Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

Personal injury protection (PIP) is a type of auto insurance designed to cover medical expenses and lost wages in the event of an accident. While PIP is mandatory in some states, it’s optional in others. If you live in a state where PIP is not required, you may be wondering if it’s worth the extra expense. In this article, we’ll discuss the benefits and drawbacks of PIP and help you decide if it’s the right choice for you. So, let’s dive in and explore if additional personal injury protection is necessary for you.

Additional Personal Injury Protection is optional and depends on your circumstances. If you have comprehensive health insurance, disability insurance, and a good life insurance policy, you may not need it. However, if you frequently drive in high-risk areas or have a high-risk job, additional coverage may provide extra protection. It’s important to weigh the cost of the coverage against the potential benefits and consult with a licensed insurance agent to determine if it’s necessary for you.

Contents

- Do I Need Additional Personal Injury Protection?

- Frequently Asked Questions

- What is Personal Injury Protection (PIP)?

- What does my current auto insurance policy cover?

- Do I need additional Personal Injury Protection?

- What are the benefits of having additional Personal Injury Protection?

- How much does additional Personal Injury Protection cost?

- Do I Need Personal Injury Protection (PIP) If I Have Health Insurance?

Do I Need Additional Personal Injury Protection?

If you are considering purchasing personal injury protection (PIP) insurance, you may be wondering if you really need it. After all, you probably already have health insurance and car insurance, so why would you need another type of insurance to cover injuries sustained in a car accident? In this article, we will explore the benefits of PIP insurance and help you decide if it is right for you.

What is Personal Injury Protection Insurance?

Personal injury protection insurance, or PIP insurance, is a type of car insurance that covers medical expenses and lost wages in the event of a car accident. Unlike traditional car insurance, PIP insurance is designed to cover injuries sustained by the driver and passengers in the insured vehicle, regardless of who is at fault for the accident.

PIP insurance typically covers a range of expenses, including medical bills, lost wages, and the cost of hiring someone to perform household tasks while you recover from your injuries. Some policies may also cover things like funeral expenses and rehabilitation costs.

Benefits of Personal Injury Protection Insurance

There are several benefits to purchasing PIP insurance. First and foremost, it provides an extra layer of protection in the event of a car accident. Even if you have health insurance and car insurance, PIP insurance can help cover expenses that fall outside of those policies.

Another benefit of PIP insurance is that it is no-fault insurance. This means that regardless of who is at fault for the accident, your PIP insurance will cover your medical expenses and lost wages. This can be especially helpful if you live in a no-fault state, where drivers are required to carry PIP insurance.

Drawbacks of Personal Injury Protection Insurance

While there are many benefits to purchasing PIP insurance, there are also some drawbacks to consider. One of the biggest drawbacks is the cost. PIP insurance can be expensive, especially if you live in a state where it is mandatory.

Additionally, PIP insurance may duplicate coverage you already have. For example, if you have excellent health insurance that covers medical expenses, you may not need PIP insurance. It is important to carefully review your current insurance policies before purchasing PIP insurance to ensure that you are not paying for duplicate coverage.

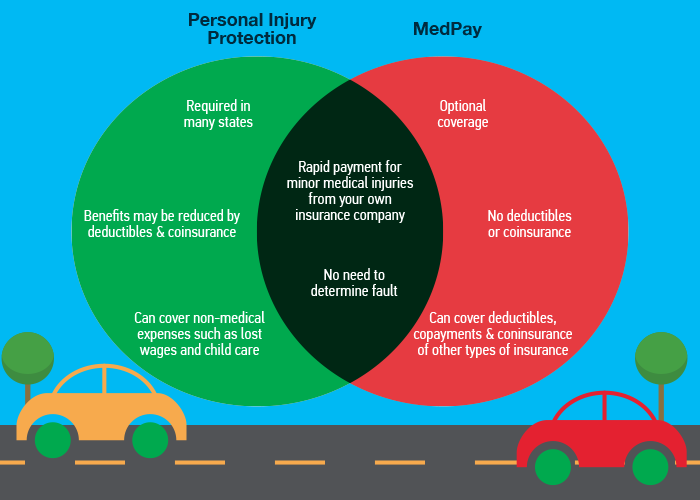

PIP Insurance vs. Medical Payments Coverage

Another type of insurance that may be available to you is medical payments coverage (MedPay). Like PIP insurance, MedPay covers medical expenses in the event of a car accident. However, MedPay only covers medical expenses, while PIP insurance covers a range of expenses, including lost wages and household services.

Additionally, MedPay is not available in all states, while PIP insurance is mandatory in some states. If you live in a state where both types of insurance are available, it is important to carefully compare the coverage and costs of each policy to determine which one is right for you.

Conclusion

Personal injury protection insurance can provide valuable coverage in the event of a car accident. However, it is important to carefully consider your current insurance policies before purchasing PIP insurance to ensure that you are not paying for duplicate coverage. Additionally, be sure to compare the costs and coverage of PIP insurance and MedPay to determine which policy is right for you.

Frequently Asked Questions

What is Personal Injury Protection (PIP)?

Personal Injury Protection (PIP) is an insurance coverage that pays for medical expenses and lost wages in the event of an accident. PIP is mandatory in some states and optional in others. It is designed to cover medical expenses regardless of who is at fault for an accident.

PIP can also cover other expenses related to an accident, such as rehabilitation services and funeral expenses. Some policies may also include coverage for lost wages and other non-medical expenses.

What does my current auto insurance policy cover?

Your current auto insurance policy may already include Personal Injury Protection (PIP) coverage. Check your policy or contact your insurance provider to find out what your current coverage includes.

If you do not have PIP coverage, you may want to consider adding it to your policy. PIP coverage can provide additional protection in the event of an accident.

Do I need additional Personal Injury Protection?

The need for additional Personal Injury Protection (PIP) coverage depends on your individual circumstances. If you have a good health insurance policy that covers accidents, you may not need additional PIP coverage.

However, if you do not have health insurance or your health insurance has high deductibles or co-payments, you may want to consider adding PIP coverage to your auto insurance policy.

What are the benefits of having additional Personal Injury Protection?

The benefits of having additional Personal Injury Protection (PIP) coverage include additional coverage for medical expenses and lost wages in the event of an accident. PIP coverage can also cover other expenses related to an accident, such as rehabilitation services and funeral expenses.

Having additional PIP coverage can provide peace of mind knowing that you have additional protection in the event of an accident.

How much does additional Personal Injury Protection cost?

The cost of additional Personal Injury Protection (PIP) coverage varies depending on the insurance provider and the amount of coverage you choose. It is important to shop around and compare quotes from different insurance providers to find the best coverage at the best price.

The cost of additional PIP coverage may be worth the peace of mind knowing that you have additional protection in the event of an accident.

Do I Need Personal Injury Protection (PIP) If I Have Health Insurance?

In conclusion, determining whether you need additional personal injury protection depends on a variety of factors. It’s important to assess your current coverage, evaluate your risk factors, and consider your personal financial situation. While personal injury protection can offer added peace of mind, it may not be necessary for everyone.

Ultimately, the decision to purchase additional personal injury protection is a personal one that should be made after careful consideration. If you’re unsure about whether you need additional coverage, it may be helpful to speak with a licensed insurance agent who can provide guidance and answer any questions you may have.

Remember, accidents can happen at any time and having adequate insurance coverage is essential for protecting yourself and your loved ones. By taking the time to evaluate your insurance needs, you can make an informed decision about whether additional personal injury protection is right for you.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts