Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

In the United States, each state has its own set of car insurance requirements. New Hampshire is one of the few states that do not require drivers to have personal injury protection (PIP) coverage. However, it is important to understand what PIP covers and the potential consequences of not having it.

While New Hampshire does not require PIP coverage, it is still highly recommended that drivers consider adding it to their car insurance policy. This type of coverage can provide valuable financial assistance to individuals who are injured in a car accident, regardless of who is at fault. Without PIP, drivers and passengers in an accident may be left with significant medical bills and other expenses.

Personal Injury Protection (PIP) is not required in New Hampshire. However, drivers can choose to purchase PIP coverage as part of their auto insurance policy. PIP coverage provides medical expenses and lost wages coverage for the driver and passengers involved in an accident, regardless of who is at fault. It is important to note that New Hampshire is a fault-based state, which means that the at-fault driver is responsible for paying for damages and injuries caused in an accident.

Is Personal Injury Protection Required in New Hampshire?

Overview of Personal Injury Protection (PIP) in New Hampshire

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses and lost wages for drivers and passengers who are injured in a car accident. PIP is mandatory in some states, but not in others. So, is PIP required in New Hampshire?

The short answer is no. New Hampshire is one of the few states that does not require drivers to carry PIP insurance. However, just because it’s not required doesn’t mean it’s not a good idea. In fact, PIP can be a valuable addition to your car insurance policy, especially if you don’t have health insurance.

Benefits of Personal Injury Protection

If you’re injured in a car accident, even a minor one, medical bills can quickly add up. PIP can help cover those costs, as well as lost wages if you’re unable to work due to your injuries. PIP can also cover expenses like childcare or household help if you’re unable to take care of those responsibilities due to your injuries.

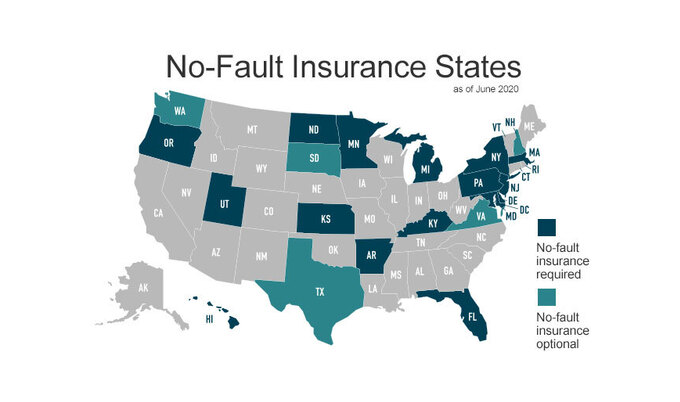

Another benefit of PIP is that it is no-fault insurance. This means that regardless of who was at fault for the accident, your medical expenses and lost wages will be covered up to the limit of your policy. This can be particularly helpful if you’re in an accident with an uninsured driver.

How PIP Compares to Other Types of Car Insurance

While PIP is not required in New Hampshire, there are other types of car insurance that are mandatory. Liability insurance, for example, is required in all states. Liability insurance covers damages to other people’s property and injuries to other people if you’re at fault for an accident.

Collision insurance is another type of car insurance that is not required, but may be a good idea if you have a newer car. Collision insurance covers damages to your own vehicle if you’re in an accident, regardless of who was at fault.

Comprehensive insurance is yet another type of car insurance that is not required, but can provide valuable coverage. Comprehensive insurance covers damages to your vehicle that are not caused by a collision, such as theft, vandalism, or natural disasters.

Conclusion: Do You Need PIP in New Hampshire?

While PIP is not required in New Hampshire, it can provide valuable coverage if you’re in a car accident. If you don’t have health insurance or disability insurance, PIP can help cover medical expenses and lost wages. Additionally, because PIP is no-fault insurance, it can provide peace of mind knowing that your expenses will be covered regardless of who was at fault for the accident.

Ultimately, the decision to purchase PIP insurance is up to you. Consider your own financial situation, as well as the risks associated with driving in New Hampshire, and decide if PIP is right for you.

Frequently Asked Questions

Here are some common questions regarding personal injury protection in New Hampshire:

What is Personal Injury Protection (PIP)?

Personal Injury Protection, or PIP, is a type of car insurance that covers medical expenses, lost wages, and other related expenses if you are injured in a car accident. It is also known as “no-fault” insurance, as it covers you regardless of who is at fault for the accident.

In New Hampshire, PIP coverage is not required by law, but it is an optional coverage that you can add to your car insurance policy.

What Does PIP Cover?

PIP coverage typically includes medical expenses, lost wages, and other related expenses such as transportation costs and household services. Medical expenses can include hospital bills, doctor visits, and rehabilitation costs. Lost wages can include your income and any future earnings you may have lost as a result of the accident. Transportation costs can include ambulance fees and transportation to and from medical appointments. Household services can include things like childcare and housekeeping if you are unable to perform these tasks as a result of your injuries.

It is important to note that PIP coverage varies by insurance company and policy, so it is important to read your policy carefully to understand what is covered.

Do I Need PIP Coverage in New Hampshire?

No, PIP coverage is not required by law in New Hampshire. However, it is an optional coverage that you can add to your car insurance policy. If you are concerned about covering medical expenses and lost wages in the event of a car accident, PIP coverage may be a good option for you.

It is important to note that if you choose not to purchase PIP coverage, you may be responsible for paying for medical expenses and lost wages out of pocket if you are injured in a car accident.

How Much PIP Coverage Should I Get?

The amount of PIP coverage you should get depends on your individual needs and budget. In New Hampshire, insurance companies typically offer PIP coverage in amounts ranging from $1,000 to $10,000. Some insurance companies may offer higher limits of coverage, but these may come with higher premiums.

When deciding how much PIP coverage to get, consider your potential medical expenses and lost wages, as well as any other related expenses, such as transportation and household services. It may also be helpful to talk to your insurance agent to understand your options and get a quote.

How Much Does PIP Coverage Cost?

The cost of PIP coverage varies by insurance company and policy. In New Hampshire, insurance companies typically offer PIP coverage in amounts ranging from $1,000 to $10,000, with higher limits of coverage available for higher premiums.

When considering PIP coverage, it is important to compare quotes from multiple insurance companies to find the coverage that best meets your needs and budget.

What is Personal Injury Protection (PIP)?

In conclusion, while Personal Injury Protection (PIP) is not legally required in New Hampshire, it is highly recommended for all drivers. PIP coverage can provide valuable financial support in the event of an accident, covering medical expenses, lost wages, and more. Without PIP, drivers may be left with hefty bills and financial strain.

It’s important to consider the potential risks and benefits of opting in or out of PIP coverage. While it does come with an added cost, the peace of mind and protection it provides can be invaluable. Ultimately, the decision to purchase PIP coverage should be carefully weighed against personal circumstances and priorities.

Regardless of whether or not PIP coverage is required in New Hampshire, all drivers should prioritize safe driving practices and responsible behavior on the road. By staying alert, avoiding distractions, and following traffic laws, we can help prevent accidents and keep our communities safer and healthier.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts