Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

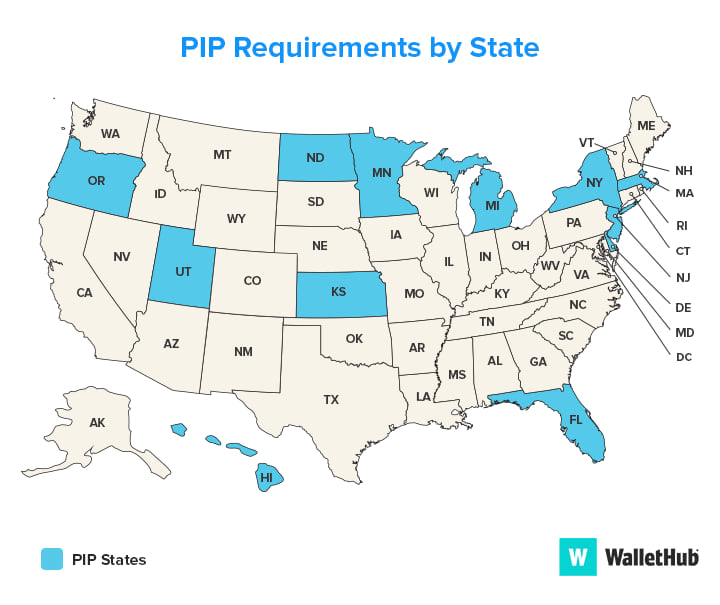

Montana roads can be dangerous, which is why it’s important to have proper auto insurance coverage. But what exactly is required in Montana? Many drivers wonder whether they need Personal Injury Protection (PIP) as part of their policy. In this article, we’ll dive into the details of PIP and whether it’s a requirement for Montana drivers.

Personal Injury Protection is not required in Montana. However, it is an optional coverage that you can add to your car insurance policy. This coverage can help pay for medical expenses, lost wages, and other related expenses if you or your passengers are injured in a car accident. It is important to note that Montana is an at-fault state, which means that the driver who caused the accident is responsible for paying for damages and injuries.

Is Personal Injury Protection Required in Montana?

If you are a resident of Montana or planning to move to the state, you may be wondering whether personal injury protection (PIP) is required. PIP is a type of auto insurance that covers medical expenses and lost wages for you and your passengers after a car accident, regardless of who was at fault. In this article, we will explore whether PIP is mandatory in Montana and what you need to know about this type of insurance.

What is Personal Injury Protection?

Personal injury protection is a type of auto insurance that provides coverage for medical expenses, lost wages, and other related expenses after a car accident. PIP is often referred to as no-fault insurance because it pays out regardless of who was at fault for the accident. This can be beneficial for drivers because it can help cover expenses that may not be covered by traditional liability insurance.

Benefits of PIP

PIP can provide several benefits for drivers in Montana. First, it can help cover medical expenses and lost wages for you and your passengers after a car accident. This can be especially important if you do not have health insurance or disability insurance. PIP can also provide coverage for other related expenses, such as rehabilitation and funeral expenses.

Another benefit of PIP is that it is no-fault insurance. This means that you can receive benefits regardless of who was at fault for the accident. This can be beneficial if you are involved in an accident with an uninsured or underinsured driver.

How is PIP Different from Liability Insurance?

While PIP and liability insurance both provide coverage for car accidents, they are different types of insurance. Liability insurance is mandatory in Montana and provides coverage for damages and injuries that you may cause to others while driving. PIP, on the other hand, provides coverage for your own medical expenses and lost wages after a car accident, regardless of who was at fault.

Benefits of Liability Insurance

Liability insurance is mandatory in Montana and provides several benefits for drivers. First, it can help protect you financially if you are involved in an accident and found to be at fault. Liability insurance can help cover damages and injuries to other drivers, passengers, and pedestrians. It can also provide coverage for legal fees and court costs if you are sued after an accident.

Another benefit of liability insurance is that it can help protect your assets. If you are found to be at fault for an accident and do not have enough insurance coverage to pay for damages and injuries, you may be held personally responsible. Liability insurance can help protect your savings, home, and other assets from being seized to pay for damages.

Is PIP Required in Montana?

Unlike some states, Montana does not require drivers to carry PIP insurance. However, drivers can choose to purchase PIP coverage as part of their auto insurance policy. PIP can be a valuable type of insurance to have, especially if you do not have health insurance or disability insurance. It can also provide additional coverage in case of an accident with an uninsured or underinsured driver.

How Much PIP Coverage Should You Have?

If you choose to purchase PIP coverage in Montana, you will need to decide how much coverage to have. The minimum amount of PIP coverage you can purchase in Montana is $2,500, but you can choose to purchase more if you wish. When deciding how much coverage to have, it is important to consider your individual needs and budget.

Benefits of More Coverage

While the minimum amount of PIP coverage may be enough for some drivers, others may benefit from purchasing more coverage. More coverage can provide additional protection in case of a serious accident that results in extensive medical bills and lost wages. It can also provide coverage for other related expenses, such as rehabilitation and funeral expenses.

Cost of PIP Coverage

The cost of PIP coverage in Montana can vary depending on several factors, including your age, driving record, and the amount of coverage you choose. However, PIP coverage is generally affordable and can provide valuable protection in case of an accident.

Conclusion

While personal injury protection is not required in Montana, it can be a valuable type of insurance to have. PIP can provide coverage for medical expenses, lost wages, and other related expenses after a car accident, regardless of who was at fault. If you are interested in purchasing PIP coverage, be sure to speak with your insurance agent to discuss your options and determine how much coverage you need.

Frequently Asked Questions

What is Personal Injury Protection (PIP)?

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses, lost wages, and other related expenses in case of a car accident, regardless of who is at fault. PIP insurance is also known as “no-fault” insurance because it pays out regardless of who caused the accident.

What does PIP insurance cover in Montana?

In Montana, PIP insurance covers medical expenses, lost wages, and other related expenses up to a certain amount, which is determined by your insurance policy. PIP insurance also covers funeral expenses and survivor benefits in case of a fatal car accident.

Is PIP insurance required in Montana?

No, PIP insurance is not required in Montana. However, insurance companies are required to offer PIP coverage to their customers. If you choose to purchase PIP insurance, you must have at least $20,000 in coverage for medical expenses and $10,000 for lost wages.

What are the benefits of having PIP insurance in Montana?

The benefits of having PIP insurance in Montana include being able to receive immediate medical treatment without worrying about who is at fault for the accident. PIP insurance also covers lost wages, so you can continue to pay your bills while you recover from your injuries. Additionally, PIP insurance provides peace of mind knowing that you are covered in case of an accident.

Can I still sue the at-fault driver if I have PIP insurance in Montana?

Yes, you can still sue the at-fault driver even if you have PIP insurance in Montana. However, if you choose to sue, you may have to reimburse your insurance company for any benefits you received under your PIP coverage. It is important to talk to a personal injury lawyer to determine the best course of action for your specific case.

What is Personal Injury Protection (PIP)?

In conclusion, while Personal Injury Protection (PIP) is not mandatory in Montana, it is still highly recommended. PIP can provide coverage for medical expenses, lost wages, and other related expenses in the event of an accident. Without PIP, you may be responsible for paying these costs out of pocket, which can be financially devastating.

Additionally, PIP can provide peace of mind knowing that you and your passengers are covered in the event of an accident, regardless of who is at fault. This type of coverage can help relieve the stress and financial burden that can come with unexpected medical bills and other expenses.

Ultimately, while the decision to purchase PIP is up to the individual, it is important to consider the potential risks and benefits. By investing in PIP, you can protect yourself, your passengers, and your finances in the event of an accident.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts