Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

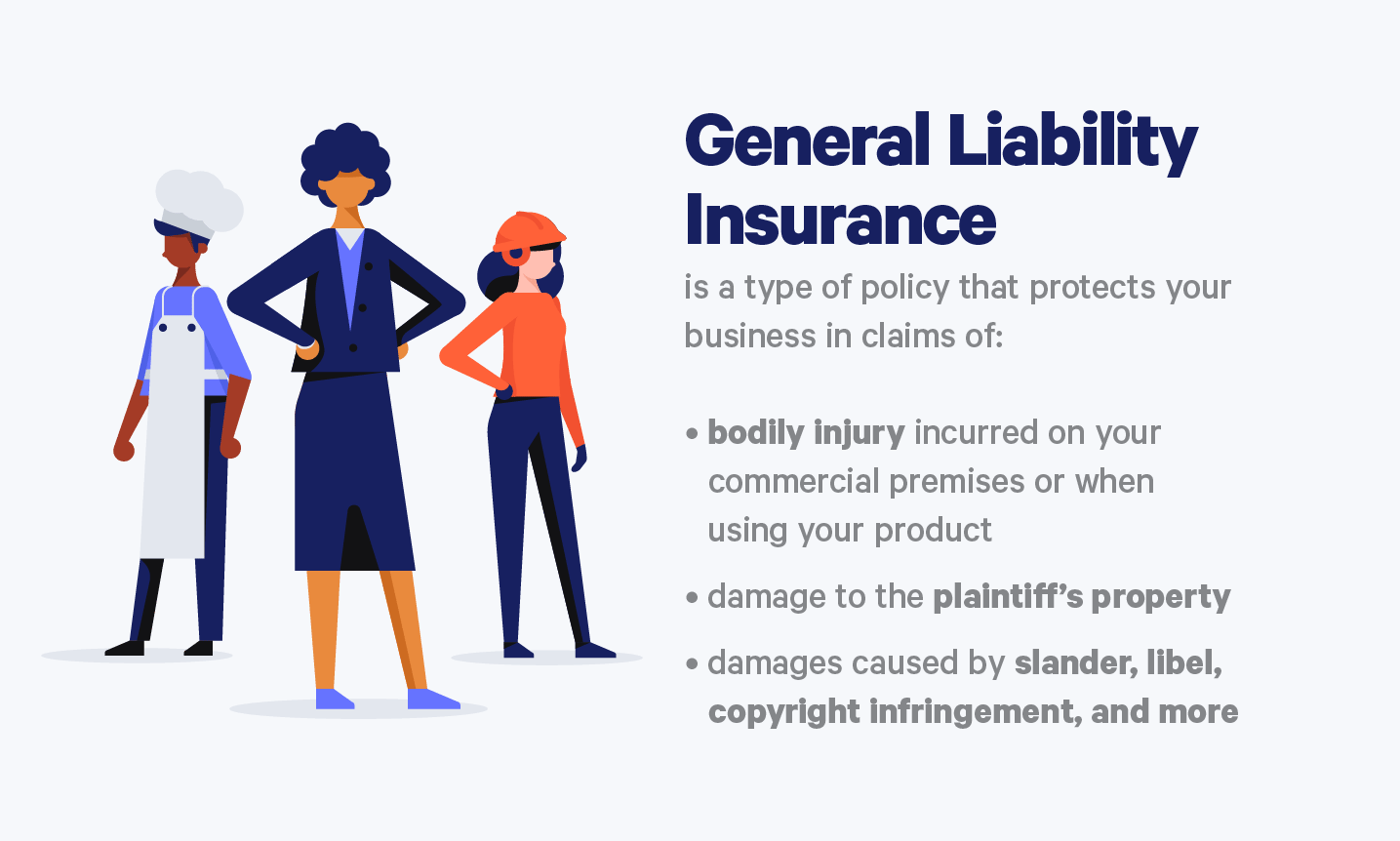

General liability insurance is a crucial investment for businesses, protecting them from unexpected lawsuits and claims. However, many business owners may wonder if their general liability insurance covers personal injury claims. Personal injury claims can be costly and time-consuming, making it vital for businesses to understand their liability coverage. In this article, we will explore whether general liability insurance covers personal injury claims and what type of personal injuries are covered under this policy.

General Liability Insurance typically covers personal injury claims that occur on the insured’s property or as a result of the insured’s actions. This can include slip and fall accidents, bodily injury, and property damage caused by the insured’s negligence. However, it may not cover all types of personal injury claims, such as intentional acts or professional negligence. It’s important to read your policy carefully and speak with your insurance provider to fully understand your coverage.

Does General Liability Insurance Cover Personal Injury?

As a business owner, you have a lot of responsibilities, and one of them is to ensure that your business is protected from any potential risks. One of the most common risks that businesses face is the possibility of a customer or client being injured on their property. This is where general liability insurance comes in. But the question is, does general liability insurance cover personal injury? Let’s find out.

Understanding General Liability Insurance

General liability insurance is a type of insurance that provides financial protection to businesses in case they are sued for damages due to negligence. This type of insurance covers a wide range of risks, including property damage, bodily injury, and advertising injury. It is designed to protect businesses from financial losses associated with lawsuits, settlements, and judgments.

In most cases, general liability insurance covers bodily injury and property damage caused by the business or its employees. This means that if a customer or client is injured on your business premises, general liability insurance will cover the medical expenses, lost wages, and other damages resulting from the injury.

However, it is important to note that there are some limitations to general liability insurance. For example, it does not cover intentional acts, such as assault or battery. It also does not cover damages resulting from professional services, which are covered by professional liability insurance.

Personal Injury and General Liability Insurance

Personal injury is a legal term that refers to a type of injury that affects a person’s body, mind, or emotions, as opposed to their property. Examples of personal injury include slip and fall accidents, dog bites, and defamation.

In general, general liability insurance covers personal injury claims that are related to bodily injury. This means that if a customer or client is injured on your business premises due to your negligence, general liability insurance will cover the medical expenses, lost wages, and other damages resulting from the injury.

However, it is important to note that general liability insurance does not cover all types of personal injury claims. For example, it does not cover claims related to emotional distress or invasion of privacy. It also does not cover claims related to intentional acts, such as assault or battery.

Benefits of General Liability Insurance

General liability insurance provides several benefits to businesses, including:

1. Financial Protection – General liability insurance provides financial protection to businesses in case they are sued for damages due to negligence.

2. Peace of Mind – Knowing that your business is protected from potential risks can give you peace of mind and allow you to focus on growing your business.

3. Professional Image – Having general liability insurance can give your business a more professional image, which can help attract customers and clients.

4. Compliance – In many cases, general liability insurance is required by law or by contract, so having this type of insurance can help you stay compliant.

General Liability Insurance vs. Professional Liability Insurance

While general liability insurance covers bodily injury and property damage caused by the business or its employees, professional liability insurance covers damages resulting from professional services. This means that if a customer or client sues your business for damages resulting from a mistake or error in your professional services, professional liability insurance will cover the damages.

It is important to note that professional liability insurance is not included in general liability insurance. If your business provides professional services, such as legal or accounting services, you will need to purchase professional liability insurance separately.

In conclusion, general liability insurance does cover personal injury claims related to bodily injury caused by the business or its employees. However, it is important to understand the limitations of this type of insurance and to consider additional insurance coverage, such as professional liability insurance, if your business provides professional services.

Contents

- Frequently Asked Questions

- What is Personal Injury Coverage?

- What Types of Personal Injury are Covered by General Liability Insurance?

- What is the Difference Between Personal Injury and Bodily Injury?

- What is the Limits of Liability for Personal Injury Claims?

- Do I Need Personal Injury Coverage if I Have Workers’ Compensation Insurance?

Frequently Asked Questions

As a business owner, you may have questions about the coverage provided by general liability insurance. One of the key areas of concern is personal injury. Here are some common questions and answers regarding this topic.

What is Personal Injury Coverage?

Personal injury coverage is a type of insurance that protects businesses from claims made by individuals who have suffered physical or emotional injuries as a result of negligence or wrongdoing on the part of the business. This type of coverage typically includes medical expenses, lost wages, and pain and suffering. It can also cover legal fees if the injured party decides to sue the business.

However, it’s important to note that not all personal injuries are covered by general liability insurance. For example, injuries that occur during the course of employment are typically covered by workers’ compensation insurance, not general liability.

What Types of Personal Injury are Covered by General Liability Insurance?

General liability insurance typically covers personal injuries that occur on your business premises, such as slip and fall accidents. It may also cover injuries that occur as a result of your products or services. For example, if a customer is injured while using a faulty product you sold, your general liability insurance may cover their medical expenses and any legal fees associated with the claim.

It’s important to note that intentional acts are generally not covered by general liability insurance. If an employee or business owner intentionally causes harm to someone, the policy will not provide coverage.

What is the Difference Between Personal Injury and Bodily Injury?

Personal injury and bodily injury are often used interchangeably, but they are actually two different types of injuries. Bodily injury refers to physical harm caused to a person, such as a broken bone or a concussion. Personal injury, on the other hand, is a broader category that includes bodily injury as well as emotional or mental harm, such as defamation or invasion of privacy.

General liability insurance typically covers both bodily injury and personal injury claims, but it’s important to check your policy to make sure you have adequate coverage.

What is the Limits of Liability for Personal Injury Claims?

The limit of liability for personal injury claims is the maximum amount that your insurance company will pay out for a single claim. This limit is typically stated in your policy and can vary depending on the type of business you operate, the level of risk associated with your industry, and other factors.

It’s important to choose a limit of liability that is appropriate for your business. If you are sued for a personal injury claim and the damages exceed your policy limit, you may be responsible for paying the difference out of pocket.

Do I Need Personal Injury Coverage if I Have Workers’ Compensation Insurance?

Yes, you may still need personal injury coverage even if you have workers’ compensation insurance. Workers’ compensation only covers injuries that occur during the course of employment, whereas personal injury coverage can protect you from claims made by customers, vendors, or other third parties.

It’s important to evaluate your business risks and choose the appropriate coverage to protect your assets and reputation.

In conclusion, general liability insurance is designed to protect businesses against claims of property damage and bodily injury. While it does cover personal injury claims, it is essential to understand the extent of coverage and any exclusions. It is always recommended to review your policy and consult with an insurance professional to ensure that you have adequate coverage for your business needs.

Remember, accidents can happen at any time, and having the right insurance coverage can provide peace of mind and protect your business from financial ruin. So, if you are a business owner or considering starting one, it is crucial to invest in a robust general liability insurance policy that covers personal injury claims. Don’t wait until it’s too late to protect your business and its assets. Get the coverage you need today!

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts