Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

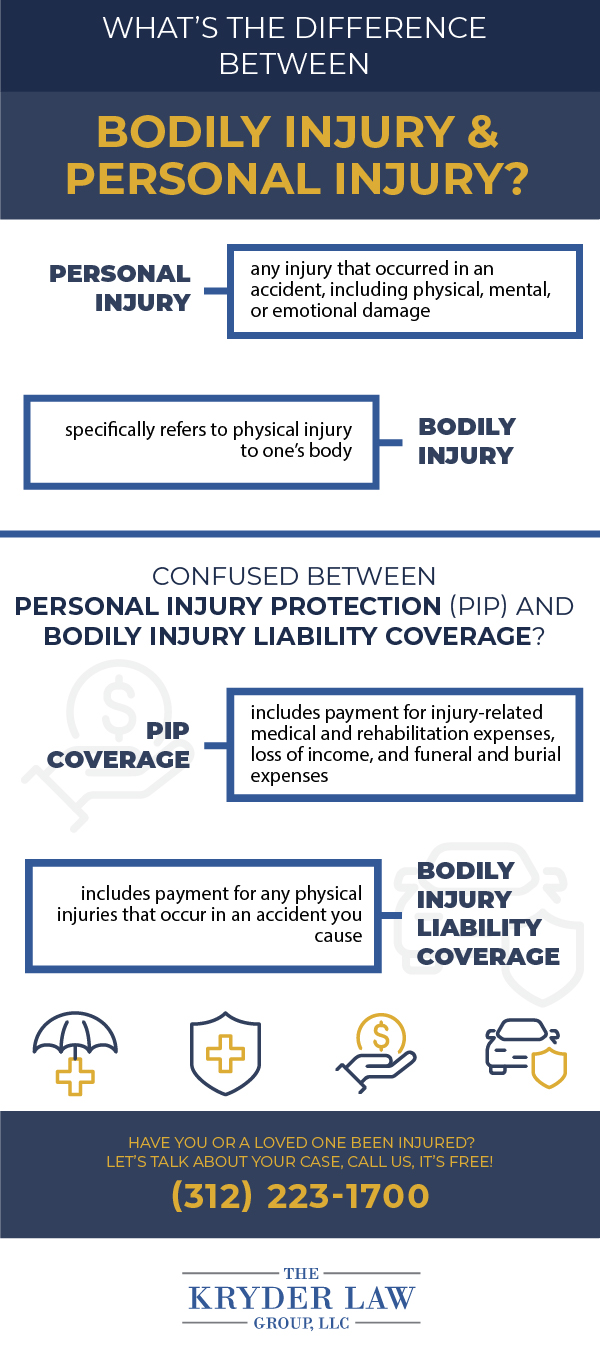

When it comes to protecting yourself and your family from the financial fallout of an accident, understanding the difference between Personal Injury and Bodily Injury Insurance is essential. With the right protection, you can ensure that you are not left with a hefty medical bill or other financial burden in the wake of an accident. In this article, we’ll explore the differences between Personal Injury and Bodily Injury Insurance to help you make an informed decision about the best coverage for your needs.

| Personal Injury | Bodily Injury Insurance |

|---|---|

| Personal injury insurance is a type of insurance that helps pay for medical bills, lost wages, and other costs resulting from an injury or illness. | Bodily injury insurance is a type of insurance that helps pay for medical bills, lost wages, and other costs resulting from an injury or illness caused by another person’s negligence or intentional act. |

Chart Comparing: Personal Injury Vs Bodily Injury Insurance

| Personal Injury Insurance | Bodily Injury Insurance |

|---|---|

| Personal injury insurance provides financial protection in the event of an injury or illness that is caused by an accident or incident. | Bodily injury insurance provides coverage for injuries caused to someone else in an accident or incident involving the insured person. |

| It covers medical bills and lost wages resulting from the accident or illness, as well as legal fees associated with defending against a lawsuit. | Bodily injury insurance provides coverage for expenses related to the injured party, such as medical bills and lost wages resulting from the accident. |

| It also covers legal fees associated with defending against a lawsuit that may arise if the injured person decides to sue the insured person for damages. | It also covers legal fees associated with defending against a lawsuit that may arise if the injured person decides to sue the insured person for damages. |

| Personal injury insurance may cover pain and suffering, emotional distress, and other non-economic losses. | Bodily injury insurance generally does not cover pain and suffering, emotional distress, or other non-economic losses. |

| This type of insurance is typically only available to individuals who are not covered by health insurance or other types of insurance. | Bodily injury insurance is typically required by law and is available to individuals who own a vehicle or other property. |

| It can be purchased as a stand-alone policy or as part of a comprehensive insurance package. | Bodily injury insurance is usually purchased as part of a comprehensive insurance package. |

| It may be offered as an endorsement to an existing insurance policy. | Bodily injury insurance is usually offered as an endorsement to an existing insurance policy. |

Contents

Personal Injury Vs Bodily Injury Insurance

Personal Injury and Bodily Injury Insurance are two types of insurance policies that are commonly offered by insurance companies. Personal Injury Insurance covers damages caused to a person due to the negligence of another person, while Bodily Injury Insurance covers damages caused to a person due to an accident or bodily harm. Both are important types of insurance policies that can help protect individuals from financial losses.

What Is Personal Injury Insurance?

Personal Injury Insurance (PII) is a type of insurance that covers the costs of medical expenses, lost wages, and other damages due to the negligence of another person. This type of insurance is often required by law in certain states and can be purchased separately or as part of an insurance policy. PII also covers legal expenses, such as attorney fees, should the policyholder need to pursue a legal claim against the person responsible for the injury.

Personal Injury Insurance is designed to help policyholders cope with the financial burden of an accident or injury, regardless of who is at fault. This type of insurance typically covers medical expenses, lost wages, and other damages related to the injury or accident, such as pain and suffering. PII also covers legal expenses if the policyholder needs to pursue a legal claim against the person responsible for the injury.

Personal Injury Insurance is an important type of insurance to have, as it can help protect individuals from unexpected medical expenses and lost wages due to an injury or accident. It is important to note that PII is not the same as Bodily Injury Insurance, which covers damages caused to the body as a result of an accident.

What Is Bodily Injury Insurance?

Bodily Injury Insurance (BII) is a type of insurance that covers the costs of medical expenses, lost wages, and other damages caused to the body as a result of an accident or other incident. This type of insurance is typically included in auto and homeowners insurance policies and can also be purchased separately. BII covers medical expenses related to bodily injury, such as hospital stays, surgery, and rehabilitation, as well as lost wages due to an inability to work.

Bodily Injury Insurance is designed to help policyholders cope with the financial burden of an injury or accident. It is important to note that BII is not the same as Personal Injury Insurance, which covers damages due to the negligence of another person. BII covers damages caused to the body as a result of an accident, regardless of who is at fault.

Bodily Injury Insurance is an important type of insurance to have, as it can help protect individuals from unexpected medical expenses and lost wages due to an injury or accident. BII can also help individuals cover the costs of legal expenses if they need to pursue a legal claim against the person responsible for the injury.

Difference Between Personal Injury and Bodily Injury Insurance

The main difference between Personal Injury Insurance and Bodily Injury Insurance is that PII covers damages due to the negligence of another person, while BII covers damages caused to the body as a result of an accident. Both are important types of insurance policies that can help protect individuals from financial losses.

Another difference between the two types of insurance is that Personal Injury Insurance typically covers legal expenses, while Bodily Injury Insurance does not. Personal Injury Insurance is also often required by law in certain states, while Bodily Injury Insurance is typically included in auto and homeowners policies.

It is important to understand the difference between Personal Injury Insurance and Bodily Injury Insurance in order to make an informed decision when purchasing insurance. It is also important to note that both types of insurance can help protect individuals from financial losses due to an injury or accident.

Benefits of Personal Injury and Bodily Injury Insurance

Both Personal Injury Insurance and Bodily Injury Insurance offer several benefits to policyholders. These benefits include coverage for medical expenses and lost wages due to an injury or accident, as well as legal expenses should the policyholder need to pursue a legal claim against the person responsible for the injury.

Personal Injury Insurance and Bodily Injury Insurance can also help protect individuals from unexpected medical expenses and lost wages due to an injury or accident. In addition, both types of insurance can provide peace of mind knowing that should an accident or injury occur, the policyholder will be financially protected.

It is important to understand the benefits of Personal Injury Insurance and Bodily Injury Insurance in order to make an informed decision when purchasing insurance. Both types of insurance are important and can help protect individuals from financial losses due to an injury or accident.

How Much Does Personal Injury and Bodily Injury Insurance Cost?

The cost of Personal Injury Insurance and Bodily Injury Insurance will vary depending on the type and amount of coverage purchased. Personal Injury Insurance can be purchased separately or as part of an insurance policy, while Bodily Injury Insurance is typically included in auto and homeowners policies. It is important to compare quotes from different insurance companies in order to get the best rate.

In addition to the cost of the insurance, policyholders should also consider the amount of coverage they need. It is important to purchase enough coverage to ensure that any medical expenses or lost wages due to an injury or accident are covered.

It is important to understand the cost of Personal Injury Insurance and Bodily Injury Insurance in order to make an informed decision when purchasing insurance. It is also important to make sure that the coverage purchased is sufficient enough to cover any medical expenses or lost wages due to an injury or accident.

Personal Injury Vs Bodily Injury Insurance Pros & Cons

Pros of Personal Injury Insurance

- Provides coverage for medical expenses resulting from an injury

- Covers physical and psychological injuries

- Protects you from a potential lawsuit

Cons of Personal Injury Insurance

- Expensive premiums

- Strict eligibility requirements

- Does not cover property damage

Pros of Bodily Injury Insurance

- Provides coverage for medical expenses resulting from an injury

- Covers property damage caused by you or your vehicle

- Protects you from a potential lawsuit

Cons of Bodily Injury Insurance

- Expensive premiums

- Strict eligibility requirements

- Does not cover psychological injuries

Comparing Personal Injury and Bodily Injury Insurance

When it comes to choosing between personal injury and bodily injury insurance, there is no easy answer. Each type of insurance offers its own unique benefits and drawbacks, and the choice ultimately depends on your individual needs and circumstances.

Bodily injury insurance provides coverage for medical bills in the event of an accident or injury that is caused by someone else. This type of insurance is designed to protect you against financial losses due to another person’s negligence or recklessness. It is also useful for helping to cover your own medical expenses if the other person is not able to pay.

Personal injury insurance, on the other hand, covers both medical bills and legal expenses. It can be used to reimburse you for lost wages, pain and suffering, and other damages resulting from an injury. This type of insurance is often used in cases where the other person is not at fault or does not have sufficient coverage.

After considering the advantages and disadvantages of both types of insurance, it is clear that personal injury insurance is the better choice. Here are three reasons why:

- It provides comprehensive coverage for medical bills and legal costs.

- It can help protect you from financial losses due to another person’s negligence.

- It can help cover your own medical expenses if the other person is not able to pay.

Overall, personal injury insurance is the best option for those who want to be fully protected in the event of an accident or injury. It offers a wide range of coverage and can help to ensure that you have the financial resources to cope with any losses that may occur.

Frequently Asked Questions:

Are you confused about the difference between Personal Injury and Bodily Injury Insurance? Learn more about what each of these types of insurance covers and how they protect you with the answers to these frequently asked questions.

What is Personal Injury Insurance?

Personal Injury Insurance provides coverage for damages caused by an individual’s negligence or intentional acts. Examples of damages covered under Personal Injury Insurance include medical expenses, pain and suffering, and emotional distress. This type of insurance can also provide coverage for legal expenses if the injured party decides to pursue legal action.

Personal Injury Insurance is designed to protect individuals from the financial burden of paying for damages resulting from their own negligence. It is important to note that this type of insurance does not provide coverage for property damage.

What is Bodily Injury Insurance?

Bodily Injury Insurance provides coverage for bodily injury or death caused by another person’s negligence or intentional acts. This type of insurance is designed to protect individuals from the financial burden of paying for medical expenses and other damages resulting from another person’s negligence or intentional acts.

Bodily Injury Insurance can also provide coverage for property damage caused by the negligent or intentional acts of another person. This type of insurance typically covers medical bills, lost wages, pain and suffering, and other damages resulting from another person’s negligence or intentional acts.

How do Personal Injury and Bodily Injury Insurance Differ?

The primary difference between Personal Injury and Bodily Injury Insurance is the type of coverage provided. Personal Injury Insurance provides coverage for damages caused by an individual’s own negligence or intentional acts, while Bodily Injury Insurance provides coverage for damages caused by another person’s negligence or intentional acts.

Another key difference between the two types of insurance is the type of damages covered. Personal Injury Insurance typically covers medical expenses, pain and suffering, and emotional distress. Bodily Injury Insurance typically covers medical bills, lost wages, pain and suffering, and other damages resulting from another person’s negligence or intentional acts.

When Should I Purchase Personal Injury Insurance?

It is important to purchase Personal Injury Insurance if you are at risk of being liable for damages caused by your own negligence or intentional acts. This type of insurance can provide financial protection in the event that you are sued for damages resulting from your own negligence or intentional acts.

When purchasing Personal Injury Insurance, it is important to make sure that the policy provides sufficient coverage for your individual needs. It is also important to make sure that the policy includes coverage for legal expenses in the event that you are sued for damages resulting from your own negligence or intentional acts.

When Should I Purchase Bodily Injury Insurance?

Bodily Injury Insurance should be purchased if you are at risk of being liable for damages caused by another person’s negligence or intentional acts. This type of insurance can provide financial protection in the event that you are sued for damages resulting from another person’s negligence or intentional acts.

When purchasing Bodily Injury Insurance, it is important to make sure that the policy provides sufficient coverage for your individual needs. It is also important to make sure that the policy includes coverage for property damage caused by the negligent or intentional acts of another person.

Bodily Injury Liability Insurance Explained | American Family Insurance

In summation, it is important to understand the difference between personal injury and bodily injury insurance in order to make sure you are appropriately covered in the event of an accident. Personal injury insurance covers non-physical damages, such as mental anguish or slander, while bodily injury insurance covers physical injuries and medical expenses. With the right insurance coverage, you can rest easy knowing you are financially protected in the event of an accident.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts