Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

Car accidents are an unfortunate reality of driving. They can cause significant damage to both vehicles and people, and they can also have a lasting impact on your insurance premiums. If you’ve been in a car accident, you may be wondering if your insurance rates will increase. The short answer is yes, but the extent of the increase depends on a variety of factors.

Insurance companies use a complex set of algorithms to determine the risk level of each driver. If you’ve been in an accident, you are considered a higher risk driver, and your insurance rates will likely go up. However, the amount of the increase will depend on factors such as the severity of the accident, who was at fault, and your driving history. In this article, we’ll explore the impact of car accidents on insurance rates and provide some tips on how to minimize the damage.

Yes, a car accident can increase your insurance rates. Insurance companies consider a variety of factors when determining rates, and accidents are one of the major factors. If you are found at fault for an accident, you can expect your rates to increase significantly. However, if the accident was not your fault, your rates may not increase as much or at all.

Does a Car Accident Increase Insurance?

Car accidents are never planned, and they can be a major inconvenience to drivers. However, the real pain can come when it’s time to renew your car insurance policy. After a car accident, many drivers worry about whether their insurance rates will increase. This article will explore whether getting into a car accident will increase your car insurance rates.

How does an insurance company determine your insurance rate?

Insurance companies look at several factors when determining your insurance rate. These factors include your driving history, age, gender, location, and the type of car you drive. Insurance companies use this information to determine how likely you are to get into an accident. Drivers who are considered high-risk will typically pay more for car insurance than low-risk drivers.

When you get into a car accident, your insurance company will consider the accident as part of your driving history. If you have a history of accidents, your insurance company may consider you a high-risk driver and increase your insurance rates.

Does a car accident always increase your insurance rates?

Getting into a car accident doesn’t always mean your insurance rates will increase. Whether or not your rates increase depends on several factors, including the severity of the accident, who was at fault, and your driving history.

If the accident was minor and you were not at fault, your insurance rates may not increase. However, if the accident was severe and you were at fault, your insurance rates will likely increase. If you have a history of accidents, even minor ones, your insurance rates may also increase.

How much will your insurance rates increase after a car accident?

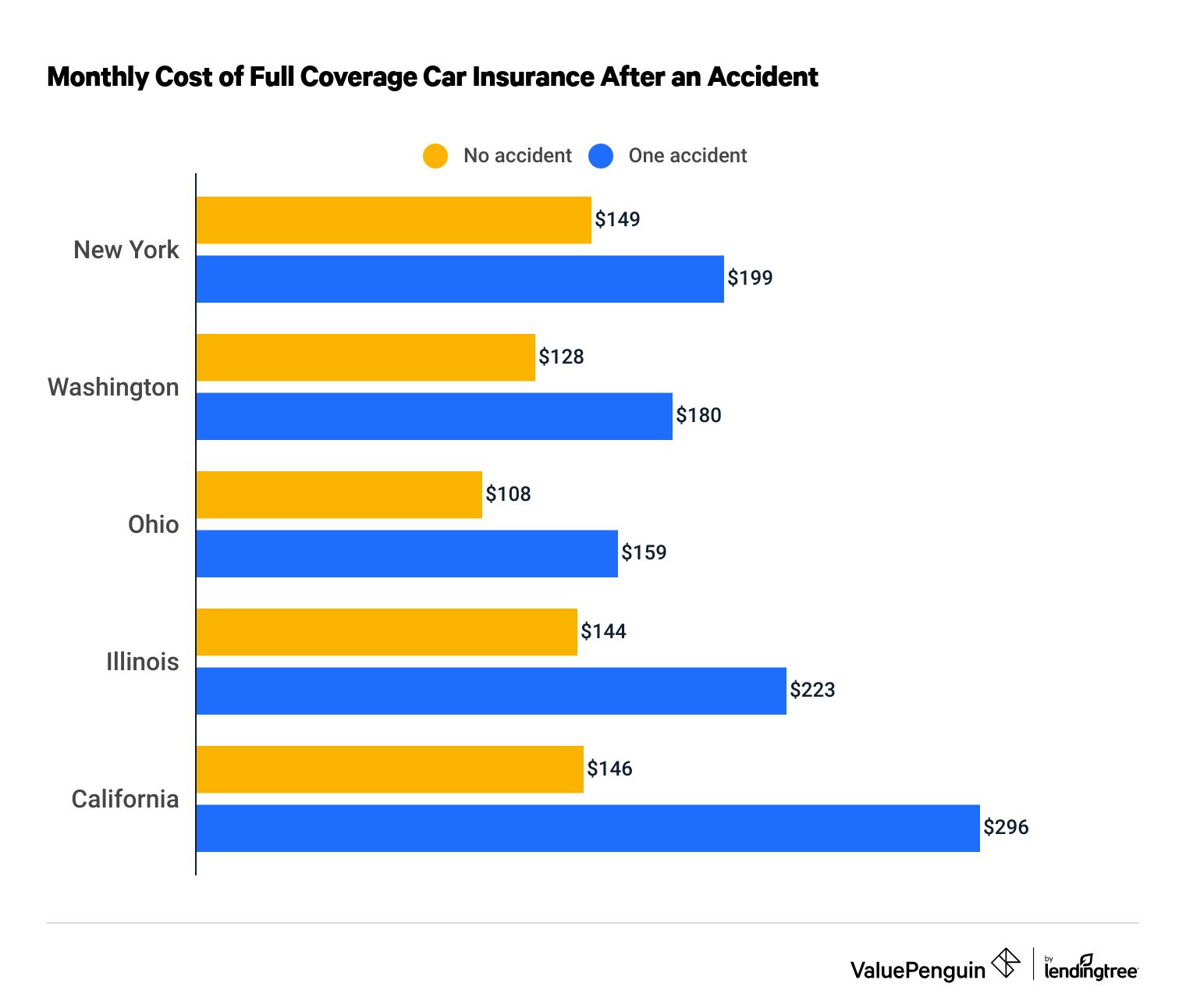

The amount your insurance rates increase after a car accident will depend on several factors, including the severity of the accident, your driving history, and the insurance company’s policies. However, on average, drivers can expect their insurance rates to increase by about 30% after an accident.

It’s important to note that this increase is not permanent. Most insurance companies will only consider the accident for a few years, after which your rates should return to normal.

What can you do to prevent your insurance rates from increasing after a car accident?

The best way to prevent your insurance rates from increasing after a car accident is to drive safely and avoid accidents altogether. However, accidents can happen, even to the safest drivers.

If you do get into a car accident, there are a few things you can do to prevent your insurance rates from increasing. First, make sure you report the accident to your insurance company as soon as possible. This will allow your insurance company to start processing the claim and determine the severity of the accident.

You can also consider taking a defensive driving course. Many insurance companies offer discounts to drivers who complete these courses, and it can help to show your insurance company that you are committed to safe driving.

Benefits of reporting a car accident to your insurance company

Reporting a car accident to your insurance company is important for several reasons. First, it’s required by law in most states. Second, it can help you get the compensation you need to cover damages to your car and any medical expenses.

Reporting the accident can also help to protect you from liability if the other driver decides to sue you. Your insurance company will provide legal representation and help to negotiate a settlement.

Conclusion

Getting into a car accident can be stressful, but it doesn’t have to be financially devastating. While your insurance rates may increase after an accident, there are things you can do to prevent this from happening. By driving safely, reporting accidents promptly, and taking defensive driving courses, you can keep your insurance rates low and protect yourself from liability.

Contents

- Frequently Asked Questions

- What factors determine if a car accident increases insurance rates?

- How long do car accidents affect insurance rates?

- What if the car accident wasn’t my fault?

- Is it possible to avoid insurance rate increases after a car accident?

- What should I do if my insurance rates increase after a car accident?

- How much does your insurance go up after an accident

Frequently Asked Questions

What factors determine if a car accident increases insurance rates?

Several factors determine if a car accident increases insurance rates. The first is fault; if you were found at fault for the accident, your rates will likely increase. The severity of the accident and the amount of damage to your car and other vehicles involved also play a role. Finally, your driving history and insurance claims history can impact whether your rates increase.

It’s important to note that each insurance company has its own policy for determining rate increases after an accident, so it’s a good idea to review your policy or contact your insurance agent to understand how your rates may be affected.

How long do car accidents affect insurance rates?

The length of time a car accident affects insurance rates varies by insurance company and state. In general, accidents can remain on your driving record for up to 3-5 years. During this time, you may experience higher insurance rates, but as time passes and you maintain a clean driving record, your rates may decrease.

It’s important to note that even after an accident is no longer on your driving record, your insurance company may still consider the accident when determining your rates, particularly if it was a severe accident or if you have a history of multiple accidents.

What if the car accident wasn’t my fault?

If the car accident wasn’t your fault, your insurance rates may still increase, but the increase may be less severe. Your insurance company will likely attempt to recover the cost of the claim from the other driver’s insurance company, and if successful, your rates may not increase at all. However, if the other driver is uninsured or if your insurance company is unable to recover the costs, your rates may still increase.

It’s important to report any accidents to your insurance company, regardless of fault, to ensure that you are properly covered and to avoid any potential legal issues.

Is it possible to avoid insurance rate increases after a car accident?

It may be possible to avoid insurance rate increases after a car accident by taking certain steps. First, consider paying for the damage out of pocket if it’s minor and if the cost is less than your deductible. This will prevent you from filing a claim and potentially increasing your rates.

Additionally, you may be able to avoid a rate increase by taking a defensive driving course, maintaining a clean driving record, and choosing an insurance company that offers accident forgiveness as part of their policy.

What should I do if my insurance rates increase after a car accident?

If your insurance rates increase after a car accident, it’s important to review your policy and speak with your insurance agent to understand why your rates increased. You may be able to find ways to reduce your rates, such as increasing your deductible or choosing a different insurance company.

If you feel that your rates increased unfairly, you can file a complaint with your state’s insurance department or consider seeking the advice of a legal professional.

How much does your insurance go up after an accident

In conclusion, it is often the case that a car accident can increase your insurance rates. This is because insurance companies view drivers who have been in accidents as a higher risk than those who haven’t. However, it is important to note that not all accidents will result in an increase in your rates. Factors such as who was at fault and the severity of the accident will be taken into consideration.

It is also worth noting that there are steps you can take to lower your insurance rates after an accident. This can include taking a defensive driving course or installing safety features in your car. Additionally, shopping around for different insurance providers can help you find a better rate.

Ultimately, the impact that a car accident will have on your insurance rates will vary depending on a number of factors. It is important to stay informed about your insurance policy and to take steps to drive safely on the road. By doing so, you can help keep your rates as low as possible.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts