Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

Car accidents are never a pleasant experience. From the physical injuries to the financial setbacks, they can take a toll on your life in many ways. But have you ever wondered if a car accident affects your credit score? This is a question that has crossed the minds of many drivers, and the answer is not as straightforward as you might think. In this article, we will explore the impact of car accidents on your credit score and provide you with some useful tips on how to minimize the damage.

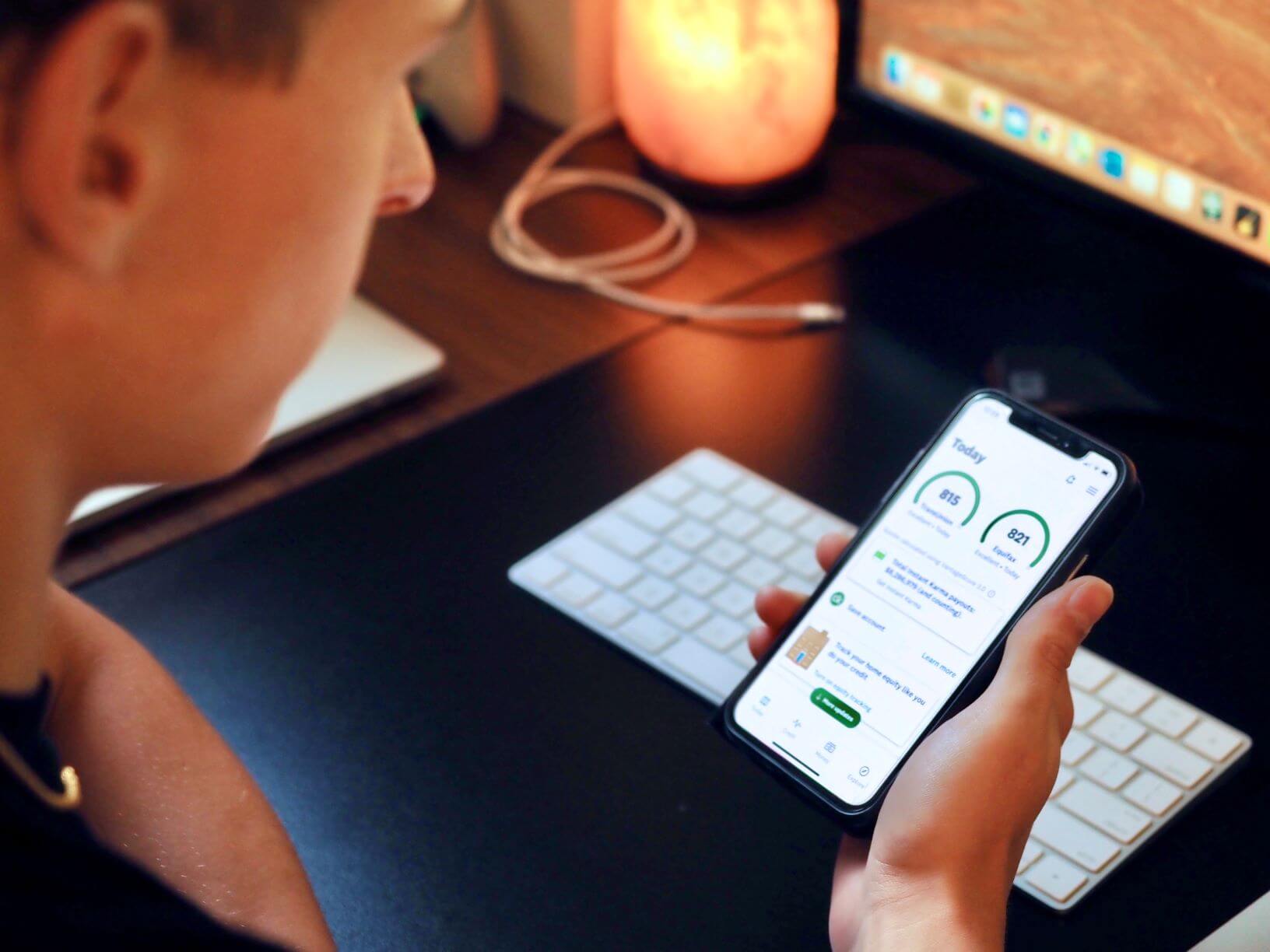

Your credit score is a crucial factor that determines your financial health and stability. It is a measure of your creditworthiness and affects your ability to obtain loans, credit cards, and other financial products. A good credit score can open many doors for you, while a bad one can limit your options and cost you a lot of money in the long run. Therefore, it is essential to understand how car accidents can affect your credit score and what you can do to protect it.

A car accident does not directly affect your credit score. However, if you have outstanding bills from the accident, such as repairs or medical bills, and you fail to pay them, those unpaid bills can end up in collections and negatively impact your credit score.

Contents

- Does a Car Accident Affect Your Credit Score?

- Frequently Asked Questions

- 1. Will a Car Accident Affect My Credit Score?

- 2. Do Insurance Claims Affect My Credit Score?

- 3. Can a Car Loan be Affected by a Car Accident?

- 4. Will Medical Bills from a Car Accident Affect My Credit Score?

- 5. How Can I Protect My Credit Score After a Car Accident?

- Will A Car Accident Affect My Credit Score?

Does a Car Accident Affect Your Credit Score?

Car accidents can be traumatic experiences that leave a lasting impact on your life. Aside from the physical injuries, property damage, and emotional trauma, there are also financial consequences to consider. One of the questions that often come up after a car accident is whether it can affect your credit score. In this article, we’ll explore the relationship between car accidents and credit scores, and what you can do to protect your credit.

Car Accidents and Credit Scores: The Connection

Your credit score is a numerical representation of your creditworthiness. It’s a measure of how likely you are to pay back your debts on time based on your credit history. Your credit score is calculated based on several factors, including your payment history, credit utilization, length of credit history, and types of credit accounts.

So, where do car accidents come into play? The short answer is that car accidents don’t directly affect your credit score. That means that if you get into a car accident, it won’t automatically lower your credit score. However, there are indirect ways that car accidents can impact your credit.

For example, if you’re at fault for the accident and you don’t have enough insurance coverage to pay for the damages, you may be sued by the other driver or their insurance company. If you lose the lawsuit and you don’t have the funds to pay the damages, a judgment may be entered against you. Judgments are public records that can stay on your credit report for up to seven years, and they can lower your credit score.

Protecting Your Credit After a Car Accident

While car accidents themselves don’t directly affect your credit score, there are still steps you can take to protect your credit after an accident. Here are a few things to keep in mind:

1. File an Insurance Claim

If you’re involved in a car accident, it’s important to file an insurance claim as soon as possible. Your insurance company can help you pay for the damages and protect you from any lawsuits that may arise from the accident.

2. Keep an Eye on Your Credit Report

Even if the accident doesn’t directly impact your credit score, it’s still a good idea to keep an eye on your credit report to make sure there are no errors or fraudulent activity. You can get a free copy of your credit report from each of the three major credit bureaus once a year at AnnualCreditReport.com.

3. Pay Your Bills on Time

One of the most important factors that determine your credit score is your payment history. Make sure you pay all of your bills on time, including any medical bills or repair bills from the accident.

4. Consider Credit Counseling

If you’re struggling to pay your bills after a car accident, consider reaching out to a credit counseling agency for help. They can help you create a budget, negotiate with your creditors, and come up with a plan to get back on track financially.

Conclusion

While car accidents themselves don’t directly affect your credit score, there are still ways that they can impact your credit. By taking the steps outlined in this article, you can protect your credit and minimize the financial impact of a car accident. Remember to file an insurance claim, keep an eye on your credit report, pay your bills on time, and consider credit counseling if you need help.

Frequently Asked Questions

Car accidents can be a traumatizing experience, not just physically and emotionally but also financially. Many people wonder whether a car accident can affect their credit score. We have answered some frequently asked questions related to this topic to help you understand better.

1. Will a Car Accident Affect My Credit Score?

The simple answer is NO. A car accident in itself will not affect your credit score. Your credit score is determined by your credit history, payment behavior, credit utilization, and other factors. However, if you fail to pay for the damages caused by the accident, it could lead to collections and a negative impact on your credit score.

If you are unable to pay for the damages, you can negotiate with the insurance company or the other party involved in the accident and come up with a payment plan. It is crucial to communicate with them to avoid any negative impact on your credit score.

2. Do Insurance Claims Affect My Credit Score?

No, insurance claims do not directly affect your credit score. However, if you file multiple claims in a short period, it could lead to an increase in your insurance premium, which can affect your finances. It is essential to assess the damages and decide whether filing a claim is necessary or not.

It is also important to note that insurance companies check your credit score when you apply for insurance. A low credit score can result in higher premiums, so it is crucial to maintain a good credit score.

3. Can a Car Loan be Affected by a Car Accident?

If you have a car loan, a car accident may not directly affect your loan. However, if the damage to the car is significant and the insurance payout is not enough to cover the loan, you will still be responsible for paying the remaining amount. This could affect your finances and, in turn, your credit score.

If you are unable to pay the remaining amount, the lender may take legal action, which could negatively affect your credit score. It is vital to keep your lender informed and negotiate with them to come up with a payment plan.

4. Will Medical Bills from a Car Accident Affect My Credit Score?

If you have medical bills from a car accident, they can affect your credit score if you fail to pay them on time. Medical bills are treated like any other bills, and if they are sent to collections, they can have a negative impact on your credit score. It is crucial to communicate with the medical provider and negotiate a payment plan if you are unable to pay the full amount.

It is also important to note that if you have health insurance, they will cover most of the medical expenses. However, you will still be responsible for the deductible and copay, which can be a significant expense. Make sure to keep track of all medical bills and communicate with the insurance company to avoid any negative impact on your credit score.

5. How Can I Protect My Credit Score After a Car Accident?

To protect your credit score after a car accident, it is essential to communicate with all parties involved, including the insurance company, the other driver, and the medical provider. Make sure to negotiate a payment plan if you are unable to pay the full amount and keep track of all bills and payments.

It is also crucial to maintain a good credit score by paying your bills on time, keeping your credit utilization low, and avoiding multiple credit inquiries. A good credit score can help you negotiate better terms with lenders and insurance companies and avoid any negative impact on your finances.

Will A Car Accident Affect My Credit Score?

In conclusion, a car accident alone does not directly impact your credit score. However, the financial aftermath of an accident, such as missed payments or defaulting on a car loan, can lead to negative marks on your credit report. It is important to stay on top of your finances and communicate with lenders if you are experiencing financial hardship after an accident.

It is also worth noting that insurance claims and payouts may not necessarily affect your credit score. However, if you have a history of making frequent claims or have a poor driving record, this may lead to higher insurance premiums, which can ultimately affect your overall financial health.

Overall, while a car accident may not directly impact your credit score, it is important to be mindful of the financial consequences that may arise from the incident. By staying vigilant and taking proactive steps to manage your finances, you can mitigate the impact of a car accident on your credit score and overall financial health.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts