Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

North Dakota is known for its harsh winters and dangerous driving conditions. It’s no wonder that residents of the state are concerned about their safety on the roads. One question that often comes up is whether or not personal injury protection (PIP) is required in North Dakota.

In this article, we’ll explore the ins and outs of PIP insurance and whether or not it’s mandatory in North Dakota. We’ll also take a look at the benefits of having PIP coverage and what it can do for you in the event of an accident. So, if you’re a North Dakota resident or just curious about PIP insurance, keep reading!

Yes, Personal Injury Protection (PIP) is mandatory in North Dakota. It is required to have a minimum of $30,000 in PIP coverage per person per accident. PIP coverage provides medical expenses, lost wages, and other related expenses regardless of who is at fault in the accident. Failure to have PIP coverage may result in fines and penalties.

Contents

- Understanding Personal Injury Protection (PIP) in North Dakota

- What is Personal Injury Protection (PIP)?

- Is Personal Injury Protection Required in North Dakota?

- What does PIP Cover in North Dakota?

- What are the Benefits of PIP in North Dakota?

- What are the Drawbacks of PIP in North Dakota?

- PIP vs. Medical Payments Coverage (MedPay)

- PIP vs. Bodily Injury Liability (BIL)

- How to Choose the Right PIP Coverage in North Dakota?

- Conclusion

- Frequently Asked Questions

- What is Personal Injury Protection (PIP)?

- What does Personal Injury Protection cover?

- Is Personal Injury Protection required in North Dakota?

- What happens if I don’t have Personal Injury Protection in North Dakota?

- Can I waive Personal Injury Protection in North Dakota?

- What is Personal Injury Protection (PIP)?

Understanding Personal Injury Protection (PIP) in North Dakota

What is Personal Injury Protection (PIP)?

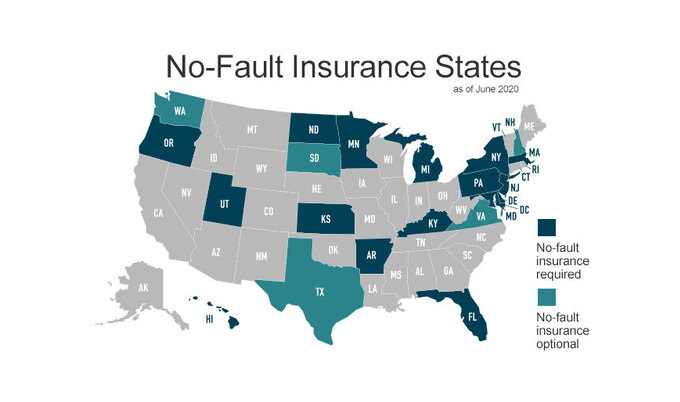

Personal Injury Protection (PIP) is a type of car insurance that covers medical expenses, lost wages, and other related expenses in case of an accident. It is mandatory in some states, including North Dakota. PIP provides coverage regardless of who is at fault in the accident. In North Dakota, PIP is a “no-fault” insurance, which means that even if you are at fault in the accident, you can still receive benefits from your PIP policy.

Is Personal Injury Protection Required in North Dakota?

Yes, Personal Injury Protection (PIP) is required in North Dakota. The minimum coverage required by law is $30,000 per person per accident for medical expenses, $30,000 per person per accident for lost wages, and $25,000 per person per accident for other related expenses.

What does PIP Cover in North Dakota?

Personal Injury Protection (PIP) in North Dakota covers medical expenses, lost wages, and other related expenses in case of an accident. Medical expenses include hospitalization, doctor visits, surgery, and other medical treatments. Lost wages include the income that you would have earned if you had not been injured in the accident. Other related expenses include transportation costs, household services, and funeral expenses.

What are the Benefits of PIP in North Dakota?

There are several benefits of having Personal Injury Protection (PIP) in North Dakota. First, PIP provides coverage regardless of who is at fault in the accident. This means that even if you are at fault in the accident, you can still receive benefits from your PIP policy. Second, PIP covers medical expenses, lost wages, and other related expenses in case of an accident. This can help you avoid financial hardship and focus on your recovery. Third, PIP is a “no-fault” insurance, which means that you do not have to prove fault in order to receive benefits.

What are the Drawbacks of PIP in North Dakota?

There are some drawbacks of having Personal Injury Protection (PIP) in North Dakota. First, PIP is mandatory, which means that you have to pay for it even if you do not want to. Second, PIP only covers a limited amount of medical expenses, lost wages, and other related expenses. If your expenses exceed the coverage limit, you may have to pay out of pocket. Third, PIP does not cover property damage or liability, which means that you may need additional insurance to fully protect yourself in case of an accident.

PIP vs. Medical Payments Coverage (MedPay)

Medical Payments Coverage (MedPay) is similar to Personal Injury Protection (PIP) in that it covers medical expenses in case of an accident. However, unlike PIP, MedPay is not mandatory in North Dakota. MedPay only covers medical expenses, while PIP covers medical expenses, lost wages, and other related expenses. PIP also provides coverage regardless of who is at fault in the accident, while MedPay may require fault to be established before benefits can be paid.

PIP vs. Bodily Injury Liability (BIL)

Bodily Injury Liability (BIL) is a type of car insurance that covers the cost of injuries that you cause to other people in an accident. Unlike Personal Injury Protection (PIP), BIL is not mandatory in North Dakota. PIP provides coverage regardless of who is at fault in the accident, while BIL only covers injuries that you cause to other people. BIL does not cover your own medical expenses, lost wages, or other related expenses.

How to Choose the Right PIP Coverage in North Dakota?

When choosing Personal Injury Protection (PIP) coverage in North Dakota, you should consider the minimum coverage required by law, your budget, and your personal needs. You may want to consider purchasing additional coverage if you have a high risk of accidents or if you want to have more protection. You should also compare quotes from different insurance companies to find the best coverage at the best price.

Conclusion

Personal Injury Protection (PIP) is mandatory in North Dakota and provides coverage for medical expenses, lost wages, and other related expenses in case of an accident. PIP is a “no-fault” insurance, which means that even if you are at fault in the accident, you can still receive benefits from your PIP policy. When choosing PIP coverage, you should consider the minimum coverage required by law, your budget, and your personal needs. You may also want to consider purchasing additional coverage for more protection.

Frequently Asked Questions

What is Personal Injury Protection (PIP)?

Personal Injury Protection (PIP) is a type of insurance coverage that pays for medical expenses, lost wages, and other expenses related to a car accident. PIP coverage is often referred to as “no-fault” coverage because it pays out regardless of who was at fault for the accident.

What does Personal Injury Protection cover?

Personal Injury Protection (PIP) covers a variety of expenses related to a car accident, including medical expenses, lost wages, and other expenses like childcare or household help. PIP coverage can also cover expenses like funeral costs and rehabilitation expenses.

Is Personal Injury Protection required in North Dakota?

Yes, Personal Injury Protection (PIP) is required in North Dakota. Drivers in North Dakota must carry a minimum of $30,000 in PIP coverage per person, per accident, and $25,000 in property damage liability coverage.

What happens if I don’t have Personal Injury Protection in North Dakota?

If you do not have Personal Injury Protection (PIP) coverage in North Dakota, you may be subject to fines and penalties. Additionally, if you are involved in a car accident, you may be responsible for paying for your own medical expenses, lost wages, and other expenses related to the accident.

Can I waive Personal Injury Protection in North Dakota?

No, you cannot waive Personal Injury Protection (PIP) coverage in North Dakota. PIP coverage is required by law in North Dakota, and drivers must carry a minimum of $30,000 in PIP coverage per person, per accident, and $25,000 in property damage liability coverage.

What is Personal Injury Protection (PIP)?

In conclusion, personal injury protection is a mandatory requirement in North Dakota. It is intended to provide financial support and medical coverage to individuals who have been injured in a car accident regardless of who is at fault. The state believes that PIP coverage is an essential part of every driver’s insurance policy and is committed to protecting its citizens. So, if you live in North Dakota, make sure you have PIP coverage to ensure that you are protected from any unforeseen circumstances that may arise. Stay safe and drive responsibly!

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts