection (PIP)?

Personal Injury Protection, also known as no-fault insurance, is a type of auto insurance coverage that pays for medical expenses and lost wages in the event of an accident. It covers the policyholder and their passengers, regardless of who is at fault for the accident. In Florida, PIP coverage is mandatory and must be included in all auto insurance policies.

The Requirements for Personal Injury Protection (PIP) in Florida

In Florida, all registered vehicles must have a minimum of $10,000 in PIP coverage. This coverage will pay for 80% of medical expenses and 60% of lost wages, up to the policy limit. It is important to note that the remaining 20% of medical expenses and 40% of lost wages will be the responsibility of the policyholder.

The Benefits of Personal Injury Protection (PIP) Coverage in Florida

One of the main benefits of PIP coverage in Florida is that it provides immediate medical coverage for policyholders and their passengers, regardless of who is at fault for the accident. This means that injured parties can receive medical treatment quickly, without having to wait for a determination of fault.

Another benefit of PIP coverage is that it can help to mitigate the risk of lawsuits. In Florida, injured parties can only sue for damages that exceed their PIP coverage limit. This means that if a policyholder has the minimum required PIP coverage of $10,000, the injured party can only sue for damages that exceed $10,000.

The Drawbacks of Personal Injury Protection (PIP) Coverage in Florida

One of the main drawbacks of PIP coverage in Florida is that it only covers medical expenses and lost wages. It does not cover property damage or liability for injuries or damages caused to others in an accident. This means that policyholders may need to purchase additional coverage to protect themselves in the event of an accident.

Another drawback of PIP coverage in Florida is that it can be expensive. The cost of PIP coverage can vary depending on a number of factors, including the policyholder’s age, driving record, and the type of vehicle they drive.

Personal Injury Protection (PIP) vs. Bodily Injury Liability Coverage in Florida

Bodily Injury Liability (BIL) coverage is another type of auto insurance coverage that is mandatory in Florida. Unlike PIP coverage, BIL coverage covers damages that a policyholder may be liable for in an accident. This includes damages caused to others, as well as medical expenses and lost wages.

While PIP coverage provides immediate medical coverage for policyholders and their passengers, BIL coverage provides broader coverage for damages caused to others. It is important for drivers to understand the differences between PIP and BIL coverage to ensure they have adequate protection in the event of an accident.

The Verdict: Is Personal Injury Protection (PIP) Required in Florida?

In short, yes. Personal Injury Protection (PIP) coverage is required for all registered vehicles in Florida. It provides immediate medical coverage for policyholders and their passengers, regardless of who is at fault for the accident. While it has some drawbacks, such as limited coverage for damages caused to others, it is an important coverage to have in Florida.

Conclusion

Personal Injury Protection (PIP) coverage is a mandatory auto insurance coverage in Florida. It provides immediate medical coverage for policyholders and their passengers, which can be crucial in the event of an accident. While it has some drawbacks, such as limited coverage for damages caused to others, it is an important coverage to have. Drivers should make sure they understand the specifics of PIP coverage in Florida to ensure they are adequately protected.

Frequently Asked Questions

Florida is a no-fault state when it comes to car insurance. This means that drivers are required to carry personal injury protection (PIP) insurance, which covers medical expenses and lost wages in the event of an accident. Here are some common questions about PIP insurance in Florida:

What is personal injury protection (PIP) insurance?

Personal injury protection (PIP) insurance is a type of car insurance that covers medical expenses and lost wages for the policyholder and their passengers in the event of an accident. PIP insurance is required in Florida, where it is known as no-fault insurance. This means that regardless of who was at fault for the accident, each driver’s insurance company is responsible for paying their own medical expenses and lost wages.

PIP insurance typically covers medical expenses, lost wages, and other related expenses, such as transportation to medical appointments and household services. The amount of coverage varies depending on the policy, but Florida law requires a minimum of $10,000 in PIP coverage.

Do I need PIP insurance if I have health insurance?

Yes, even if you have health insurance, you are still required to carry PIP insurance in Florida. This is because PIP insurance is specifically designed to cover medical expenses and lost wages related to car accidents, regardless of who was at fault. Health insurance may not cover all of the expenses related to an accident, and it may not cover lost wages or other related expenses. PIP insurance is meant to supplement your health insurance coverage.

Additionally, if you are injured in a car accident and do not have PIP insurance, you may be responsible for paying out of pocket for your medical expenses and lost wages, even if the accident was not your fault.

What happens if I don’t have PIP insurance in Florida?

If you are caught driving without PIP insurance in Florida, you may face penalties and fines. Additionally, if you are injured in a car accident and do not have PIP insurance, you may be responsible for paying out of pocket for your medical expenses and lost wages, even if the accident was not your fault. This can be extremely costly, especially if your injuries are serious.

It is important to carry PIP insurance in Florida to ensure that you are protected in the event of an accident. If you are unsure if you have PIP insurance or how much coverage you have, contact your insurance company to find out.

Can I waive PIP insurance in Florida?

In Florida, you have the option to waive PIP insurance if you have health insurance that covers car accidents. However, this is not recommended, as health insurance may not cover all of the expenses related to a car accident, such as lost wages and other related expenses. Additionally, if you do not carry PIP insurance and are injured in a car accident, you may be responsible for paying out of pocket for your medical expenses and lost wages, even if the accident was not your fault.

If you choose to waive PIP insurance in Florida, you must do so in writing and provide proof of your health insurance coverage. You should also consider purchasing additional insurance coverage, such as uninsured motorist coverage, to ensure that you are fully protected in the event of an accident.

What is the deadline for filing a PIP claim in Florida?

In Florida, you must file a PIP claim within 14 days of the accident in order to receive benefits. If you do not file a claim within this timeframe, you may not be eligible for PIP benefits. It is important to seek medical attention as soon as possible after an accident and to notify your insurance company of the accident and your injuries.

If you are unable to file a claim within the 14-day timeframe due to extenuating circumstances, such as being hospitalized or incapacitated, you may be able to file a claim at a later date. However, it is important to notify your insurance company as soon as possible if you are unable to file a claim within the 14-day timeframe.

Florida Car Insurance 101: What is PIP (Personal Injury Protection) Coverage?

In conclusion, personal injury protection (PIP) is indeed required for all drivers who own a registered vehicle in Florida. This mandatory coverage is put in place to protect drivers and passengers from the financial burden of medical expenses and lost wages in the event of an accident. While some may argue that the cost of PIP is too high, it is important to remember that the consequences of being involved in an accident without proper coverage can be much more costly in the long run.

Furthermore, PIP offers benefits beyond just medical coverage, such as coverage for lost wages and death benefits. It is also worth noting that Florida has one of the highest rates of uninsured drivers in the country, making PIP even more crucial for those who are involved in accidents with uninsured motorists.

Overall, while it may be tempting to try and save money by forgoing PIP coverage, it is important to consider the potential consequences and weigh the risks. By following the laws and regulations set forth by the state of Florida, drivers can ensure that they are protected and prepared for any unforeseen accidents that may occur on the road.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts