Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

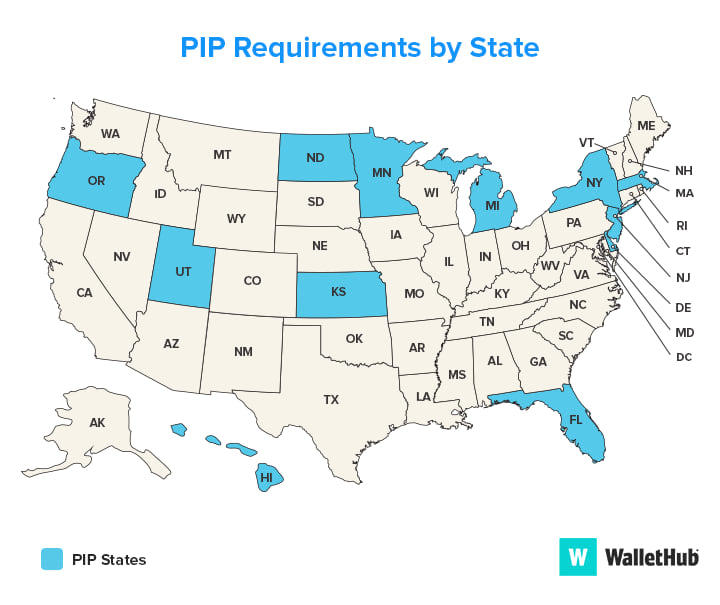

Personal injury protection (PIP) is an important aspect of auto insurance that provides coverage for medical expenses and lost wages in the event of an accident. However, the requirements for PIP coverage vary by state. If you’re a driver in West Virginia, you may be wondering whether PIP coverage is mandatory or optional. In this article, we’ll explore the details of West Virginia’s PIP requirements and what it means for drivers in the state.

Yes, Personal Injury Protection (PIP) is required in West Virginia. The minimum coverage required is $25,000 for bodily injury per person, per accident, and $50,000 for all persons per accident. PIP coverage helps pay for medical expenses, lost wages, and other expenses related to injuries sustained in a car accident, regardless of who is at fault.

Is Personal Injury Protection Required in West Virginia?

What is Personal Injury Protection?

Personal Injury Protection, or PIP, is a type of car insurance coverage that pays for medical expenses, lost wages, and other related expenses if you or your passengers are injured in a car accident. PIP is optional in most states, but some states require it.

Is PIP Required in West Virginia?

Yes, Personal Injury Protection is required in West Virginia. The state law requires all drivers to have PIP coverage as a part of their car insurance policy. The minimum coverage amount for PIP in West Virginia is $25,000 per person, per accident.

Benefits of Having PIP in West Virginia

Having PIP coverage in West Virginia can provide several benefits. Firstly, if you or your passengers are injured in a car accident, your PIP coverage will pay for medical expenses, regardless of who was at fault for the accident. This can help you avoid costly medical bills and ensure that you receive the necessary medical treatment.

Secondly, PIP coverage can also provide lost wages if you are unable to work due to your injuries. This can help you maintain your financial stability while you recover from your injuries.

Lastly, PIP coverage in West Virginia can also provide coverage for essential services, such as childcare and household chores, that you may not be able to perform due to your injuries.

PIP vs. Other Insurance Coverage

PIP coverage is often compared to other types of insurance coverage, such as liability and medical payments coverage. While liability coverage pays for damages and injuries that you are responsible for, and medical payments coverage pays for medical expenses regardless of fault, PIP coverage provides a more comprehensive coverage option.

Unlike liability coverage, PIP coverage pays for your medical expenses and lost wages regardless of who was at fault for the accident. Additionally, unlike medical payments coverage, PIP coverage can also provide coverage for essential services that you may not be able to perform due to your injuries.

Conclusion

In conclusion, if you are a driver in West Virginia, it is important to understand the state’s requirements for car insurance coverage. Personal Injury Protection, or PIP, is required in West Virginia and can provide several benefits if you are injured in a car accident. Be sure to review your car insurance policy to ensure that you have the necessary coverage in case of an accident.

Contents

Frequently Asked Questions

What is Personal Injury Protection (PIP)?

Personal Injury Protection (PIP) is a type of car insurance coverage that pays for medical expenses, lost wages, and other related expenses if you or your passengers are injured in a car accident, regardless of who is at fault.

PIP coverage can also provide benefits if you are hit by a car while walking or biking. It is sometimes referred to as no-fault insurance because it pays out regardless of who caused the accident.

Is PIP coverage required in West Virginia?

No, Personal Injury Protection (PIP) coverage is not required in West Virginia. However, it is an optional coverage that you can choose to add to your car insurance policy.

If you decide to purchase PIP coverage, you can choose the amount of coverage you want, up to the limits of your policy. Keep in mind that adding PIP coverage will increase your insurance premiums.

What are the benefits of having PIP coverage?

There are several benefits to having Personal Injury Protection (PIP) coverage. First and foremost, it provides additional financial protection if you or your passengers are injured in a car accident. This can help cover medical expenses, lost wages, and other related expenses.

Another benefit of PIP coverage is that it is no-fault insurance. This means that you can receive benefits regardless of who caused the accident. This can be particularly helpful if the other driver is uninsured or underinsured.

What is the difference between PIP and medical payments coverage?

Personal Injury Protection (PIP) and medical payments coverage are both types of car insurance coverage that provide benefits for medical expenses. However, there are some key differences between the two.

PIP coverage typically provides broader coverage than medical payments coverage. For example, PIP coverage can also provide benefits for lost wages and other related expenses, while medical payments coverage only covers medical expenses.

Additionally, PIP coverage is no-fault insurance, while medical payments coverage is not. This means that you can receive benefits from PIP coverage regardless of who caused the accident, while medical payments coverage only pays out if the other driver is at fault.

Do I need PIP coverage if I already have health insurance?

Having health insurance can certainly help cover medical expenses in the event of a car accident. However, Personal Injury Protection (PIP) coverage can provide additional benefits that health insurance may not cover, such as lost wages and other related expenses.

In addition, PIP coverage is no-fault insurance, which means that you can receive benefits regardless of who caused the accident. This can be particularly helpful if the other driver is uninsured or underinsured.

Ultimately, whether or not you need PIP coverage will depend on your individual circumstances and the level of financial protection you want in the event of a car accident.

What is Personal Injury Protection (PIP)?

In conclusion, if you are a resident of West Virginia, it is important to know the state’s laws regarding personal injury protection. While it is not required by law, it is highly recommended as it provides coverage for medical expenses and lost wages in the event of an accident.

Moreover, having personal injury protection can give you peace of mind knowing that you are covered in case of an unexpected accident. With the increasing number of accidents on the road, having this protection can be a lifesaver for you and your loved ones.

Therefore, it is advisable to consult with your insurance provider to determine the best coverage options for you. By doing so, you can ensure that you have the necessary coverage to protect yourself and your family in case of an accident.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts