Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

Car accidents are a common occurrence on the roads, and even the most experienced drivers can fall victim to them. No matter how cautious you are, there is always a chance of being involved in a car accident. When it happens, it can be a stressful and overwhelming experience, especially when you’re not at fault. One of the questions that may cross your mind is, “Does car insurance go up after a no-fault accident?” Let’s explore this topic further to get a better understanding of the impact of a no-fault accident on your car insurance rates.

Auto insurance premiums are determined by several factors, including your driving history, type of vehicle, and location. However, a no-fault accident is not likely to increase your car insurance rates. In most states, a no-fault accident means that each party’s insurance company will cover their respective damages, and there will be no fault assigned. So, if you were not at fault in the accident, your car insurance rates should not go up. But, there are exceptions, and it’s essential to understand them to avoid any surprises.

Yes, car insurance can go up after a no-fault accident depending on the circumstances. While no-fault insurance means your insurance company pays for your damages regardless of who caused the accident, insurers still consider factors such as the severity of the accident, your driving record, and the cost of damages when determining your premium. Additionally, if you file a claim, your insurer may see you as a higher risk and increase your rates.

Contents

- Does Car Insurance Go Up No Fault Accident?

- Frequently Asked Questions

- What is a no-fault accident?

- Will my car insurance rates go up after a no-fault accident?

- What factors affect whether my car insurance rates will go up after a no-fault accident?

- How long will my car insurance rates stay increased after a no-fault accident?

- What can I do to keep my car insurance rates from going up after a no-fault accident?

- How much does your insurance go up after an accident

Does Car Insurance Go Up No Fault Accident?

Car accidents can be a stressful experience, especially if you’re not at fault. In a no-fault accident, each driver’s insurance company pays for their respective policyholder’s damages and injuries, regardless of who caused the accident. But what happens to your car insurance rates after a no-fault accident? Does car insurance go up no fault accident? In this article, we’ll explore the answer to this question and provide you with some useful information to help you better understand how your insurance rates are affected.

Factors that Affect Car Insurance Rates

Many factors can affect your car insurance rates, including your driving record, age, gender, location, and type of vehicle. Insurance companies also consider how likely you are to file a claim when setting your premiums. If you have a history of accidents or traffic violations, your rates will likely be higher than if you have a clean driving record. Additionally, if you live in an area with high rates of car theft or vandalism, your premiums will reflect the increased risk.

No-Fault Accidents and Your Insurance Rates

In most cases, your insurance rates will not go up after a no-fault accident. Since each driver’s insurance company pays for their own policyholder’s damages and injuries, there is no need to assign fault or determine who caused the accident. However, if you file a claim following a no-fault accident, your rates may still increase due to other factors.

Your insurance company may consider the severity of the accident and the amount of damage to your vehicle when determining your rates. If the accident was particularly severe or resulted in significant damage, your rates may increase. Additionally, if you have a history of filing claims or have a high-risk driving profile, your rates may be higher than someone with a clean record.

Benefits of No-Fault Insurance

No-fault insurance can provide several benefits, including faster claims processing and reduced legal costs. Since each driver’s insurance company pays for their own policyholder’s damages and injuries, there is no need for lengthy investigations or legal battles to determine fault. This can result in faster claims processing and reduced legal costs, which can benefit both the policyholder and the insurance company.

No-Fault Insurance vs. Fault Insurance

In fault insurance states, the driver who is found to be at fault for an accident is responsible for paying for the damages and injuries sustained by the other driver. This can result in lengthy legal battles and higher insurance rates for the at-fault driver. In contrast, no-fault insurance states require each driver’s insurance company to pay for their respective policyholder’s damages and injuries, regardless of who caused the accident. This can result in faster claims processing and reduced legal costs for both parties.

Comparison of No-Fault and Fault Insurance

The following table compares some of the key differences between no-fault and fault insurance:

| Aspect | No-Fault Insurance | Fault Insurance |

|---|---|---|

| Fault Determination | No need to determine fault | Fault must be determined |

| Claims Processing | Faster processing | Can be slower due to legal battles |

| Legal Costs | Reduced legal costs | Higher legal costs for at-fault driver |

| Insurance Rates | May be lower due to reduced legal costs | May be higher for at-fault driver |

Conclusion

In summary, your car insurance rates may not go up after a no-fault accident. However, other factors such as the severity of the accident and your driving history can still affect your premiums. No-fault insurance can provide several benefits, including faster claims processing and reduced legal costs, but it’s important to understand the differences between no-fault and fault insurance when choosing your policy. By understanding how your insurance rates are determined, you can make informed decisions about your coverage and ensure that you have the protection you need.

Frequently Asked Questions

What is a no-fault accident?

A no-fault accident is one in which each driver’s insurance pays for their own damages and injuries regardless of who was at fault for the accident. This system is used in some states to help reduce the number of lawsuits filed after car accidents.

While it can help streamline the claims process, it can also result in higher insurance premiums overall as insurance companies absorb the costs of each driver’s damages and injuries.

Will my car insurance rates go up after a no-fault accident?

It depends on your insurance company and the laws in your state. In some states, insurance companies are not allowed to raise your rates after a no-fault accident. However, in other states, they can.

Even if your rates do go up, the increase may not be as significant as it would be for an at-fault accident. Additionally, some insurance companies offer accident forgiveness programs that can help mitigate the impact on your rates.

What factors affect whether my car insurance rates will go up after a no-fault accident?

Factors that can impact whether your insurance rates go up after a no-fault accident include your driving record, the severity of the accident, the state you live in, and the policies of your insurance company.

If you have a history of accidents or traffic violations, your rates may be more likely to increase. Similarly, if the accident was particularly severe or resulted in a large payout from your insurance company, your rates may go up as a result.

How long will my car insurance rates stay increased after a no-fault accident?

Again, this can vary depending on your insurance company and the laws in your state. In some cases, your rates may only stay increased for a few years before returning to their previous level. In other cases, the increase may be permanent.

If you’re concerned about the impact on your rates, it’s a good idea to talk to your insurance company and see if they can provide any information on how long the increase is likely to last.

What can I do to keep my car insurance rates from going up after a no-fault accident?

One of the best things you can do is to drive safely and avoid future accidents. You may also want to consider taking a defensive driving course, which can show your insurance company that you’re committed to being a safe driver.

If your rates do go up, you may be able to shop around and find a better deal with another insurance company. Additionally, you can look for discounts or other ways to save money on your insurance premiums.

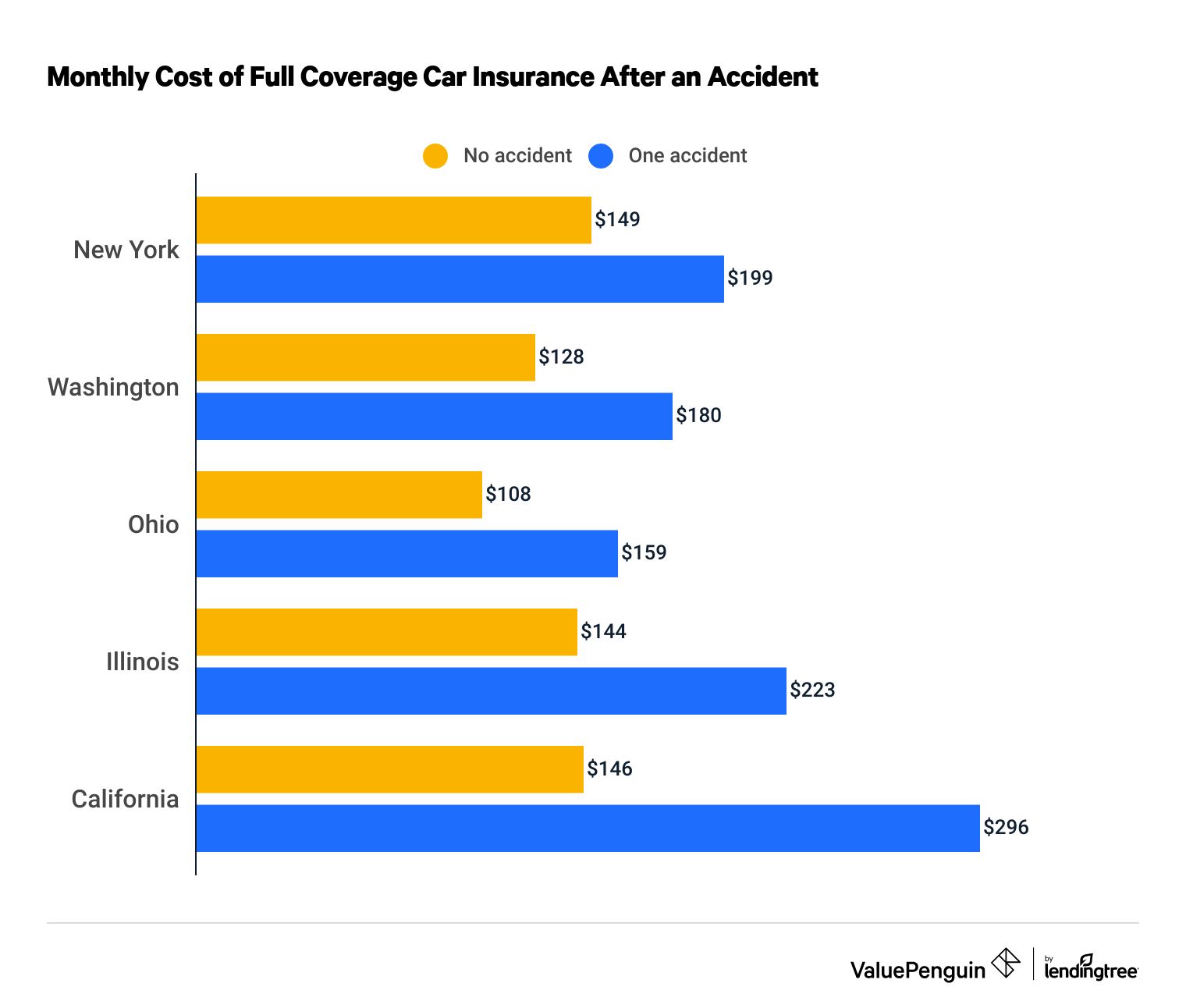

How much does your insurance go up after an accident

In conclusion, the answer to the question “Does car insurance go up for a no-fault accident?” is not a straightforward one. While it is true that filing a claim for a no-fault accident may result in an increase in your car insurance premium, this is not always the case. Many factors come into play when determining the impact of a no-fault accident on your car insurance rates, such as the severity of the accident, your driving history, and the policies of your insurance provider.

It is important to note that even if your car insurance premium does go up after a no-fault accident, it may not be a significant increase. Many insurance providers offer accident forgiveness programs that may waive the increase in premium for a first-time no-fault accident. Additionally, some states have laws that prohibit insurance companies from increasing rates for no-fault accidents.

Ultimately, the best way to ensure that you are prepared for any potential increase in car insurance premiums after a no-fault accident is to review your policy and speak with your insurance provider. They can provide you with detailed information about your coverage and how it may be impacted by a no-fault accident. By staying informed and taking steps to protect yourself, you can navigate the aftermath of a no-fault accident with confidence.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts