Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

When you are involved in a car accident, one of the most important decisions you can make is understanding the difference between car accident insurance coverage and underinsured motorist coverage. While both types of coverage are designed to help protect you financially in the event of an accident, there are key differences between the two that can make a major difference in the amount of protection you have in the event of an accident. In this article, we will discuss the differences between car accident insurance coverage and underinsured motorist coverage, and how knowing the difference can help you make an informed decision about the best coverage for your needs.

| Car Accident Insurance Coverage | Underinsured Motorist Coverage |

|---|---|

| Provides coverage for medical bills and car repairs after a car accident. | Provides coverage if the driver responsible for the accident has insufficient insurance coverage. |

| Typically covers costs related to physical injury, property damage, and lost wages. | Typically covers costs related to physical injury, property damage, and lost wages. |

| Does not cover damage to the insured’s own vehicle. | Does not cover damage to the insured’s own vehicle. |

Chart Comparing: Car Accident Insurance Coverage Vs Underinsured Motorist Coverage

| Car Accident Insurance Coverage | Underinsured Motorist Coverage |

|---|---|

| Car Accident Insurance Coverage is mandatory insurance coverage that pays for the damages caused to another person’s vehicle in the event of an accident. It also covers medical expenses and personal injury. | Underinsured Motorist Coverage is optional insurance coverage that pays for the damages caused to your own vehicle in the event of an accident when the other driver is underinsured or does not have enough insurance to cover the cost of repairs. |

| It is required by law in most states. | It is not required by law in most states. |

| It is used to pay for damages caused to another person’s vehicle or property in the event of an accident. | It is used to pay for damages caused to your own vehicle in the event of an accident when the other driver is underinsured or does not have enough insurance to cover the cost of repairs. |

| It typically covers medical expenses and personal injury. | It typically does not cover medical expenses and personal injury. |

| It is usually offered in the form of liability coverage. | It is usually offered in the form of uninsured/underinsured motorist coverage. |

Contents

Car Accident Insurance Coverage Vs Underinsured Motorist Coverage

Car Accident Insurance Coverage and Underinsured Motorist Coverage both provide financial protection for individuals that have been involved in a car accident. Both of these coverages provide important financial protection for individuals that are victims of an accident, but there are differences between them that should be considered. In this article, we will discuss the differences between these two coverages so that you can make the best decision for your needs.

What is Car Accident Insurance Coverage?

Car Accident Insurance Coverage is a type of coverage that is designed to provide financial protection to individuals that have been involved in a car accident. This coverage typically includes medical expenses, lost wages, and property damage. This coverage is usually offered by the same company that provides the car insurance.

The amount of coverage that is provided by this type of coverage will depend on the individual policy. This coverage usually covers the costs associated with medical bills, lost wages, and any property damage that is caused by the accident. It is important to read the policy carefully in order to know exactly what is covered.

This coverage is typically offered to individuals that have a car insurance policy. It is important to remember that this coverage is not included in all car insurance policies, so it is important to check with your insurance provider to see if this coverage is included in your policy.

What is Underinsured Motorist Coverage?

Underinsured Motorist Coverage is a type of coverage that is designed to provide financial protection to individuals that have been injured in a car accident that was caused by an underinsured driver. This coverage typically includes medical expenses, lost wages, and property damage.

The amount of coverage that is provided by this type of coverage will depend on the individual policy. This coverage usually covers the costs associated with medical bills, lost wages, and any property damage that is caused by the accident. It is important to read the policy carefully in order to know exactly what is covered.

This coverage is typically offered to individuals that have a car insurance policy. It is important to remember that this coverage is not included in all car insurance policies, so it is important to check with your insurance provider to see if this coverage is included in your policy.

What are the Advantages of Car Accident Insurance Coverage?

The main advantage of Car Accident Insurance Coverage is that it provides financial protection to individuals that have been involved in a car accident. This coverage typically includes medical expenses, lost wages, and property damage. This coverage is usually offered by the same company that provides the car insurance.

Another advantage of this coverage is that it can provide coverage for damages that are caused by an uninsured motorist. This coverage is typically offered to individuals that have a car insurance policy.

The amount of coverage that is provided by this type of coverage will depend on the individual policy. This coverage usually covers the costs associated with medical bills, lost wages, and any property damage that is caused by the accident. It is important to read the policy carefully in order to know exactly what is covered.

What are the Advantages of Underinsured Motorist Coverage?

The main advantage of Underinsured Motorist Coverage is that it provides financial protection to individuals that have been injured in a car accident that was caused by an underinsured driver. This coverage typically includes medical expenses, lost wages, and property damage.

Another advantage of this coverage is that it can provide coverage for damages that are caused by an uninsured motorist. This coverage is typically offered to individuals that have a car insurance policy.

The amount of coverage that is provided by this type of coverage will depend on the individual policy. This coverage usually covers the costs associated with medical bills, lost wages, and any property damage that is caused by the accident. It is important to read the policy carefully in order to know exactly what is covered.

Which is the Right Coverage for You?

When it comes to choosing the right coverage for you, it is important to understand the differences between Car Accident Insurance Coverage and Underinsured Motorist Coverage. Both of these coverages provide important financial protection for individuals that are victims of an accident, but there are differences between them that should be considered.

It is important to read the policy carefully in order to know exactly what is covered by each type of coverage and to make sure that you are getting the right coverage for your needs. It is also important to consider the cost of the coverage, as well as the amount of coverage that is offered.

It is also important to consider the type of accident that you are involved in and whether or not you are at fault. In some cases, it may be beneficial to purchase additional coverage in order to provide more financial protection for yourself and any passengers in your vehicle.

Car Accident Insurance Coverage Vs Underinsured Motorist Coverage Pros & Cons

Pros of Car Accident Insurance Coverage

- Provides coverage for medical bills and other associated costs

- Covers the cost of repairing or replacing your car

- Pays for damages that you are legally responsible for

- Provides coverage for lost wages due to an accident

Cons of Car Accident Insurance Coverage

- Premiums can be expensive

- May not cover some types of damages

- May not cover all medical expenses

- Does not cover damage caused by underinsured motorists

Pros of Underinsured Motorist Coverage

- Provides coverage for damages caused by underinsured motorists

- Can provide coverage for medical expenses and lost wages

- Can provide coverage for property damage

- Premiums may be cheaper than other types of coverage

Cons of Underinsured Motorist Coverage

- May not cover all types of damages

- May not provide adequate coverage for medical expenses

- May not provide enough coverage for lost wages

- May not provide enough coverage for property damage

Which is Better – Car Accident Insurance Coverage vs. Underinsured Motorist Coverage?

The decision of which type of coverage is right for you depends on your individual situation and the risks that you face. Ultimately, both types of coverage can be beneficial, but there are pros and cons to each. Car accident insurance coverage is typically required by law, and provides protection for the driver and passengers in the event of an accident. Underinsured motorist coverage, on the other hand, is optional but provides greater protections in the event of a collision with an underinsured motorist.

In general, car accident insurance coverage is the more affordable option. This coverage typically provides protection for medical expenses, such as hospital stays, as well as property damage. However, this type of coverage does not provide any protection in the event of a collision with an underinsured motorist.

Underinsured motorist coverage is more expensive, but can provide greater protection in the event of an accident with an underinsured motorist. This type of coverage can cover medical and property expenses, as well as any additional costs that may arise due to the underinsured motorist.

The final decision should be based on your individual needs and the risks that you face. Here are three reasons why underinsured motorist coverage may be the better choice:

1. Greater protection in the event of an accident with an underinsured motorist.

2. Coverage for additional costs that may arise due to the underinsured motorist.

3. Peace of mind knowing that you have greater coverage in the event of an accident.

Frequently Asked Questions

Car accident insurance coverage and underinsured motorist coverage are two of the most important types of car insurance coverage available to drivers. Understanding the differences between these two types of coverage can help you decide which one is best for your needs.

What is car accident insurance coverage?

Car accident insurance coverage is the most basic type of car insurance coverage. It covers the cost of repairs, medical bills, and other costs associated with an accident that is caused by another driver. It also covers the cost of any damage to your car, regardless of who is at fault in the accident. This type of coverage is typically required by law in most states.

Car accident insurance coverage is typically the most affordable type of car insurance coverage, but it does have its limits. In some cases, the coverage may not be enough to fully cover the costs of an accident. In these cases, additional coverage may be necessary.

What is underinsured motorist coverage?

Underinsured motorist coverage is a type of car insurance coverage that provides additional protection in the event that another driver is at fault in an accident but does not have enough insurance to cover all of the costs associated with the accident. This type of coverage can help to cover the gap between what the other driver’s insurance covers and what is needed to cover the costs of the accident.

Underinsured motorist coverage is typically more expensive than car accident insurance coverage, but it can provide a great deal of peace of mind knowing that you are covered in the event of an accident. It is important to remember, however, that underinsured motorist coverage does not cover damage to your own car.

What are the benefits of car accident insurance coverage?

The main benefit of car accident insurance coverage is that it provides protection in the event of an accident that is caused by another driver. This type of coverage can help to cover the costs associated with the accident, such as medical bills, repairs, and other costs. It also provides peace of mind knowing that you are protected in the event of an accident.

Another benefit of car accident insurance coverage is that it is typically the most affordable type of car insurance coverage. This makes it ideal for drivers who are on a budget or who do not want to spend a lot of money on car insurance.

What are the benefits of underinsured motorist coverage?

The main benefit of underinsured motorist coverage is that it provides additional protection in the event that another driver is at fault in an accident but does not have enough insurance to cover all of the costs associated with the accident. This type of coverage can help to cover the gap between what the other driver’s insurance covers and what is needed to cover the costs of the accident.

Underinsured motorist coverage is also beneficial because it can provide peace of mind knowing that you are protected in the event of an accident. This can be especially helpful for drivers who are concerned about not having enough coverage in the event of an accident.

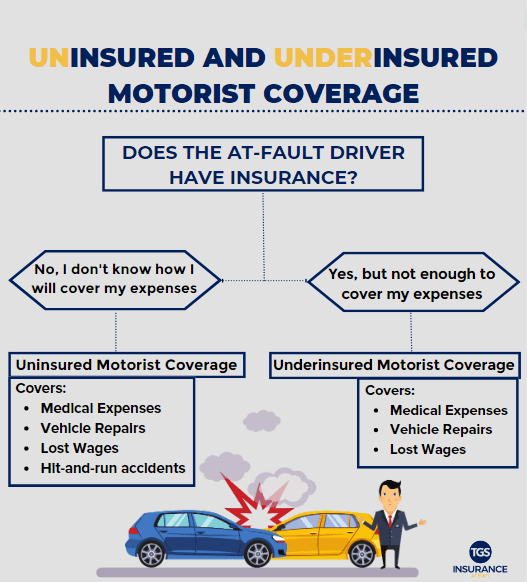

Uninsured vs Underinsured Motorist Coverage

In conclusion, car accident insurance coverage and underinsured motorist coverage can both play an important role in helping you protect yourself and your assets in the event of an accident. While both provide coverage for medical expenses, property damage, and other losses incurred as a result of an accident, underinsured motorist coverage is often the best option as it covers you if the other driver involved in an accident is not adequately insured. Therefore, it is important to carefully consider both of these coverage types when selecting the best auto insurance policy for you.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts