Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

Car accidents can be a stressful and overwhelming experience, especially when it comes to dealing with insurance companies. Knowing how to handle insurance after a car accident is crucial in ensuring that you receive the compensation you deserve. In this guide, we will provide you with helpful tips and information on how to navigate the insurance process and protect yourself after an accident. So, let’s get started!

Dealing with insurance companies can be a complicated and confusing process, but it’s important not to let that deter you from seeking the compensation you’re entitled to. By understanding the steps involved in filing an insurance claim, communicating effectively with your insurance company, and seeking legal assistance when necessary, you can help ensure that your rights are protected and that you receive the financial support you need to move on from your car accident. Let’s dive into the details and learn how to handle insurance after a car accident.

After a car accident, handling insurance can be overwhelming, but it’s crucial to ensure you receive the compensation you’re entitled to. First, exchange information with the other driver and take photos of the damage. Then, notify your insurance company and provide them with the necessary details. Be honest about the accident and don’t accept fault if you’re unsure. Finally, work with your insurance adjuster to determine the extent of the damage and any potential settlements.

Contents

- How to Handle Insurance After Car Accident?

- Frequently Asked Questions

- What should I do immediately after a car accident?

- How do I file a claim with my insurance company?

- What if the other driver’s insurance company contacts me?

- What if my insurance company denies my claim?

- Do I need an attorney to handle my insurance claim?

- 7 Dirty Tricks Insurance Companies Will Play After an Auto Accident | Denmon Pearlman Law

How to Handle Insurance After Car Accident?

Car accidents can happen to anyone, at any time and anywhere. It is important to know what to do after a car accident, especially when it comes to dealing with insurance. In this article, we will guide you through the steps to take when handling insurance after a car accident.

1. Stay Calm and Safe

The first thing to do after a car accident is to stay calm and safe. Turn on your hazard lights, move your car to a safe place if possible, and check for any injuries. Call 911 if anyone is injured or if the accident is blocking traffic. Once you are safe, you can start to think about dealing with insurance.

When dealing with insurance, it is important to remember that anything you say or do can be used against you. Avoid admitting fault and stick to the facts. Take photos of the accident, including damage to your car and any other vehicles involved, as well as the location of the accident.

2. Contact Your Insurance Company

Contact your insurance company as soon as possible after the accident. They will guide you through the process of making a claim and let you know what information they need from you. Be sure to provide them with accurate information and answer their questions truthfully.

Your insurance company will also let you know what coverage you have and what your deductible is. Your deductible is the amount you will have to pay out of pocket before your insurance company will cover the rest of the cost.

3. Get a Police Report

Get a police report of the accident, especially if there are injuries or significant damage to any vehicles. The police report will include important information about the accident, including the date, time, and location of the accident, as well as the names of any witnesses and the responding officer’s name and badge number.

4. Gather Evidence

Gather evidence to support your claim, including photos of the accident, witness statements, and any medical records related to injuries sustained in the accident. Keep all of this information in a safe place and provide it to your insurance company as needed.

5. Be Honest with Your Insurance Company

Be honest with your insurance company about what happened during the accident. Lying or withholding information can lead to your claim being denied or even your policy being cancelled. Your insurance company is there to help you, so be truthful and provide them with all the information they need.

6. Know Your Rights

Know your rights when dealing with insurance companies. You have the right to choose your own repair shop and the right to get a second opinion on any repairs. You also have the right to appeal any decision made by your insurance company.

7. Keep Track of Expenses

Keep track of all expenses related to the accident, including medical bills, car repairs, and any lost wages. This information will be important when filing your claim and can help you get the compensation you deserve.

8. Don’t Settle Too Quickly

Don’t settle too quickly with your insurance company. If you are not happy with the offer they make, you have the right to negotiate or even hire an attorney to help you get the compensation you deserve.

9. Consider Hiring an Attorney

Consider hiring an attorney if you are having trouble getting the compensation you deserve. An attorney can help you navigate the complex world of insurance and make sure you get the best possible outcome.

10. Be Prepared for the Future

Be prepared for the future by understanding your insurance policy and making sure you have the coverage you need. Review your policy regularly and make changes as needed to ensure that you are fully protected in the event of an accident.

In conclusion, dealing with insurance after a car accident can be stressful, but by following these steps and knowing your rights, you can ensure that you get the compensation you deserve. Remember to stay calm, be honest, and keep track of all expenses related to the accident.

Frequently Asked Questions

Car accidents can be overwhelming, and dealing with insurance can add to the stress. Here are some common questions and answers about handling insurance after a car accident.

What should I do immediately after a car accident?

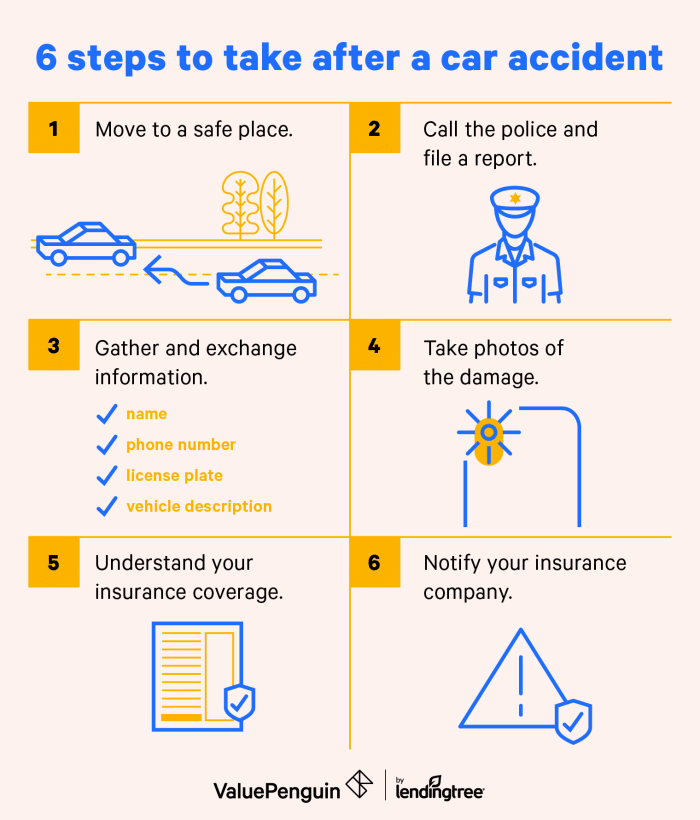

First, check if everyone involved is okay and call for medical assistance if needed. Then, call the police and file a report. Exchange information with the other driver(s) such as name, contact information, and insurance details. Take pictures of the damage and the accident scene. Notify your insurance company as soon as possible about the accident.

Remember that you should avoid admitting fault or discussing the accident with anyone other than the police and your insurance company. Stick to the facts and avoid speculating on what happened.

How do I file a claim with my insurance company?

Contact your insurance company as soon as possible after the accident. They will ask for a description of the accident and the damage to your vehicle. Provide them with all the necessary information, including the police report, pictures, and the other driver’s information. Your insurance company will assign an adjuster to assess the damage and estimate the cost of repairs. They will then work with you to settle the claim.

Be honest and thorough when providing information to your insurance company. Also, keep track of all communication with them and follow up regularly to ensure that your claim is being processed in a timely manner.

What if the other driver’s insurance company contacts me?

If the other driver’s insurance company contacts you, be polite but don’t provide any more information than necessary. You can provide your contact information and the name of your insurance company, but avoid discussing the details of the accident or admitting fault. Refer them to your insurance company for further communication.

If the other driver’s insurance company is trying to pressure you into settling the claim quickly or accepting a low settlement offer, don’t agree to anything without consulting with your own insurance company or an attorney.

What if my insurance company denies my claim?

If your insurance company denies your claim, ask for an explanation and review your policy to see if the denial is justified. If you believe that the denial is unjustified, you can file a complaint with your state’s insurance department or seek legal advice. You can also try negotiating with your insurance company or appealing the decision.

Remember that insurance companies have their own interests in mind, so it’s important to understand your rights and advocate for yourself in case of a dispute.

Do I need an attorney to handle my insurance claim?

While you don’t necessarily need an attorney to handle your insurance claim, it can be helpful to consult with one if you’re facing a complex or disputed claim. An attorney can help you understand your rights, negotiate with your insurance company, and represent you in court if necessary.

However, keep in mind that attorneys can be expensive, and their fees may not be covered by your insurance policy. You should weigh the potential benefits and costs of hiring an attorney before making a decision.

7 Dirty Tricks Insurance Companies Will Play After an Auto Accident | Denmon Pearlman Law

In conclusion, dealing with insurance after a car accident can be a stressful and overwhelming experience. However, it is important to remain calm and informed throughout the process to ensure that you receive the necessary coverage and compensation. Remember to gather all necessary information, including photos, witness statements, and police reports, and to report the accident to your insurance company as soon as possible. By taking these steps and working with your insurance provider, you can navigate the aftermath of a car accident with confidence and peace of mind.

Ultimately, the key to handling insurance after a car accident is to be proactive and prepared. This means taking the time to review your policy and understand your coverage before an accident occurs, as well as staying organized and informed throughout the claims process. Whether you are filing a claim for property damage, medical expenses, or lost wages, be sure to communicate clearly with your insurance provider and keep records of all correspondence and documentation.

In the end, remember that while dealing with insurance after a car accident can be frustrating, it is an important step in protecting yourself and your finances. By following the tips outlined above and seeking help from trusted professionals when needed, you can ensure that you receive the coverage and compensation you deserve.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts