Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

Texas is a state that prides itself on its independent spirit, but when it comes to car insurance, the Lone Star State has strict requirements for drivers. One question that often arises is whether personal injury protection (PIP) is required in Texas.

PIP is a type of car insurance that covers medical expenses and lost wages for the driver and passengers in the event of an accident. While it is not required in all states, Texans may be surprised to learn that PIP coverage is mandatory under state law. So, let’s explore the ins and outs of PIP and why it’s important to have this coverage in Texas.

Personal Injury Protection (PIP) is not required in Texas, but it is an optional coverage that can be added to your auto insurance policy. PIP provides medical expenses, lost wages, and other related expenses in case of an accident, regardless of who is at fault. However, PIP coverage can increase your insurance premium, so it’s important to consider your options carefully before making a decision.

Is Personal Injury Protection Required in Texas?

Personal injury protection, commonly known as PIP, is a type of car insurance coverage that pays for medical expenses and other related costs in case of an accident. In Texas, PIP coverage is not required by law, but it is strongly recommended for all drivers. This article will explore the reasons why PIP is important and the benefits it provides.

What is Personal Injury Protection?

Personal injury protection is a type of car insurance coverage that helps pay for medical expenses and lost wages in case of an accident. It can also provide coverage for other related expenses such as rehabilitation costs, funeral expenses, and childcare expenses. PIP coverage is designed to provide quick and easy access to medical care and other related expenses, regardless of who is at fault in the accident.

Benefits of Personal Injury Protection

One of the key benefits of PIP coverage is that it provides quick and easy access to medical care and other related expenses in case of an accident. This can be especially important if you or a family member is injured in an accident and needs immediate medical attention. PIP coverage can also provide coverage for lost wages, which can be a critical source of income if you are unable to work due to your injuries.

Another benefit of PIP coverage is that it can provide coverage for other related expenses such as rehabilitation costs, funeral expenses, and childcare expenses. These expenses can quickly add up and become a financial burden if you are not prepared for them.

PIP vs. Other Types of Car Insurance Coverage

PIP coverage is often compared to other types of car insurance coverage such as liability coverage and medical payments coverage. Liability coverage is required by law in Texas and provides coverage for damages and injuries you may cause to others in an accident. Medical payments coverage provides coverage for medical expenses for you and your passengers in case of an accident.

While liability coverage and medical payments coverage are important, they do not provide the same level of protection as PIP coverage. PIP coverage is designed to provide comprehensive coverage for medical expenses, lost wages, and other related expenses, regardless of who is at fault in the accident.

Do You Need Personal Injury Protection?

While PIP coverage is not required by law in Texas, it is strongly recommended for all drivers. Accidents can happen at any time, and PIP coverage can provide critical protection in case of an accident. If you have health insurance, you may be able to forgo PIP coverage, but it is still a good idea to consider it as an additional layer of protection.

Conclusion

In conclusion, personal injury protection is an important type of car insurance coverage that can provide critical protection in case of an accident. While it is not required by law in Texas, it is strongly recommended for all drivers. PIP coverage can provide quick and easy access to medical care and other related expenses, regardless of who is at fault in the accident. It can also provide coverage for lost wages, rehabilitation costs, funeral expenses, and childcare expenses. If you are looking for comprehensive car insurance coverage, PIP coverage is definitely worth considering.

Frequently Asked Questions

What is Personal Injury Protection (PIP) coverage in Texas?

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses and other related expenses that arise from a car accident. This type of coverage is mandatory in some states, but not in Texas. However, it is an optional add-on to your car insurance policy in Texas.

PIP coverage in Texas can cover medical bills, lost wages, and other related expenses. It can also cover expenses related to rehabilitation, home care, and funeral expenses. If you are involved in a car accident and have PIP coverage, your medical expenses and related expenses will be covered up to the policy limit.

What are the benefits of having PIP coverage in Texas?

PIP coverage in Texas can provide several benefits. Firstly, it can cover your medical bills and related expenses if you are involved in a car accident. Secondly, it can cover your lost wages if you are unable to work due to the injuries sustained in the accident. Thirdly, it can cover your rehabilitation expenses, home care expenses, and even funeral expenses if necessary.

Having PIP coverage in Texas can give you peace of mind knowing that you and your family are financially protected in case of a car accident. It can also help you avoid expensive medical bills and lost wages due to injuries sustained in the accident.

Who is eligible for PIP coverage in Texas?

Anyone who owns a car in Texas is eligible for PIP coverage. However, it is not mandatory to have PIP coverage in Texas. It is an optional add-on to your car insurance policy.

If you choose to have PIP coverage, you will need to pay an additional premium on top of your regular car insurance premium. The amount of the premium will depend on the coverage limit you choose.

How much PIP coverage should I get in Texas?

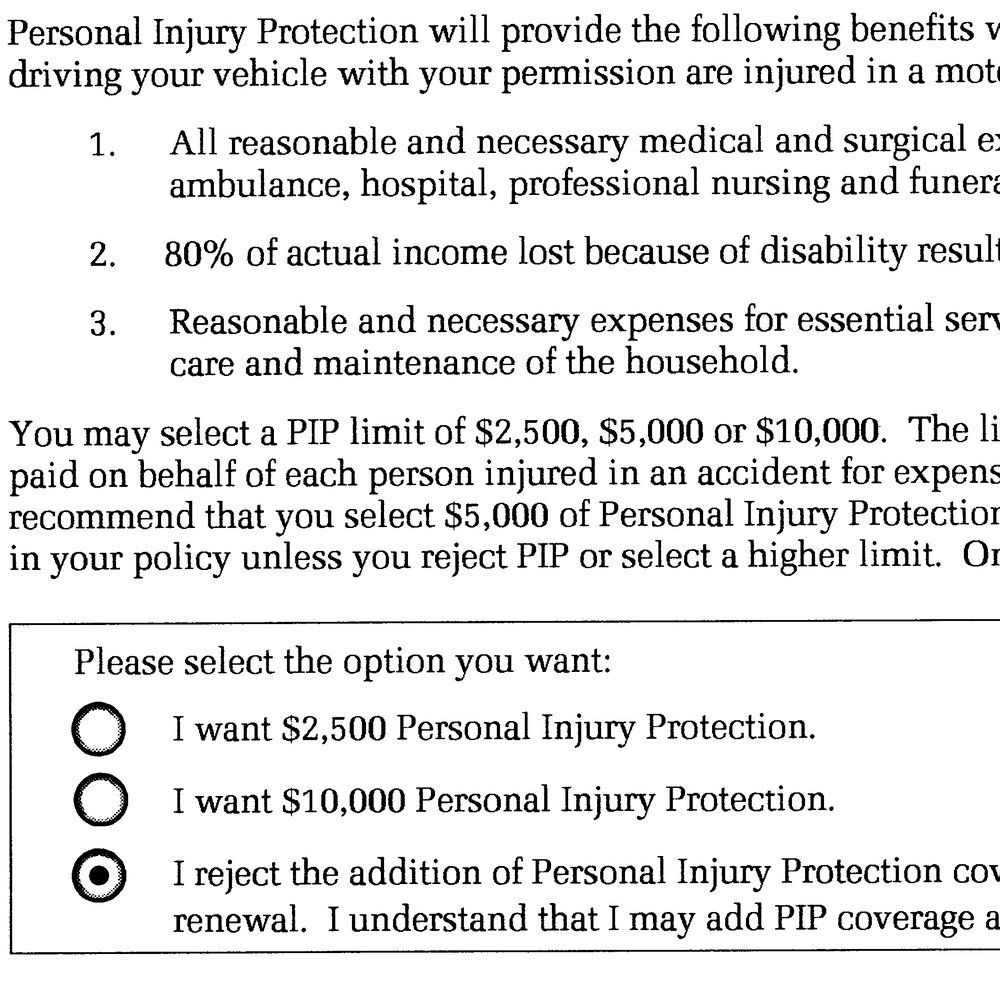

The amount of PIP coverage you should get in Texas depends on your personal needs and budget. The minimum PIP coverage limit in Texas is $2,500. However, you can choose to have a higher coverage limit if you want more protection.

If you have health insurance, you may not need a high PIP coverage limit. However, if you do not have health insurance or have a high deductible, you may want to consider having a higher PIP coverage limit.

Can I waive PIP coverage in Texas?

Yes, you can waive PIP coverage in Texas. If you choose to waive PIP coverage, you will need to sign a waiver stating that you do not want PIP coverage. However, it is important to note that if you waive PIP coverage, you will not be covered for medical expenses or related expenses if you are involved in a car accident.

Is Personal Injury Protection (PIP) Mandatory in Texas? | Be

In conclusion, personal injury protection (PIP) is not required in the state of Texas, but it can be a valuable resource for those who are involved in an accident. PIP can help cover medical expenses and lost wages, regardless of who was at fault for the accident. It can also provide coverage for passengers in your vehicle.

While PIP is not mandatory in Texas, it is important to consider the potential benefits it can provide. Accidents can happen at any time, and the financial aftermath can be overwhelming. Having PIP coverage can help ease the burden and provide peace of mind in the event of an accident.

Ultimately, the decision to purchase PIP coverage is up to the individual. It is important to carefully consider your personal needs and circumstances when deciding whether or not to obtain this coverage. However, it is always wise to be prepared for the unexpected and have a plan in place for unforeseen accidents.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts