Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

Kansas is a state that requires drivers to carry auto insurance, but what about Personal Injury Protection (PIP)? PIP is a type of insurance that covers medical expenses and lost wages in case of an accident. So, is PIP required in Kansas? Let’s find out.

If you’re a driver in Kansas, you know how important it is to have the right insurance coverage. But with so many options out there, it can be confusing to know what you really need. In this article, we’ll explore the ins and outs of PIP insurance in Kansas and whether or not it’s required by law.

Yes, Personal Injury Protection (PIP) is mandatory in Kansas. It provides coverage for medical expenses, lost wages, and other related expenses regardless of who was at fault in the accident. The minimum coverage required is $4,500 for medical expenses, $900 per month for disability or loss of income, $25 per day for in-home services, and $2,000 for funeral, burial, or cremation expenses. Failure to carry PIP insurance can result in legal and financial penalties.

Is Personal Injury Protection Required in Kansas?

Kansas is one of the many states in the US that requires drivers to have car insurance. However, unlike most other states, Kansas mandates Personal Injury Protection (PIP) coverage as a part of the car insurance policy. PIP coverage is designed to help drivers and passengers injured in a car accident to pay for medical expenses, lost wages, and other related expenses. In this article, we will discuss what PIP coverage is, how it works, and why it is required in Kansas.

What is Personal Injury Protection (PIP) coverage?

Personal Injury Protection (PIP) coverage is a type of car insurance that covers medical expenses and lost wages for drivers and their passengers who are injured in a car accident. Unlike traditional car insurance, PIP coverage is a no-fault insurance, which means that it pays out regardless of who is at fault for the accident.

Benefits of PIP Coverage:

- Covers medical expenses and lost wages for drivers and passengers

- Pays out regardless of who is at fault for the accident

- Provides coverage for a range of medical expenses, including hospitalization, rehabilitation, and therapy

- Can be used to cover expenses that are not covered by health insurance, such as deductibles and copays

VS Traditional Car Insurance:

| PIP Coverage | Traditional Car Insurance |

|---|---|

| Covers medical expenses and lost wages for drivers and passengers | Only covers damage to the vehicle and liability for injuries caused to others |

| Pays out regardless of who is at fault for the accident | Only pays out if the insured party is at fault for the accident |

| Provides coverage for a range of medical expenses, including hospitalization, rehabilitation, and therapy | Does not cover medical expenses beyond liability limits |

How does PIP coverage work?

In Kansas, drivers are required to carry a minimum of $4,500 in PIP coverage. This coverage can be used to pay for medical expenses and lost wages for the driver and passengers in the event of an accident. PIP coverage can also be used to cover other related expenses, such as childcare and funeral expenses.

If you are involved in a car accident in Kansas, your PIP coverage will kick in regardless of who is at fault for the accident. This means that if you are injured in an accident, you can file a claim with your own insurance company to cover your medical expenses and lost wages.

How to file a PIP claim?

- Contact your insurance company and report the accident as soon as possible

- Provide your insurance company with all the necessary information, such as the date, time, and location of the accident

- Provide your insurance company with copies of all medical bills and other related expenses

- Cooperate with your insurance company’s investigation into the accident

Why is PIP coverage required in Kansas?

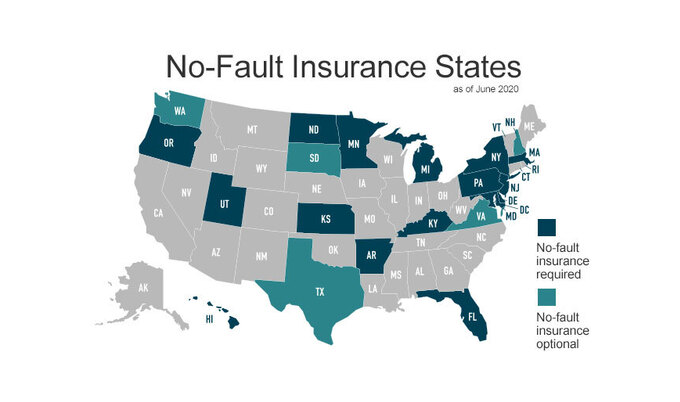

Kansas is one of the 13 states in the US that mandates PIP coverage as a part of the car insurance policy. The main reason why PIP coverage is required is to ensure that drivers and passengers who are injured in a car accident have access to medical care and lost wages. PIP coverage also helps to reduce the burden on the state’s healthcare system by providing insurance coverage for medical expenses that would otherwise be paid for by Medicaid or other government programs.

In conclusion, Personal Injury Protection (PIP) coverage is required in Kansas as a part of the state’s car insurance policy. PIP coverage is designed to help drivers and passengers who are injured in a car accident to pay for medical expenses, lost wages, and other related expenses. PIP coverage is a no-fault insurance, which means that it pays out regardless of who is at fault for the accident. If you are a driver in Kansas, it is important to understand the benefits of PIP coverage and how it works.

Frequently Asked Questions

Here are some common questions related to personal injury protection in Kansas:

What is Personal Injury Protection?

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses and lost wages for the policyholder and their passengers in the event of an accident. It is often referred to as “no-fault” insurance because it pays out regardless of who is at fault for the accident.

In Kansas, PIP coverage includes medical expenses, rehabilitation expenses, funeral expenses, and lost wages. The minimum coverage required by law is $4,500 per person per accident for medical expenses and $900 per month for one year for disability or loss of income.

Is PIP Required in Kansas?

Yes, PIP coverage is required in Kansas. The state’s no-fault insurance law mandates that all drivers carry PIP coverage as part of their auto insurance policy. This requirement is in place to ensure that drivers and passengers have access to medical care and lost wages in the event of an accident, regardless of who is at fault.

It is important to note that drivers can choose to opt-out of PIP coverage if they have an alternative form of insurance that provides similar benefits, such as health insurance or disability insurance. However, opting out of PIP coverage can have serious financial consequences in the event of an accident.

How Does PIP Coverage Work in Kansas?

If you are involved in a car accident in Kansas, your PIP coverage will kick in to cover medical expenses and lost wages for you and your passengers. This coverage is available regardless of who is at fault for the accident.

Once your PIP benefits have been exhausted, you may be able to pursue additional compensation from the at-fault driver’s insurance company or through a personal injury lawsuit. However, it is important to note that Kansas has a modified comparative fault rule, which means that your damages may be reduced if you are found to be partially at fault for the accident.

What are the Benefits of PIP Coverage?

There are several benefits to carrying PIP coverage in Kansas. First and foremost, it ensures that you and your passengers will have access to medical care and lost wages in the event of an accident, regardless of who is at fault. This can provide peace of mind and financial security during a difficult time.

In addition, PIP coverage can help to cover expenses that may not be covered by other insurance policies, such as health insurance or disability insurance. This can include things like funeral expenses, rehabilitation expenses, and lost wages.

How Much Does PIP Coverage Cost in Kansas?

The cost of PIP coverage in Kansas can vary depending on a number of factors, including your age, driving record, and the amount of coverage you choose to purchase. However, the minimum required coverage is relatively affordable, with an average cost of around $50-$100 per year.

It is important to note that while PIP coverage may add to your overall insurance costs, it can provide valuable benefits and financial protection in the event of an accident. Ultimately, the cost of PIP coverage is a small price to pay for the peace of mind and security it can provide.

What is Personal Injury Protection (PIP)?

In conclusion, while Personal Injury Protection (PIP) is not required in Kansas, it is highly recommended. PIP coverage can provide vital financial support for medical costs and lost wages in the event of an accident, regardless of who is at fault. By choosing to add PIP coverage to your auto insurance policy, you can have peace of mind knowing that you and your loved ones are protected in the event of an unexpected accident.

However, if you choose not to purchase PIP coverage, it is important to understand that you may be responsible for covering any medical expenses and lost wages resulting from an accident. This can lead to significant financial strain and stress, which can be avoided by adding PIP coverage to your policy.

Ultimately, the decision to purchase PIP coverage is a personal one that should be based on your individual needs and circumstances. However, it is important to carefully consider the potential risks and benefits before making a final decision. By doing so, you can make an informed choice that best protects you and your loved ones on the road.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts