Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

Car accidents can be a harrowing experience, leaving you feeling overwhelmed and unsure of what to do next. However, one of the most important steps you need to take after an accident is contacting your insurance company. Not only can they guide you through the claims process, but they can also provide you with the necessary support and protection you need during this difficult time.

But how exactly do you contact your insurance after a car accident? In this guide, we will walk you through the steps you need to take to ensure you get in touch with your insurance company quickly and efficiently. From gathering the necessary information to understanding what you need to say, we have everything you need to know to make the process as smooth as possible. So, let’s dive in and get started!

If you have been in a car accident, the first step is to contact your insurance company. Look for the contact information on your insurance card or policy documents. Call the number provided and provide your policy number and details of the accident. An adjuster will be assigned to your case who will guide you through the claims process.

Contents

- How to Contact Insurance After Car Accident?

- Frequently Asked Questions

- What information do I need to provide when contacting my insurance company after a car accident?

- Should I contact my insurance company if the accident wasn’t my fault?

- What should I do if I can’t get in touch with my insurance company after a car accident?

- How long does it take for my insurance company to process my claim after a car accident?

- What should I do if my insurance company denies my claim after a car accident?

- What to Say to Insurance Adjuster After a Car Accident

How to Contact Insurance After Car Accident?

Getting into a car accident is a stressful experience, and it can be overwhelming to know what to do next. One of the most important steps after an accident is to contact your insurance company. In this article, we will discuss the steps you need to take to contact your insurance company after a car accident.

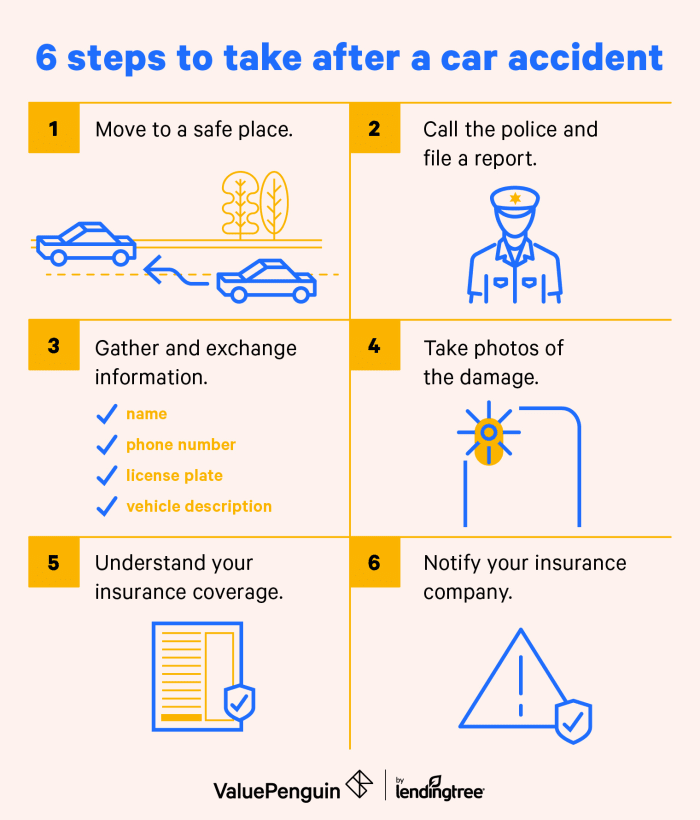

1. Gather Information

Before you contact your insurance company, it’s important to gather all the necessary information related to the accident. This includes the name and contact information of the other driver(s) involved in the accident, their insurance information, and any witness statements or police reports. You should also take pictures of the accident scene and any damage to your vehicle.

Once you have all this information, you can contact your insurance company. Be prepared to provide them with a detailed account of the accident, including the date, time, and location.

2. Contact Your Insurance Company

The next step is to contact your insurance company as soon as possible after the accident. You can do this by phone, email, or through your insurance company’s online portal. When you contact your insurance company, be sure to provide them with all the information you have gathered about the accident.

Your insurance company will assign you a claims adjuster who will be responsible for handling your claim. The claims adjuster will investigate the accident and determine who is at fault. They will also assess the damage to your vehicle and provide you with an estimate for repairs.

3. Provide Documentation

To process your claim, your insurance company will require documentation related to the accident. This includes the police report, witness statements, and any medical bills or records related to injuries sustained in the accident.

Be sure to provide all the necessary documentation to your insurance company in a timely manner. This will help expedite the claims process and ensure that you receive the compensation you are entitled to.

4. Determine Your Coverage

Your insurance policy will determine the amount of coverage you have for an accident. This includes liability coverage, which covers damage to other vehicles or property, as well as collision coverage, which covers damage to your own vehicle.

Your insurance company will review your policy and determine what coverage you have for the accident. They will also advise you on any deductibles or limits that apply to your coverage.

5. File Your Claim

Once you have provided all the necessary documentation and your insurance company has determined your coverage, you can file your claim. Your insurance company will provide you with a claim number and any additional information you need to complete the claims process.

Be sure to follow up with your insurance company regularly to check on the status of your claim and ensure that it is being processed in a timely manner.

6. Get Your Vehicle Repaired

If your vehicle has been damaged in the accident, your insurance company will provide you with an estimate for repairs. You can choose to have your vehicle repaired at a body shop of your choice or one recommended by your insurance company.

Be sure to keep all receipts and documentation related to the repairs. Your insurance company will reimburse you for the cost of repairs up to the limits of your coverage.

7. Consider a Rental Car

If your vehicle is in the shop for repairs, you may need a rental car to get around. Your insurance company may provide coverage for a rental car, depending on your policy.

Be sure to check your policy for coverage limits and any restrictions that apply. You can also ask your claims adjuster for guidance on renting a car and submitting the rental car expenses for reimbursement.

8. Be Aware of Deadlines

Most insurance policies have deadlines for filing claims and submitting documentation. Be sure to read your policy carefully and comply with all deadlines.

Failing to meet deadlines can result in your claim being denied or delayed. This can cause further stress and frustration after an already difficult experience.

9. Know Your Rights

As a policyholder, you have rights when it comes to filing a claim with your insurance company. These rights include the right to a fair and timely claims process, the right to appeal a denied claim, and the right to take legal action if necessary.

Be sure to familiarize yourself with your rights as a policyholder and assert them if necessary.

10. Work with an Attorney

If you have been injured in a car accident, or if your insurance company is denying your claim, you may want to consider working with an attorney.

An experienced attorney can help you navigate the claims process, negotiate with your insurance company, and fight for the compensation you deserve.

In conclusion, contacting your insurance company after a car accident is an important step in the claims process. By following these steps and working with your insurance company, you can ensure that your claim is processed in a timely and fair manner.

Frequently Asked Questions

Car accidents can be a stressful experience. If you need to contact your insurance company after an accident, here are some frequently asked questions to help guide you through the process.

What information do I need to provide when contacting my insurance company after a car accident?

When contacting your insurance company after a car accident, be sure to have your policy number and the date and time of the accident. You should also provide a detailed description of the accident, including the location and any injuries sustained. If possible, take pictures of the damage to your car and the other vehicles involved.

It is important to be honest and accurate when providing information to your insurance company. Providing false or misleading information could result in your claim being denied.

Should I contact my insurance company if the accident wasn’t my fault?

Yes, you should still contact your insurance company even if the accident wasn’t your fault. Your insurance company can help you navigate the claims process and communicate with the other driver’s insurance company. Even if you are not at fault, your insurance company may need to pay for some of the damages or injuries sustained in the accident.

When contacting your insurance company, be sure to provide as much information as possible about the accident and the other driver’s insurance company. Your insurance company can then work with the other driver’s insurance company to determine who is at fault and who is responsible for paying for damages and injuries.

What should I do if I can’t get in touch with my insurance company after a car accident?

If you are having trouble getting in touch with your insurance company after a car accident, try calling their customer service number or contacting them through their website. If you still can’t get through, you may want to consider contacting a lawyer who can help you navigate the claims process.

It is important to remember that you have a limited amount of time to file a claim with your insurance company after a car accident. If you are having trouble getting in touch with your insurance company, don’t wait too long to seek help.

How long does it take for my insurance company to process my claim after a car accident?

The amount of time it takes for your insurance company to process your claim after a car accident can vary depending on the complexity of the claim and the amount of damage or injuries involved. In some cases, your insurance company may be able to process your claim quickly and provide you with a settlement within a few days.

In other cases, your insurance company may need to investigate the accident further or gather additional information before processing your claim. This can take several weeks or even months. If you have any questions about the status of your claim, don’t hesitate to contact your insurance company for an update.

What should I do if my insurance company denies my claim after a car accident?

If your insurance company denies your claim after a car accident, you may want to consider contacting a lawyer who can help you appeal the decision. Your lawyer can review your case and help you gather additional evidence to support your claim.

In some cases, your insurance company may deny your claim because they believe you were at fault for the accident or because they believe the damages or injuries are not covered under your policy. If you disagree with their decision, don’t hesitate to seek legal help to protect your rights and get the compensation you deserve.

What to Say to Insurance Adjuster After a Car Accident

In conclusion, contacting your insurance company after a car accident can seem daunting, but it is an important step to take. Remember to gather all necessary information, such as the other driver’s contact and insurance information, as well as any witnesses to the accident. Providing your own insurance company with as much information as possible can help expedite the claims process and ensure that you receive the compensation you deserve.

It is also important to remember to stay calm and collected when speaking with your insurance company. Try to provide only factual information and avoid speculating about the accident or admitting fault. Your insurance company will investigate the accident and determine who is at fault based on the evidence provided.

Finally, if you have any questions or concerns about the claims process, don’t hesitate to reach out to your insurance company for clarification. They are there to assist you and ensure that you are fully informed throughout the process. By following these steps, you can make the process of contacting your insurance company after a car accident as smooth and stress-free as possible.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts