Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

If you’re a driver in Indiana, you might be wondering whether you need to have Personal Injury Protection (PIP) as part of your auto insurance coverage. The short answer is yes, but there are some nuances to the law that can make it confusing to understand.

In this article, we’ll break down the requirements for PIP in Indiana, including what it covers, how much you need, and what your options are if you decide not to carry it. Whether you’re a seasoned driver or a new one, it’s important to understand your insurance options to make sure you’re protected on the road.

Indiana requires all drivers to have Personal Injury Protection (PIP) insurance. PIP covers medical expenses and lost wages for you and your passengers in case of an accident, regardless of who was at fault. The minimum coverage required is $10,000 for medical expenses and $20,000 for lost wages. Failure to have PIP insurance can result in fines and penalties.

Contents

- Is Personal Injury Protection Required in Indiana?

- Frequently Asked Questions

- What is Personal Injury Protection (PIP) in Indiana?

- What does Personal Injury Protection cover in Indiana?

- Is Personal Injury Protection Required in Indiana?

- Can I decline Personal Injury Protection in Indiana?

- How much does Personal Injury Protection cost in Indiana?

- What is Personal Injury Protection (PIP)?

Is Personal Injury Protection Required in Indiana?

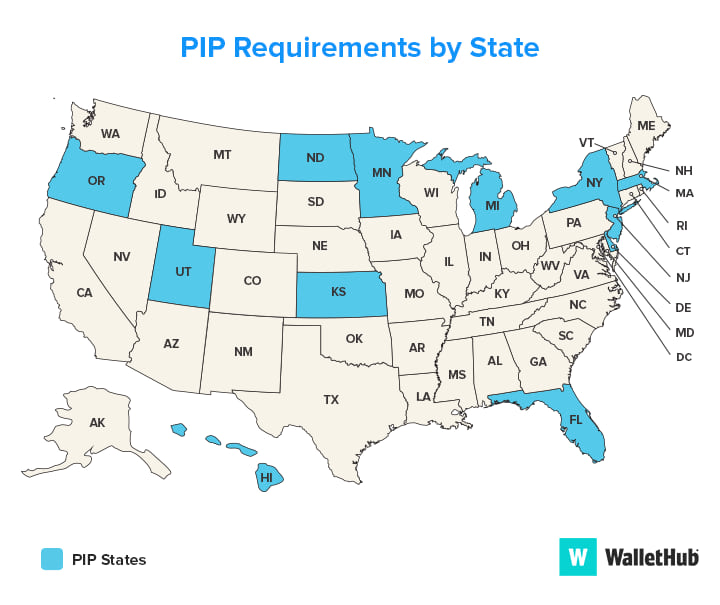

Personal Injury Protection (PIP) is a type of insurance coverage that provides medical expenses and lost wages to the policyholder and passengers involved in an accident. PIP is not required in all states, but it is mandatory in Indiana. In this article, we will discuss the details of PIP in Indiana and its benefits.

What is Personal Injury Protection (PIP)?

Personal Injury Protection (PIP) is a form of car insurance that provides coverage for medical expenses, lost wages, and other related expenses resulting from a car accident. PIP insurance pays for medical expenses regardless of who is at fault for the accident. In Indiana, PIP is also known as “no-fault” insurance because it provides benefits regardless of who caused the accident.

PIP insurance covers medical expenses such as hospital bills, doctor visits, and prescription medications. It also covers lost wages due to disability resulting from the accident. PIP insurance can also cover expenses related to household services, such as cleaning and childcare, that the policyholder is unable to perform due to the accident.

Why is PIP Required in Indiana?

Indiana is a no-fault state, which means that PIP insurance is required for all drivers. The purpose of PIP insurance is to provide prompt payment of medical expenses and lost wages to the policyholder and passengers involved in an accident. The goal is to reduce the number of lawsuits resulting from car accidents and to ensure that injured parties receive the care they need as soon as possible.

In Indiana, the minimum amount of PIP insurance required is $10,000 per person per accident. This means that if you are involved in an accident, your PIP insurance will pay up to $10,000 for medical expenses and lost wages. If your medical expenses and lost wages exceed $10,000, you may be able to recover additional damages from the at-fault driver’s insurance policy.

The Benefits of PIP Insurance

PIP insurance provides several benefits to policyholders and passengers involved in an accident. First, PIP insurance ensures that medical expenses and lost wages are paid promptly, without the need for a lengthy legal battle. This can be particularly important in cases where the injured party is unable to work due to disability resulting from the accident.

Second, PIP insurance provides coverage regardless of who is at fault for the accident. This means that even if you caused the accident, your PIP insurance will pay for your medical expenses and lost wages. This can be particularly beneficial in cases where the other driver is uninsured or underinsured.

Third, PIP insurance can provide coverage for expenses related to household services that the policyholder is unable to perform due to the accident. This can include cleaning, cooking, and childcare services. These benefits can be particularly important for single-parent households or those without a support system.

Potential Drawbacks of PIP Insurance

While PIP insurance provides several benefits, there are also potential drawbacks to consider. First, PIP insurance can be expensive, particularly for high-risk drivers. This can make it difficult for some drivers to afford the coverage.

Second, PIP insurance may not cover all medical expenses and lost wages resulting from an accident. If your expenses exceed the limits of your PIP policy, you may need to seek additional compensation from the at-fault driver’s insurance policy or through a lawsuit.

Finally, PIP insurance may not be necessary for all drivers. If you have a strong health insurance policy or disability insurance, you may not need the additional coverage provided by PIP insurance.

PIP Insurance vs. Medical Payments Coverage

In addition to PIP insurance, some drivers may choose to purchase Medical Payments (MedPay) coverage. MedPay coverage is similar to PIP insurance in that it provides coverage for medical expenses resulting from a car accident. However, unlike PIP insurance, MedPay coverage does not provide coverage for lost wages or household services.

MedPay coverage may be a good option for drivers with strong health insurance policies who are primarily concerned with covering medical expenses resulting from an accident. However, it is important to note that MedPay coverage is not mandatory in Indiana.

Conclusion

Personal Injury Protection (PIP) insurance is mandatory in Indiana and provides coverage for medical expenses and lost wages resulting from a car accident. While PIP insurance provides several benefits, including prompt payment of expenses and coverage regardless of who is at fault for the accident, there are also potential drawbacks to consider. Drivers may also choose to purchase Medical Payments (MedPay) coverage as an alternative to PIP insurance. Ultimately, the decision to purchase PIP insurance or MedPay coverage will depend on the individual driver’s needs and budget.

Frequently Asked Questions

What is Personal Injury Protection (PIP) in Indiana?

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses and lost wages for you and your passengers in the event of an accident. It is also known as no-fault insurance because it pays out regardless of who is at fault for the accident.

What does Personal Injury Protection cover in Indiana?

Personal Injury Protection covers medical expenses, lost wages, and other related expenses like childcare and household services if you or your passengers are injured in a car accident. It also covers funeral expenses if someone is killed in an accident.

Is Personal Injury Protection Required in Indiana?

Yes, Personal Injury Protection is required in Indiana. The minimum coverage amount is $10,000 for medical expenses and lost wages, but you can choose to purchase additional coverage if you want more protection.

Can I decline Personal Injury Protection in Indiana?

No, you cannot decline Personal Injury Protection in Indiana. It is a mandatory coverage that you must have as part of your car insurance policy. However, you can choose to purchase additional coverage on top of the minimum requirement.

How much does Personal Injury Protection cost in Indiana?

The cost of Personal Injury Protection in Indiana varies depending on the insurance company and the coverage amount you choose. The minimum coverage amount is $10,000, but you can purchase additional coverage up to $100,000 or more. Your insurance premiums will be higher if you choose more coverage.

What is Personal Injury Protection (PIP)?

In conclusion, it is mandatory for drivers in Indiana to carry Personal Injury Protection (PIP) insurance to cover medical expenses and lost wages in the event of an accident. This requirement is in place to ensure that all drivers have access to the necessary medical care and financial support in case of an accident, regardless of who is at fault.

While PIP insurance is required in Indiana, it is important to note that the minimum coverage may not be enough to cover all expenses in the event of a serious accident. It is recommended that drivers consider purchasing additional coverage to protect themselves and their passengers.

Overall, while it may seem like an additional expense, having Personal Injury Protection insurance can provide peace of mind and financial security in the event of an unexpected accident. It is important for all drivers in Indiana to comply with this requirement and ensure that they have adequate coverage to protect themselves and others on the road.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts