Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

Illinois is one of the many states in the US that requires drivers to have car insurance. One of the types of coverage that drivers need to have is Personal Injury Protection (PIP). But what exactly is PIP, and why is it required in Illinois? Let’s dive deeper into this topic and find out.

In this article, we’ll explore the ins and outs of PIP, including what it covers, how much coverage you need, and the penalties for not having it. Whether you’re a new driver or a seasoned one, understanding PIP is essential for protecting yourself and others on the road. So, let’s get started and learn all about personal injury protection in Illinois.

Illinois law requires all drivers to have minimum liability insurance. While Personal Injury Protection (PIP) is not required, it can provide additional coverage for medical expenses, lost wages, and other related costs after an accident. PIP covers the policyholder and their passengers, regardless of fault. It is important to carefully consider your insurance options and consult with a licensed insurance agent to determine the best coverage for your needs.

Is Personal Injury Protection Required in Illinois?

Understanding Personal Injury Protection

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses, lost wages, and related expenses for you and your passengers in the event of an accident. PIP can also cover funeral expenses in the event of a fatal accident. PIP is a no-fault insurance, which means that it covers your expenses regardless of who was at fault for the accident.

In Illinois, PIP is not required by law. However, it is a good idea to consider adding PIP to your car insurance policy. This is because PIP can provide coverage for medical expenses and lost wages that may not be covered by your health insurance or disability insurance.

The Benefits of Personal Injury Protection

There are several benefits to having PIP coverage in Illinois. One of the main benefits is that it can provide coverage for medical expenses and lost wages that may not be covered by your health insurance or disability insurance. This can be especially important if you are injured in an accident and are unable to work for a period of time.

Another benefit of PIP is that it can provide coverage for funeral expenses in the event of a fatal accident. This can help ease the financial burden on your family during a difficult time.

Additionally, PIP can provide coverage for your passengers, regardless of who was at fault for the accident. This can be especially important if you frequently have passengers in your car.

PIP vs. Other Types of Car Insurance

While PIP is not required by law in Illinois, there are other types of car insurance that are required. For example, Illinois requires drivers to have liability insurance, which covers damages and injuries that you may cause to others in an accident.

While liability insurance is important, it does not provide coverage for your own medical expenses or lost wages. This is where PIP can be beneficial, as it provides coverage for these types of expenses.

How to Add Personal Injury Protection to Your Car Insurance Policy

If you are interested in adding PIP to your car insurance policy in Illinois, you should contact your insurance provider. They can provide you with more information on the cost and benefits of adding PIP to your policy.

It is important to note that the cost of PIP can vary depending on a number of factors, including your driving record, the type of car you drive, and your age. However, adding PIP to your policy may be worth the additional cost, as it can provide valuable coverage in the event of an accident.

Conclusion

While Personal Injury Protection is not required by law in Illinois, it can be a valuable addition to your car insurance policy. PIP can provide coverage for medical expenses, lost wages, and related expenses for you and your passengers in the event of an accident. Additionally, PIP can provide coverage for funeral expenses in the event of a fatal accident. If you are interested in adding PIP to your car insurance policy, contact your insurance provider for more information.

Contents

- Frequently Asked Questions

- What is Personal Injury Protection (PIP)?

- What are the benefits of having PIP coverage?

- What is the minimum car insurance required in Illinois?

- What other types of car insurance are available in Illinois?

- Do I need a lawyer if I am injured in a car accident in Illinois?

- What is Personal Injury Protection (PIP)?

Frequently Asked Questions

What is Personal Injury Protection (PIP)?

Personal Injury Protection (PIP) is a type of car insurance coverage that pays for medical expenses, lost wages, and other related expenses if you or your passengers are injured in a car accident. It is also known as no-fault insurance because it covers you regardless of who caused the accident.

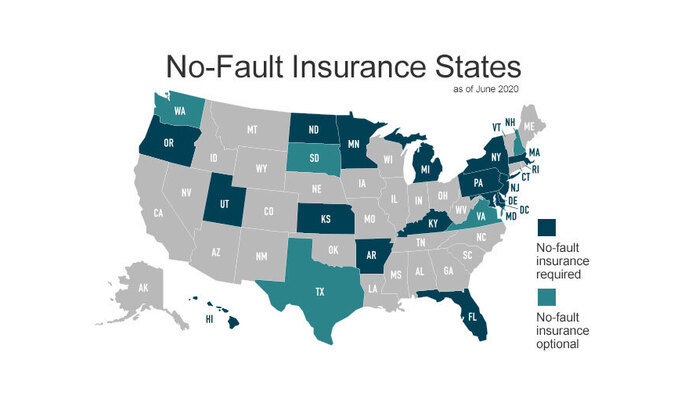

PIP coverage is mandatory in some states, but optional in others. In Illinois, PIP coverage is not required, but it is available as an option for those who want it.

What are the benefits of having PIP coverage?

There are several benefits to having PIP coverage. Firstly, it can help you pay for medical expenses and lost wages if you or your passengers are injured in a car accident. This can be especially important if you do not have health insurance or disability insurance.

Secondly, PIP coverage can help you avoid lawsuits. Since PIP is a no-fault insurance, you cannot be sued for damages related to the accident, unless you were driving under the influence or intentionally caused the accident. This can save you time, money, and stress.

What is the minimum car insurance required in Illinois?

In Illinois, the minimum car insurance required is liability insurance. This covers damages or injuries you may cause to other people or their property while driving. The minimum coverage limits are:

– $25,000 for injury or death of one person in an accident

– $50,000 for injury or death of more than one person in an accident

– $20,000 for damage to property of another person

What other types of car insurance are available in Illinois?

In addition to liability insurance, you can also purchase collision coverage, which covers damages to your own car in an accident, and comprehensive coverage, which covers damages to your car from non-accident related events such as theft, vandalism, and natural disasters.

You can also purchase uninsured/underinsured motorist coverage, which covers you if you are in an accident with a driver who does not have enough insurance to cover your damages.

Do I need a lawyer if I am injured in a car accident in Illinois?

If you are injured in a car accident in Illinois, you may want to consult with a personal injury lawyer. An experienced lawyer can help you understand your legal rights and options, and can help you navigate the complex legal system.

A lawyer can also help you negotiate with insurance companies to ensure you receive fair compensation for your injuries and damages. However, whether or not you need a lawyer depends on the specific circumstances of your case.

What is Personal Injury Protection (PIP)?

In conclusion, if you are a driver in Illinois, it is important to know the laws surrounding personal injury protection (PIP) coverage. While PIP insurance is not required by law in Illinois, it can provide valuable protection in the event of an accident.

If you choose to purchase PIP insurance, it can help cover medical expenses, lost wages, and other damages that result from an accident. However, it is important to carefully consider your options and choose a policy that meets your needs and budget.

Ultimately, whether or not you choose to purchase PIP insurance is a personal decision. However, it is important to understand the potential benefits and drawbacks of this type of coverage, and to make an informed decision based on your individual circumstances.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts