Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

Car accidents can be terrifying, especially when you consider the financial impact they can have on your insurance premiums. No one wants to be in an accident, but if you are, you may be wondering just how much your car insurance premium is going to go up.

The answer, unfortunately, is not straightforward. There are a variety of factors that can affect how much your premium will increase, from the severity of the accident to your driving history. In this article, we’ll explore some of the key factors that impact car insurance premiums after an accident, so you can better understand what to expect if you find yourself in this situation.

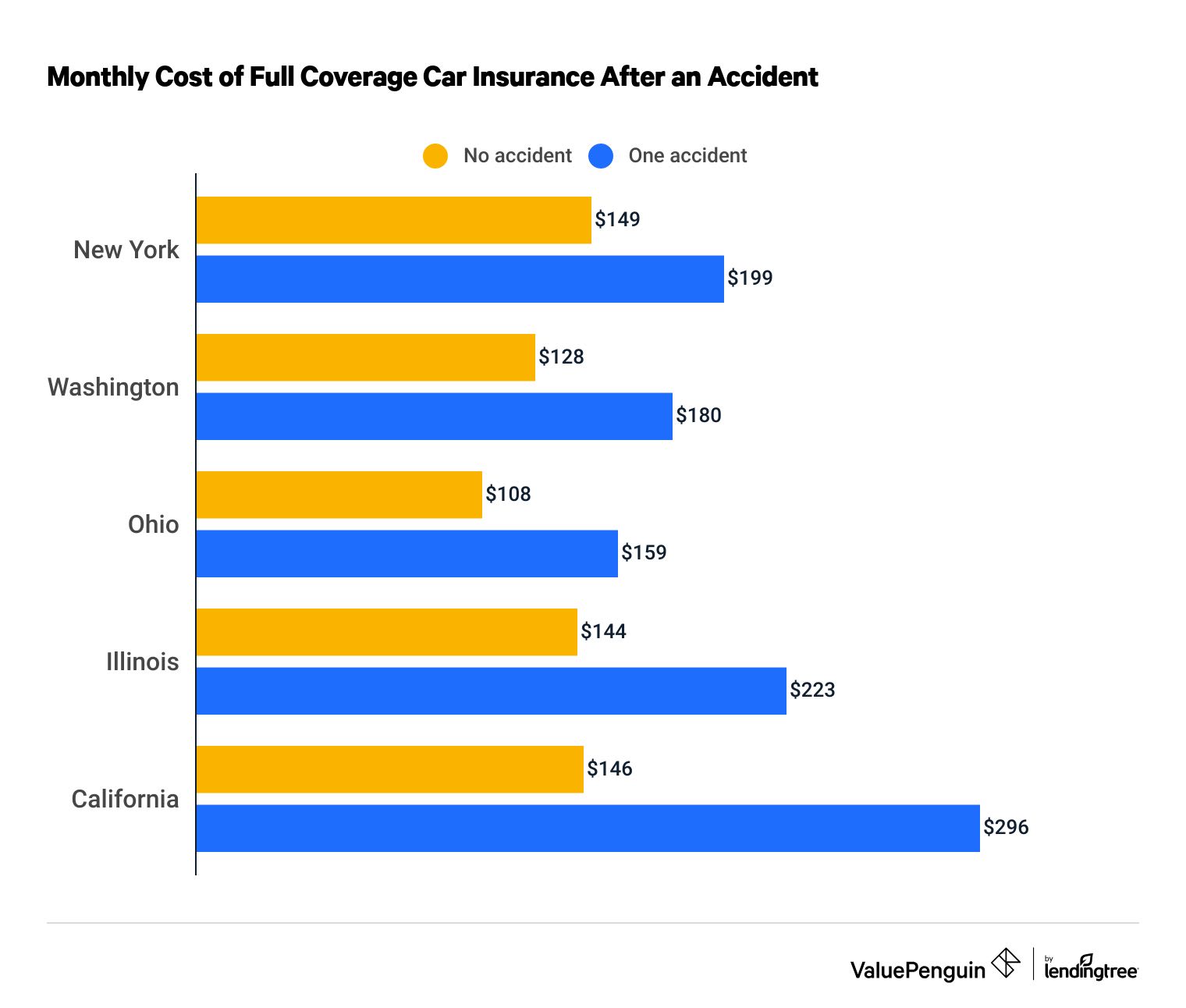

After an accident, car insurance premiums can increase by an average of 34% nationwide. This increase can vary based on factors such as the severity of the accident, the driver’s age and location, and the insurance company’s policies. Some drivers may also see a higher increase if they have a history of accidents or traffic violations. It’s important to contact your insurance provider to understand how much your premiums will increase after an accident.

Contents

- How Much Does Car Insurance Premium Go Up After an Accident?

- Frequently Asked Questions

- What factors affect how much my car insurance premium goes up after an accident?

- How long will my car insurance premium stay increased after an accident?

- Can I avoid having my car insurance premium increased after an accident?

- Does the type of accident affect how much my car insurance premium goes up?

- Is there anything I can do to reduce my car insurance premium after an accident?

- How much does your insurance go up after an accident

How Much Does Car Insurance Premium Go Up After an Accident?

Car accidents can be scary and stressful, but the aftermath can be even more daunting. One of the things you may be worried about is how much your car insurance premium will increase after an accident. Unfortunately, there’s no one-size-fits-all answer to this question, as there are several factors that come into play. In this article, we’ll explore some of these factors and give you an idea of what to expect.

Factors That Affect Your Car Insurance Premium After an Accident

- At-Fault vs. Not At-Fault

- Type of Accident

One of the biggest factors that will determine how much your car insurance premium will go up after an accident is whether or not you were at fault. If you were not at fault, your premium may not increase at all. However, if you were at fault, you can expect your premium to increase significantly.

The type of accident you were involved in can also affect your premium. For example, a minor fender bender may not result in as much of an increase as a major collision. Additionally, accidents that involve injuries or fatalities may result in even higher premiums.

How Much Will Your Premium Increase?

- Percentage Increase

- Cost of Damages

The amount that your premium will increase after an accident is typically expressed as a percentage. This percentage can vary depending on the factors we discussed earlier. On average, you can expect your premium to increase by around 30% after an at-fault accident.

The cost of damages resulting from the accident will also play a role in determining your premium increase. If the damages are extensive, your premium increase will likely be higher than if they were minor.

How Long Will the Increase Last?

- Duration of Increase

- Good Driver Discount

The length of time that your premium increase will last can also vary. In general, you can expect the increase to last for around three to five years. However, this can vary depending on the severity of the accident and your insurance company’s policies.

Some insurance companies offer a good driver discount, which can help reduce your premium increase after an accident. If you have a good driving record, you may be able to qualify for this discount and reduce the duration of your premium increase.

Conclusion

In conclusion, the amount that your car insurance premium will increase after an accident can vary based on several factors. These factors include whether or not you were at fault, the type of accident, the cost of damages, and the duration of the increase. While it can be frustrating to see your premium increase, it’s important to remember that insurance is there to protect you in case of an accident. By driving safely and following the rules of the road, you can help reduce your risk of accidents and keep your premium as low as possible.

Frequently Asked Questions

After an accident, several factors can affect how much your car insurance premium goes up. Some of these factors include the severity of the accident, the amount of damage caused, the type of accident, and whether you were at fault or not. Other factors that can affect your premium include your driving record, age, location, and the type of car you drive.

It’s important to remember that every insurance company is different, and each one may have its own formula for determining how much to increase your premium after an accident. Your best bet is to contact your insurance company directly to get an accurate estimate of how much your premium will go up.

The length of time that your car insurance premium stays increased after an accident can vary depending on several factors. In general, most insurance companies will increase your premium for three to five years after an accident. However, if you have a clean driving record and no other accidents or claims during that time, your premium may decrease sooner.

It’s important to note that some insurance companies may forgive your first accident, meaning they won’t increase your premium at all. However, this is not always the case, and forgiveness policies can vary widely from one company to another.

Unfortunately, if you are at fault for an accident, it is unlikely that you can avoid having your car insurance premium increased. However, there are some steps you can take to minimize the impact of the increase.

For example, you may be able to negotiate with your insurance company to increase your deductible or reduce your coverage in exchange for a smaller premium increase. Additionally, some insurance companies offer accident forgiveness policies, which can prevent your premium from going up after your first accident.

The type of accident you are involved in can definitely affect how much your car insurance premium goes up. Generally speaking, accidents that involve more severe damage or injuries will result in a higher premium increase than accidents that are less serious. Accidents that are your fault will also typically result in a higher premium increase than accidents that are not your fault.

If you are involved in an accident, it’s important to notify your insurance company as soon as possible so they can begin the claims process and start assessing the damage.

If your car insurance premium has increased after an accident, there are a few things you can do to try to reduce it. One option is to shop around and compare rates from different insurance companies. You may be able to find a company that offers lower rates or better discounts.

Another option is to take a defensive driving course. Some insurance companies offer discounts to drivers who complete these courses, which can help offset the increase in your premium.

Finally, you can also try to improve your driving habits and avoid future accidents or traffic violations. Over time, a clean driving record can help reduce your premium and improve your overall insurance rates.

How much does your insurance go up after an accident

In conclusion, there is no one-size-fits-all answer when it comes to how much your car insurance premium will go up after an accident. The increase in your premium will depend on factors such as the severity of the accident, your driving history, and the type of coverage you have.

It is important to note that there are steps you can take to minimize the impact of an accident on your premium. For example, you may be able to take a defensive driving course or increase your deductible to lower your premium. Additionally, it is always a good idea to shop around and compare rates from different insurance providers to ensure you are getting the best deal.

At the end of the day, the best way to avoid a premium increase after an accident is to practice safe driving habits and avoid accidents altogether. By staying focused on the road, following traffic laws, and being aware of your surroundings, you can keep yourself and others safe while also keeping your car insurance premium as low as possible.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts