Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

Car accidents can be a major financial burden, from medical bills to car repairs. Many people wonder if they can claim these expenses on their taxes. While it may seem like a logical solution, the answer is not always straightforward.

First, it’s important to understand that the IRS only allows deductions for car accident expenses in certain situations. Additionally, the amount you can claim may be limited based on various factors. In this article, we’ll explore the ins and outs of claiming car accident expenses on your taxes and help you determine if it’s a viable option for you.

In general, you cannot claim car accident expenses on your taxes unless they are related to business use of your vehicle. However, if you were injured in the accident and incurred medical expenses, you may be able to deduct those expenses on your taxes if they exceed a certain threshold. It is always best to consult with a tax professional for specific advice on your situation.

Can You Claim Car Accident on Taxes?

Car accidents can be a stressful and costly experience for anyone involved. The good news is that if you were in a car accident, you may be able to claim some of your expenses on your taxes. However, there are certain criteria that need to be met in order for you to be eligible to claim your car accident expenses on your taxes. In this article, we will take a closer look at the requirements and the process of claiming car accident expenses on your taxes.

What Car Accident Expenses Can You Claim on Your Taxes?

If you were involved in a car accident and have incurred expenses, you may be able to claim some of those expenses on your taxes. The expenses that may be eligible for a tax deduction include:

- Medical expenses

- Vehicle repair or replacement costs

- Towing fees

- Rental car expenses

- Legal fees

However, it is important to note that you can only claim these expenses if they exceed a certain threshold and are not covered by insurance.

To claim your car accident expenses on your taxes, you will need to have documentation to prove the expenses, such as bills, receipts, and invoices.

Who Can Claim Car Accident Expenses on Their Taxes?

Not everyone who is involved in a car accident can claim their expenses on their taxes. To be eligible to claim your car accident expenses, you need to meet the following criteria:

- Your expenses must exceed 10% of your adjusted gross income (AGI)

- Your insurance does not fully cover your expenses

- You were not at fault for the accident

- You are not being reimbursed by any other source for your expenses

If you meet these criteria, you may be able to claim your car accident expenses on your taxes.

How to Claim Car Accident Expenses on Your Taxes?

If you are eligible to claim your car accident expenses on your taxes, you will need to itemize your deductions on your tax return. This means that you will need to fill out Schedule A of your tax return and list your car accident expenses under the “Miscellaneous Deductions” section.

It is important to keep in mind that the total of your miscellaneous deductions must exceed 2% of your AGI in order for you to claim them on your taxes. Additionally, you will need to provide documentation to prove your expenses, such as bills, receipts, and invoices.

The Benefits of Claiming Car Accident Expenses on Your Taxes

Claiming your car accident expenses on your taxes can provide some financial relief during a difficult time. By claiming your expenses, you may be able to reduce your taxable income and ultimately lower your tax bill.

It is important to note that while claiming your car accident expenses on your taxes can be beneficial, it is not a guarantee that you will receive a tax deduction. You will need to meet the criteria and provide documentation to prove your expenses in order to be eligible for a tax deduction.

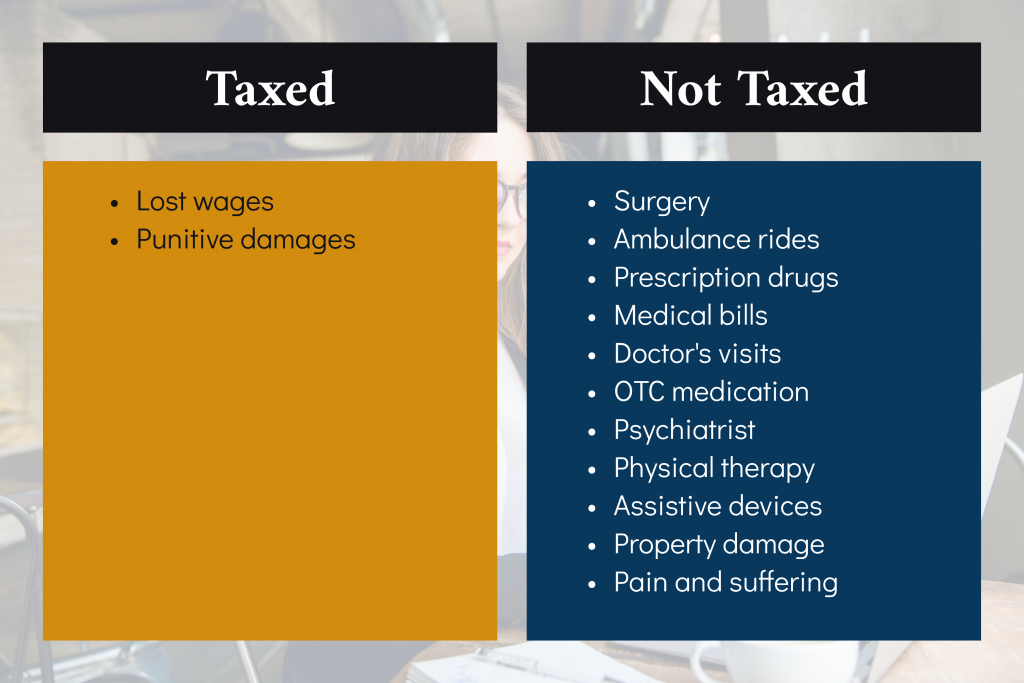

Claiming Car Accident Expenses on Your Taxes vs. Filing a Lawsuit

If you were involved in a car accident and have incurred expenses, you may be wondering if it is better to claim your expenses on your taxes or file a lawsuit. While both options can provide financial relief, they serve different purposes.

Claiming your car accident expenses on your taxes can provide a tax deduction and reduce your taxable income. Filing a lawsuit, on the other hand, can provide compensation for your expenses, as well as any other damages you may have incurred.

It is important to weigh the pros and cons of each option and consult with a professional to determine the best course of action for your specific situation.

Conclusion

If you were involved in a car accident and have incurred expenses, you may be able to claim some of those expenses on your taxes. However, you must meet certain criteria and provide documentation to prove your expenses. Claiming your car accident expenses on your taxes can provide some financial relief during a difficult time, but it is important to weigh the pros and cons of this option and consult with a professional to determine the best course of action for your specific situation.

Contents

- Frequently Asked Questions

- What expenses related to a car accident can be claimed on taxes?

- Can I claim lost wages on my taxes if I missed work due to a car accident?

- Can I claim car rental expenses on my taxes if my car was damaged in an accident?

- Can I claim legal fees related to a car accident on my taxes?

- How do I claim car accident expenses on my taxes?

- What Lawyers WON’T tell you about Car Accident Claims (but I will…)

Frequently Asked Questions

If you were involved in a car accident and suffered injuries, you may be able to claim medical expenses related to the accident on your taxes. This includes expenses such as hospital bills, medication, and therapy. Additionally, if your car was damaged in the accident and you were not reimbursed by insurance, you may be able to claim the cost of repairs on your taxes.

However, it is important to note that you can only claim expenses that were not covered by insurance or any other source of reimbursement. If you were fully reimbursed for your expenses, you cannot claim them on your taxes.

Can I claim lost wages on my taxes if I missed work due to a car accident?

If you missed work due to injuries sustained in a car accident, you may be able to claim lost wages on your taxes. However, you can only claim lost wages for the period of time that you were unable to work due to the accident. Additionally, you must have documentation from your employer verifying your missed time and the amount of wages lost.

It is important to note that if you received any type of compensation for your lost wages, such as disability insurance or workers’ compensation, you cannot claim them on your taxes.

Can I claim car rental expenses on my taxes if my car was damaged in an accident?

If your car was damaged in a car accident and you rented a car while it was being repaired, you may be able to claim the car rental expenses on your taxes. However, you can only claim the amount that was not covered by insurance. You will also need to provide documentation of the car rental expenses, including receipts and the rental agreement.

It is important to note that if you were reimbursed by insurance or any other source for the car rental expenses, you cannot claim them on your taxes.

If you incurred legal fees related to a car accident, you may be able to claim them on your taxes. However, you can only claim legal fees that were directly related to the accident and were not covered by any other source of reimbursement, such as insurance. You will need to provide documentation of the legal fees, including receipts and a statement from your lawyer.

It is important to note that if you received any type of compensation for the legal fees, such as a settlement from the other driver’s insurance company, you cannot claim them on your taxes.

How do I claim car accident expenses on my taxes?

To claim car accident expenses on your taxes, you will need to itemize your deductions on your tax return. You will need to provide documentation of the expenses, including receipts and any other relevant documents. It is recommended that you consult with a tax professional to ensure that you are claiming all eligible expenses and are following all tax laws and regulations.

Additionally, it is important to note that the amount of car accident expenses you can claim on your taxes may be limited by certain tax laws and regulations.

What Lawyers WON’T tell you about Car Accident Claims (but I will…)

In conclusion, claiming car accident expenses on your taxes is possible and can provide some financial relief. However, it is important to understand the qualifications and limitations of this deduction. It is also crucial to keep accurate records and receipts to support your claim. Consulting with a tax professional can also help ensure that you are taking advantage of all possible deductions and avoiding any mistakes.

Overall, while claiming car accident expenses on your taxes may not be a straightforward process, it can be worth the effort. Just remember to stay organized, know the rules, and seek professional advice if necessary. With these steps, you can potentially reduce your tax burden and get some much-needed financial assistance after a car accident.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts