Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

Car accidents are an unforeseeable and unfortunate event that can happen to anyone. Even the most cautious drivers can find themselves in a fender bender or a more severe collision. After the initial shock and stress of an accident, the next question that comes to mind is, “will my car insurance go up?” Unfortunately, the answer is not a straightforward yes or no.

Car insurance companies use complex algorithms and various factors to determine your insurance premium after an accident. While some accidents may not affect your premium, others could result in a significant increase. In this article, we will explore the factors that influence your insurance rates after an accident and what steps you can take to mitigate any potential increase.

Yes, your car insurance may go up after an accident, especially if you were at fault. Insurance companies consider your driving history and risk factors when determining your premium. However, the extent of the increase and how long it lasts depends on several factors, including the severity of the accident and your driving record.

Contents

- Does Your Car Insurance Go Up After an Accident?

- Factors that Influence Car Insurance Rates After an Accident

- How Car Insurance Companies Determine Rates After an Accident

- The Benefits of Having Car Insurance After an Accident

- The Pros and Cons of Filing a Claim After an Accident

- Tips for Keeping Your Car Insurance Rates Low After an Accident

- Conclusion

- Frequently Asked Questions

- 1. What factors determine whether my car insurance rates will go up after an accident?

- 2. How much can I expect my car insurance rates to go up after an accident?

- 3. How long will my car insurance rates stay high after an accident?

- 4. Is there anything I can do to lower my car insurance rates after an accident?

- 5. Will my car insurance rates go up if I file a claim but don’t have an accident?

- How much does your insurance go up after an accident

Does Your Car Insurance Go Up After an Accident?

Car accidents can be stressful and costly. In addition to dealing with the aftermath of the accident, one of the biggest concerns for drivers is the impact it will have on their car insurance rates. If you have been involved in an accident, you may be wondering if your car insurance rates will go up. The answer is not always straightforward, as there are several factors that can influence your rates.

Factors that Influence Car Insurance Rates After an Accident

After an accident, your car insurance rates may go up, but it depends on several factors. One of the most significant factors is who was at fault for the accident. If you were at fault, your rates are likely to increase. On the other hand, if the other driver was at fault, your rates may not be affected. Another factor that can impact your rates is the severity of the accident. If the accident was minor, your rates may not increase as much as they would if it was a major accident with significant damage.

Your driving record is also a key factor in determining your car insurance rates after an accident. If you have a history of accidents and/or traffic violations, your rates are likely to increase more than someone with a clean driving record. Additionally, if you have a history of filing claims, your rates may increase even if the accident was not your fault.

How Car Insurance Companies Determine Rates After an Accident

Car insurance companies use several factors to determine rates after an accident. One of the most important factors is your driving record. The more accidents and traffic violations you have on your record, the higher your rates will be. Additionally, insurance companies will consider the severity of the accident and the cost of repairs. If the damage is significant, your rates are likely to increase.

Another factor that can impact your rates is the type of car you drive. If you have a high-performance or luxury vehicle, your rates are likely to be higher than someone with a standard car. This is because these types of cars are more expensive to repair or replace.

The Benefits of Having Car Insurance After an Accident

While it can be frustrating to see an increase in your car insurance rates after an accident, having car insurance is essential. Without insurance, you would be responsible for paying for any damages or injuries out of pocket. This can be extremely costly, especially if the accident was significant.

Car insurance provides you with peace of mind knowing that you are protected in the event of an accident. It can also provide you with financial protection, as most policies include coverage for property damage and bodily injury.

The Pros and Cons of Filing a Claim After an Accident

If you have been involved in an accident, you may be wondering whether or not you should file a claim with your insurance company. There are pros and cons to filing a claim, and it ultimately depends on your individual situation.

One of the benefits of filing a claim is that your insurance company will handle the repairs and any other damages. This can be helpful if you do not have the funds to pay for repairs out of pocket. Additionally, if you were not at fault for the accident, filing a claim can help you recover damages from the other driver’s insurance company.

However, there are also some downsides to filing a claim. One of the biggest concerns is that your rates may increase. Additionally, filing a claim can be time-consuming, and it may take longer to get your car repaired.

Tips for Keeping Your Car Insurance Rates Low After an Accident

If your car insurance rates have gone up after an accident, there are several things you can do to keep them as low as possible. One of the most important things is to maintain a clean driving record. This means avoiding accidents and traffic violations as much as possible.

Additionally, you can consider increasing your deductible. A higher deductible means that you will pay more out of pocket if you are involved in an accident, but it can also lower your rates. You can also shop around for insurance quotes to find the best rates for your individual situation.

Conclusion

In conclusion, whether or not your car insurance rates will go up after an accident depends on several factors, including who was at fault, the severity of the accident, and your driving record. While it can be frustrating to see an increase in your rates, having car insurance is essential for protecting yourself and your vehicle. By maintaining a clean driving record and considering some of the tips mentioned above, you can keep your rates as low as possible after an accident.

Frequently Asked Questions

Getting into a car accident can be a stressful experience, and it’s natural to have questions about what to expect from your car insurance company. Here are some common questions and answers about whether your car insurance rates will go up after an accident.

1. What factors determine whether my car insurance rates will go up after an accident?

There are several factors that can impact whether your car insurance rates will go up after an accident. These include:

– The severity of the accident

– Whether you were at fault or not

– Your driving record prior to the accident

– The state you live in

Insurance companies use this information to determine your risk as a driver and adjust your rates accordingly.

2. How much can I expect my car insurance rates to go up after an accident?

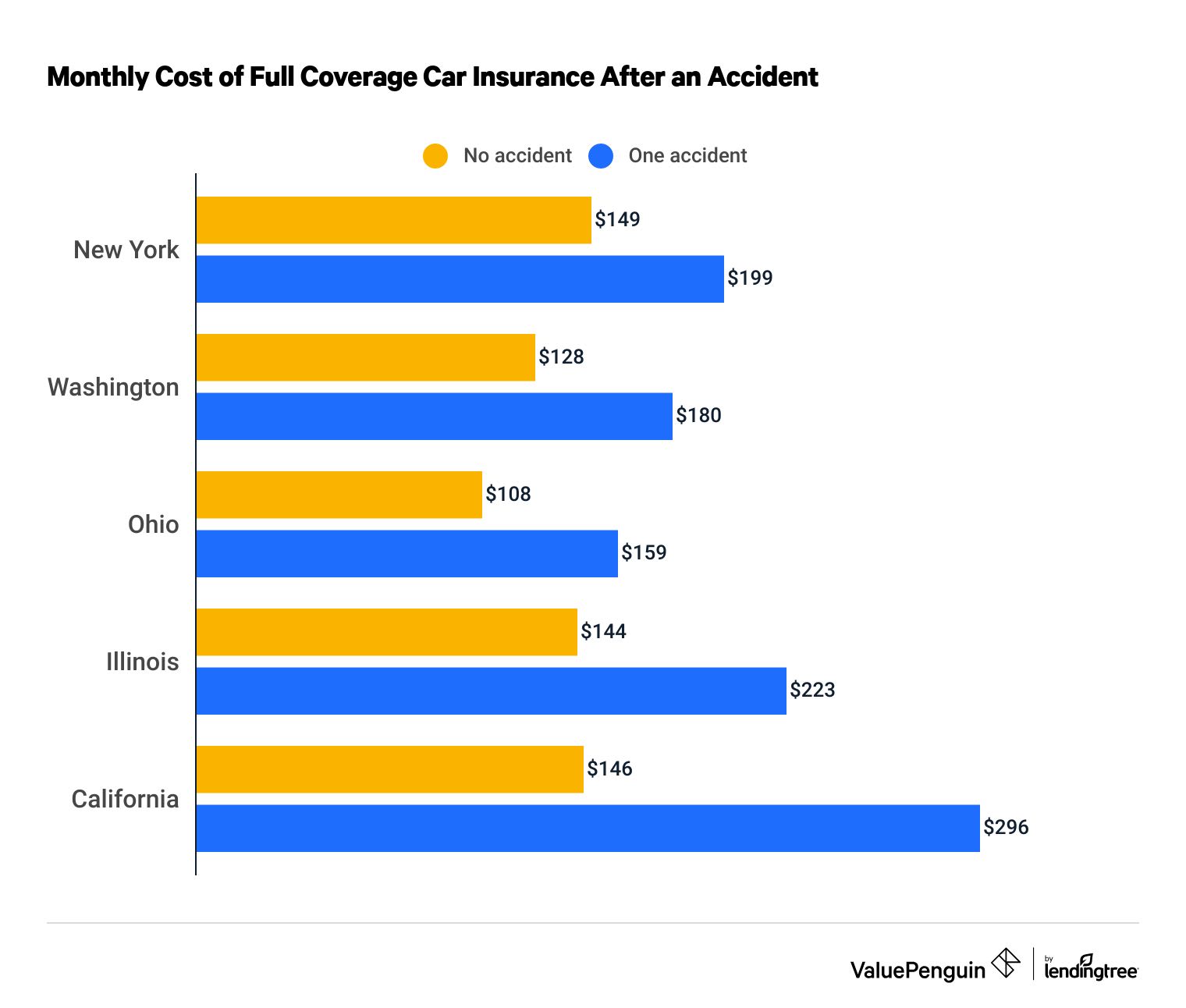

The amount that your car insurance rates will go up after an accident can vary depending on the factors mentioned above. In general, if you were at fault for the accident and it was a severe one, you can expect your rates to increase more than if you were not at fault and the accident was minor. On average, a single accident can increase your rates by anywhere from 20% to 50%.

3. How long will my car insurance rates stay high after an accident?

The length of time that your car insurance rates will stay high after an accident can vary based on the severity of the accident and the regulations in your state. In some cases, your rates may stay high for up to three years after the accident. However, if you maintain a safe driving record and don’t have any additional accidents, your rates may start to decrease after a year or two.

4. Is there anything I can do to lower my car insurance rates after an accident?

One way to potentially lower your car insurance rates after an accident is to take a defensive driving course. This can show your insurance company that you are committed to safe driving and may help offset the rate increase. Additionally, you can shop around for car insurance quotes from different companies to see if you can find a better rate.

5. Will my car insurance rates go up if I file a claim but don’t have an accident?

It’s possible that your car insurance rates could go up if you file a claim but don’t have an accident. This could happen if you file a claim for something like a stolen car or a broken windshield. However, the rate increase is likely to be smaller than if you had an accident. It’s important to weigh the potential rate increase against the cost of the repairs to determine whether it’s worth filing a claim.

How much does your insurance go up after an accident

In conclusion, getting into an accident can be a stressful and costly experience. One of the biggest concerns for drivers is whether their car insurance rates will increase as a result. While it is true that insurance companies may raise rates after an accident, there are also many factors that can influence this decision.

It’s important to note that not all accidents will result in a rate increase. Minor accidents with no injuries or damage to other vehicles may not affect your rates at all. However, more serious accidents that involve injuries or significant damage to your own or other vehicles may lead to a rate increase.

To avoid a rate increase after an accident, it’s important to drive safely and avoid accidents whenever possible. Additionally, many insurance companies offer accident forgiveness programs that can help mitigate the impact of an accident on your rates.

Overall, the best way to protect yourself from the financial impact of an accident is to have comprehensive car insurance coverage. By working with a trusted insurance provider and being a safe and responsible driver, you can rest assured that you’re protected in the event of an accident.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts