Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of...Read more

Have you ever heard of a car being totaled without being in an accident? It may seem unbelievable, but it can happen. In fact, there are a few scenarios where a car can be deemed a total loss without ever being involved in a collision. Let’s explore the possibilities and learn more about what it means for a car to be totaled.

From natural disasters to theft, there are several circumstances where a car can suffer enough damage to be considered totaled without ever being in an accident. While it may not be a common occurrence, it’s important to understand the various ways a car can be totaled and the implications it can have on insurance and resale value. So, buckle up and let’s dive into this intriguing topic.

Yes, a car can be totaled without being in an accident. If the cost of repairs exceeds the value of the car, it may be declared a total loss by the insurance company. This can happen due to various reasons such as theft, flood, or fire damage. In such cases, the insurance company will offer a settlement amount based on the car’s market value.

Can a Car Be Totaled Without Being in an Accident?

When we think of a totaled car, we typically imagine a vehicle that has been severely damaged in a collision. However, it is possible for a car to be considered totaled without being in an accident. This can happen for a variety of reasons, and it’s important for car owners to understand what can lead to a vehicle being totaled.

What Does it Mean for a Car to Be Totaled?

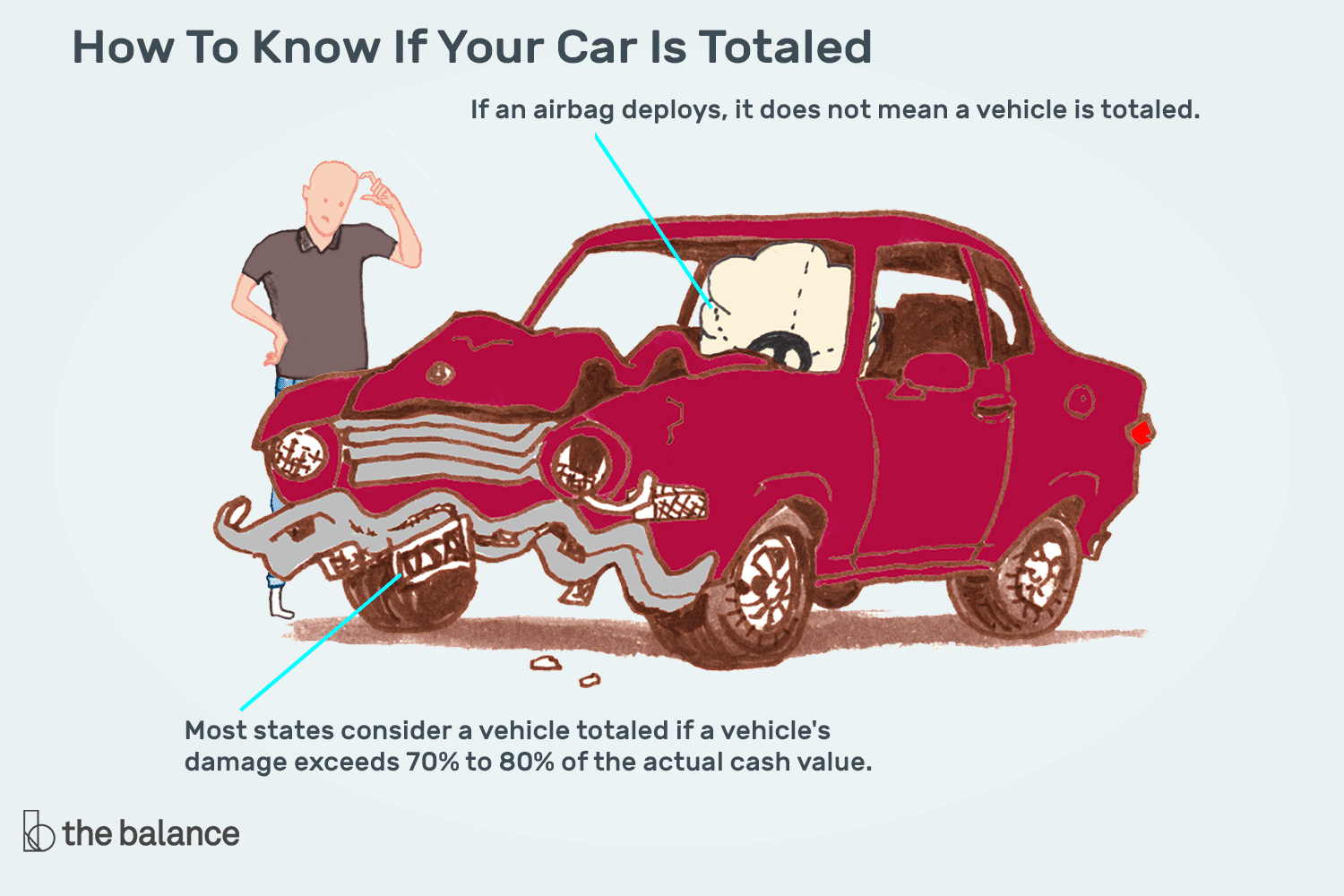

Before we dive into the reasons why a car might be totaled without being in an accident, it’s important to understand what it means for a car to be totaled. Essentially, when a car is totaled, it means that the cost of repairing the vehicle is greater than the value of the car itself. In other words, the car is considered a total loss.

When a car is totaled, the insurance company will typically offer a payout to the owner for the value of the car. This payout can be used to purchase a new vehicle or cover other expenses related to the loss of the car.

Reasons a Car Might Be Totaled Without Being in an Accident

While car accidents are a common cause of totaled vehicles, they are not the only reason why a car might be considered a total loss. Here are a few other reasons why a car might be totaled:

Natural Disasters

Natural disasters like floods, hurricanes, and tornadoes can cause significant damage to vehicles. In some cases, the damage may be so severe that the car is considered a total loss. This is because the cost of repairing the car exceeds its value.

- Benefits: Insurance policies often cover natural disasters, so car owners can receive a payout to help cover the cost of a new vehicle.

- VS: Car owners who live in areas prone to natural disasters may pay higher insurance premiums.

Fire or Theft

In some cases, a car might be stolen or catch fire, causing damage that makes the vehicle a total loss. Insurance policies typically cover theft and fire, so car owners can receive a payout to help cover the cost of a new vehicle.

- Benefits: Insurance policies often cover theft and fire, so car owners can receive a payout to help cover the cost of a new vehicle.

- VS: Car owners who live in high-crime areas may pay higher insurance premiums.

Manufacturer Defects

In rare cases, a car might be totaled due to a manufacturer defect. For example, if a car’s airbags fail to deploy during an accident, the car might be considered a total loss because the cost of replacing the airbags is greater than the value of the car.

- Benefits: Car owners may be able to file a lawsuit against the manufacturer to recover damages.

- VS: Filing a lawsuit can be a lengthy and expensive process.

What Happens to a Totaled Car?

When a car is considered a total loss, it is typically sold for scrap or salvage. In some cases, the car may be repaired and resold, but this is rare.

It’s important to note that a car that has been totaled may have a salvage title, which can make it more difficult to sell or insure in the future.

Conclusion

While car accidents are a common cause of totaled vehicles, they are not the only reason why a car might be considered a total loss. Natural disasters, theft, fire, and manufacturer defects can all lead to a car being totaled. When a car is totaled, the insurance company will typically offer a payout to the owner for the value of the car, which can be used to purchase a new vehicle or cover other expenses related to the loss of the car.

Frequently Asked Questions

Here are some frequently asked questions related to car accidents and the term “totaled.”

What does it mean for a car to be “totaled”?

When a car is “totaled,” it means that the cost of repairing the car after an accident is more than the car is worth. Insurance companies use a formula to determine when a car is considered “totaled.” This formula takes into account the car’s pre-accident value, the cost of repairs, and other factors such as the age of the car.

It’s important to note that a car can also be “totaled” if it’s stolen and not recovered or if it’s damaged by a natural disaster such as a flood or fire.

Can a car be “totaled” without being in an accident?

Yes, a car can be “totaled” without being in an accident. As mentioned earlier, a car can also be considered “totaled” if it’s stolen and not recovered or if it’s damaged by a natural disaster. Additionally, a car can also be “totaled” if it’s vandalized to the point where the cost of repairs exceeds the car’s value.

It’s important to note that in these cases, insurance companies will still use a formula to determine if the car is considered “totaled.”

Can a car be “totaled” if the damage is only cosmetic?

It’s possible for a car to be “totaled” if the damage is only cosmetic, but it’s not very common. Insurance companies will typically only consider a car “totaled” if the cost of repairs exceeds a certain percentage of the car’s pre-accident value. If the damage is only cosmetic, it’s unlikely that the cost of repairs will exceed this threshold.

However, there are some cases where a car may be considered “totaled” due to cosmetic damage. For example, if the car is a high-end luxury vehicle and the cost of replacing a damaged panel or part is extremely high, the insurance company may decide that it’s not worth repairing.

What happens if my car is “totaled”?

If your car is considered “totaled,” your insurance company will pay you the car’s pre-accident value minus your deductible. In some cases, you may be able to negotiate with the insurance company to keep the car and receive a smaller payout. However, this is not always possible.

Once the insurance company has paid you for the car, they will take possession of it. They may sell it to a salvage yard or auction it off. If you still owe money on your car loan, the insurance company will pay off the loan before giving you the remainder of the payout.

Can I still drive my car if it’s considered “totaled”?

If your car is considered “totaled,” it’s generally not safe to drive. The damage to the car could affect its structural integrity and make it more likely to be involved in another accident. Additionally, driving a “totaled” car could be illegal in some states. It’s best to have the car towed to a salvage yard or other location for disposal.

If you’re able to negotiate with the insurance company to keep the car, you may be able to drive it if you get it repaired. However, keep in mind that a “totaled” car may be difficult or expensive to insure.

Can I Still Keep My Car If It Is Totaled After An Accident

In conclusion, it is possible for a car to be considered “totaled” without actually being in an accident. This can happen when the cost of repairing the car exceeds its market value. However, it is important to note that this determination varies from state to state and from insurance company to insurance company. It is always best to review your insurance policy and consult with your insurance provider to fully understand how “total loss” is defined and how it may affect your coverage.

Reginald Gray is the visionary force behind PersonalInjuryJustice. A seasoned lawyer with over two decades of experience in personal injury law, Reginald's profound understanding of the legal landscape and his deep empathy for victims inspired the creation of PersonalInjuryJustice. His only mission is to ensure victims have easy access to comprehensive, authentic information to assist them in their fight for justice. As Chief Editor, he rigorously ensures our content's accuracy, reliability, and pertinence.

More Posts